Table of Contents

Fama and French Three Factor Model

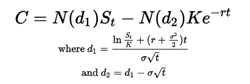

Fama and French Three Factor Model also goes by the name as Fama French Model in short. It is a famous asset pricing model that was created in the year 1992. The model is known to expand on the concept of the CAPM (Capital Asset Pricing Model) by including value risk and size risk factors to the respective Market risk factor in a typical CAPM.

As per the Fama and French Three Factor Model PDF, it is known to consider the fact that small cap stocks and values are known to outperform the existing market on a daily Basis. Through the inclusion of these two major factors, the model is known to adjust for the respective outperforming tendency. This helps in making the model a better tool for the evaluation of the respective managerial performance.

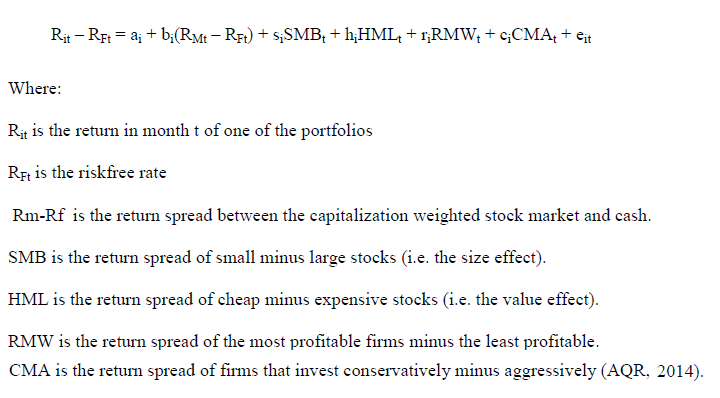

Formula

Working of the Fama and French Three Factor Model

Kenneth French –a leading researcher and Eugene Fama –a Nobel Laureate, attempted the measurement of market returns. Through in-depth research, they found that value stocks are known to outperform the growth stocks. At the same time, small-cap stocks are known to perform better than large-cap stocks. For the purpose of the evaluation tool, the performance of portfolios with large number of value stocks or small-cap stocks tends to be lower than the CAPM value. This is because the Three factor model adjusts downwards for the Value Stock and small-cap out-performance.

Talk to our investment specialist

The Fama and French model tends to feature three vital factors –excess return on the market, book-to-market values, and the overall size of the organization. It can also be said that the subsequent factors that are utilized are HML (High minus low), SMB (Small Minus Big), and the return of the Portfolio. SMB is known to account for companies that are traded publicly with smaller market caps for generating higher returns. On the other hand, HML is known to account for the respective value stocks featuring high book-to-market ratios for generating higher returns as compared to the market.

There is quite a speculation about whether the given outperformance tendency occurs due to market inefficiency or market Efficiency. With respect to market efficiency, the outperformance can be typically explained by the presence of excess risk that both small-cap stocks and value stocks tend to face due to increasing capital costs as well as higher business risks.

With respect to market inefficiency, the given outperformance is analyzed by market participants pricing the value of the respective companies inaccurately. This delivers excess return on a long-term basis due to the adjustment of the value. Investors that tend to subscribe to the evidence’s body as offered by the EMH (Efficient Market Hypothesis) agree easily with the efficiency aspect of the market.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.