Table of Contents

What is High Minus Low (HML)?

The disparity in returns between firms having a high book-to-Market value ratio and those with a low book-to-market value ratio is known as the High Minus Low. One of the three elements in the Fama-French three-Factor model is the HML, often known as the value premium. It's just the low of the day divided by the high of the day. So, like the average true Range, it's a Volatility indicator. The greater the disparity between high and low, the greater the indicator's spike.

The gap between the high and low increases as volatility increases. According to this method, firms with high book-to-market ratios, also known as value stocks, beat those with lower book-to-market ratios, also known as growth stocks.

High Minus Low Indicator

The difference between the price's highest and lowest value is illustrated using the High Minus Low indicator. It's a volatility gauge. A high HML number indicates a trending market, whereas a low HML value indicates a range-bound market. Directional trading signals can be generated using the HML indicator and volume.

HML in Fama and French's Three-Factor Model

In the Fama and French Three-Factor Model, HML is one of the three factors. This model builds off the one-factor model linked with the Capital Asset Pricing Model (CAPM). It is done by adding the factors of size, also referred to as Small Minus Big (SMB), and value as defined by HML.

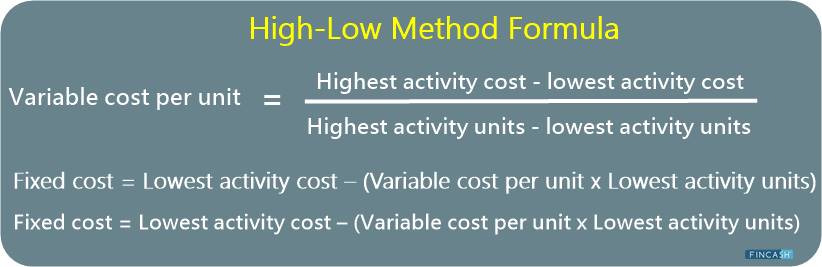

It is used to determine the short- and long-term profit margins of an investment. The High Minus Low Indicator forecasts the security's future performance. To get the related range, use the high minus low formula.

Talk to our investment specialist

How to Calculate SMB and HML?

SMB has a size impact depending on a company's market capitalization. It is a metric that evaluates the historical advantage of small cap enterprises over large-cap companies. The calculation is done by deducting historic excess returns of small-cap companies over large-cap companies.

HML, on the other hand, is a value premium. It is the difference in returns between firms having a high book-to-market value ratio (value companies) and those with a low book-to-market value ratio (growth companies).

Application of HML in Trading

Traders can use the High Minus Low indicator to determine the volatility of a stock. A low HML value indicates range-bound price movement. But a sudden spike in the indicator indicates the scrip's range expansion. Higher periods, such as daily, weekly, or monthly, are ideal for this indicator.

When working with volume, the HML is incredibly convenient as it might give you an idea of how far you can stretch your range. It also indicates whether or not the price will move in a directed way. A directional move is indicated by the increase in HML combined with the constant rise in volume. A spike in HML accompanied by a single spike in volume denotes a high or low trend.

The Bottom Line

HML indicator helps traders or investors in determining the range of an asset or stock. The price difference between the high and low is represented by the High Minus Low indicator. It's a signal of volatility. A moving market has a high HML value, but a range-bound market has a low HML value. Trading signals may be generated by combining the HML indicator with volume.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.