Table of Contents

Balanced funds Vs Balanced Advantage funds

Technically both the categories fall into Hybrid funds. It’s their structure that makes them different from each other.

Balanced Fund the known category, which you also must be aware of, now also known as an Aggressive Hybrid fund, since they are mandated to have at least 65% of direct equity exposure in their Portfolio. They may go above 65% to 80% as per their Investment strategy, but cannot go below 65% equity.

Balanced means Equally divided, and sensing this anomaly, Fund houses are required to Call balanced funds as Aggressive Hybrid since they have more than 50% of equity allocation in such funds.

This 65% exposure puts the balanced funds at par with Equity Funds as per the Income-tax Rules, which says STCG to be taxed @ 15% and LTCG @ 10% (Beyond 1 lakh) from 1st of Feb 2018.

What are Balanced Advantage funds?

Balanced advantage funds come under Dynamic Asset Allocation funds. These are the Hybrid funds but to maintain the required equity exposure of 65%, they take help of Equity Derivatives.

- Balanced advantage funds use PE/PB (Price to Earnings/ Price to Book Value) or In-House structure or active management based re balancing approach to increase or decrease the direct equity exposure in the portfolio.

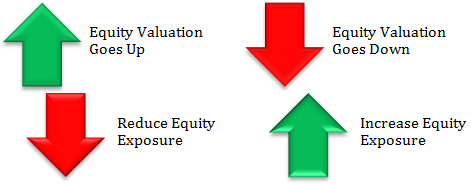

- This category of funds is expected to manage the portfolio in such a way so to reduce the equity in high valuation Market and increase the exposure when the market looks attractive.

And this is why if you have tracked some of these funds in the past you may have found that in booming markets they under perform the balanced category, but in falling or recovering phase they sometimes outperform their balanced category.

Balanced advantage category is meant for those investors who want to stay in an aggressive Hybrid structure but are wary of the Volatility that comes with high equity exposure.

Asset Composition

Balanced Advantage Funds are allowed to have Equity & Debt Asset exposure in a limit as prescribed below.

| Asset Class | Range | Example |

|---|---|---|

| Equities | 65% - 80% | Stocks, Index Funds, Funds of Funds, Global Equities |

| Debt | 20% - 35% | Corporate Bonds, Government Bonds, Commercial Paper, Convertible & Non Convertible Debentures |

Best Balanced Advantage Funds

list of best balanced advantage funds can found here.

Conclusion

When you make any investment, though generally, you look out for high returns only, you have to understand that with high returns you have to accept high volatility too.

Balanced advantage funds have the potential to generate good returns over a period of time with low volatility and recommended to medium risk appetite investors

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like

ICICI Prudential Balanced Advantage Fund Vs HDFC Balanced Advantage Fund

HDFC Balanced Advantage Fund Vs ICICI Prudential Equity And Debt Fund

ICICI Prudential Equity And Debt Fund Vs HDFC Balanced Advantage Fund

ICICI Prudential Balanced Advantage Fund Vs HDFC Hybrid Equity Fund

SBI Equity Hybrid Fund Vs ICICI Prudential Balanced Advantage Fund

ICICI Prudential Equity And Debt Fund Vs ICICI Prudential Balanced Advantage Fund

L&T Hybrid Equity Fund Vs ICICI Prudential Balanced Advantage Fund