How to Choose the Best Financial Advisor?

Financial advisor plays an important role in your Wealth Management. They give you an elaborate Financial plan that helps you reach your goals. The advisors are trusted with your investments and they make high-stake decisions for you. Thus, it becomes very crucial to choose the right financial consultant who will help you in choosing your Investment plan and gives you right financial analysis.

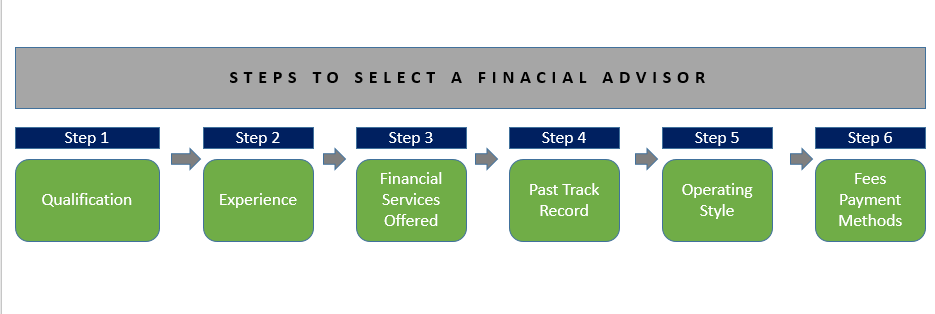

How to Choose a Financial Advisor?

Qualification of the Financial Planner

The very first thing to look for in a Financial Planner is their qualification. It is not necessary that qualification is everything, but it certainly is a starting point and gives you the idea about the credibility of the financial advisor. A common qualification like NISM certifications for Mutual Funds. NISM Investment Certification is a must for anyone who calls themselves a financial advisor. Also, there is another certification called as Certified Financial Planner (CFP) offered by FPSB India.

Experience of the Financial Consultant

Experience is another crucial Factor to consider. It is an obvious choice to choose an experienced financial advisor instead of one with a less experience even when both have the same qualifications. Seasoned financial planners have better knowledge and understanding of the markets, risks involved and how to cater to the needs of the customers in a detailed manner.

Financial Services Offered by the Financial Advisor

You should look out for the different types of services offered by the financial consultant. Generally, the advisors are not allowed to sell insurance or any other securities products without a proper licence. Please make sure that the financial advisor has the proper credentials and the services offered are of a high quality. It is important to have a financial planner who offers a variety of products like investment insurance etc. so they can create a good plan.

Past History and Client Base of the Financial Planner

It is very important to check the past history of the financial advisor you have in your mind. Financial services are very vulnerable to frauds and misconducts. Thus, it is necessary to know and find out that the person you are trusting with your finances is loyal to their profession. Next thing to look for is the customer base. Not every financial planner has a similar Range of services and products to offer. They have their area of expertise and thus it is necessary to find out whether you fit in their area of expertise. Otherwise, the mismatch may lead to very bad consequences.

Talk to our investment specialist

Operating Style of the Financial Advisor

Many financial advisors operate in a team. So it’s important to understand how the advisor will deal with you. Also, you should inquire about the handling of your account and also about the person who will be in contact with you regularly related your finances. Also, you must ask the organisation or the IFAS that who will Handle your Portfolio if the current advisor leaves or shift their business.

Fees and Payment Methods

You should be very upfront when it comes to fees and payment methods of the financial advisor. The fees of the financial services provided by the advisor will differ according to your needs. But it is necessary to know the fees charged (upfront or annual) by the concerned financial advisor. The financial advisor can be paid in many ways like direct fees, commissions or a combination of both. In your agreement, the charges should be mentioned in a clear manner and you should be aware of those beforehand.

The above-mentioned measures will certainly help you get a clear idea of choosing a right financial advisor for yourself. A healthy relationship with your advisor can lead to a prosperous wealth creation.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.