Table of Contents

Financial Advisor

What is a Financial Advisor?

A financial advisor provides financial and investment guidance to its customers. The financial advisor covers various fields such as guidance on Real Estate planning, managing investment portfolios and drawing assets during retirement. Other than this, they also provide services to institutional clients like pension plans, municipal government and corporation, charitable organization and so on.

They carry a wide Range of financial services and give a one-stop solution to the customers. There are two kinds of financial advisory services such as - financial planning and asset management. Some advisors do one of these, while others cover both.

What Financial does the Financial Advisor do?

A financial advisor provides financial planning that refers to the non-Investing aspects of wealth planning. Some of the services of financial advisors are as follows:

1. Tax planning

Advisors help you minimize your tax payments and file your Taxes.

2. Estate planning

They help you to maintain your property in a good shape with minimum taxation.

Talk to our investment specialist

3. Insurance planning

They make sure that you are adequately covered and get the best option for your situation.

4. Budgeting

A financial advisor helps you to track your expenses and draws a budget so that you spend a minimum and save enough each month.

5. Retirement planning

They help you in planning your investments, so that you can start saving right from an early age. Enough savings before retirement will give you a relaxed life later.

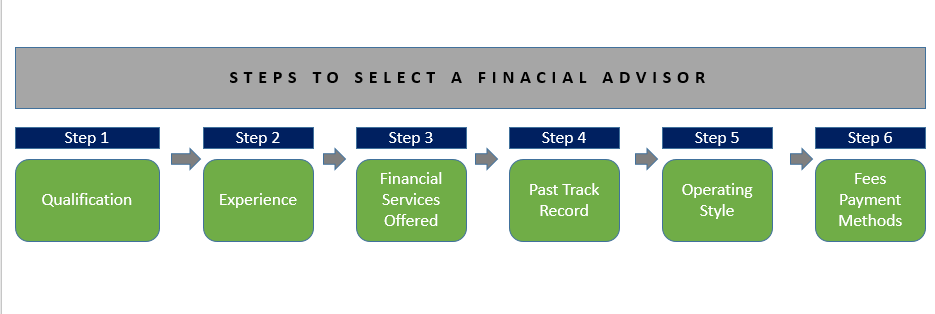

Types of Financial Advisors

1. Registered Investment Advisor

Registered Investment Advisor (RIA) is registered with a state or a federal agency to provide investment advice. They can help you with buying and selling securities and other investment practices.

2. Financial Planner

A Financial Planner is a general advisor who aids in the creation of a holistic plan for your finances. They can help you with Retirement planning, education funding and budgeting.

3. Wealth manager

The wealth manager is those who have more assets especially with a high-net-worth. These professionals assist with management, Capital gains and estate planning.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.