Table of Contents

Basics of Financial Statement Analysis

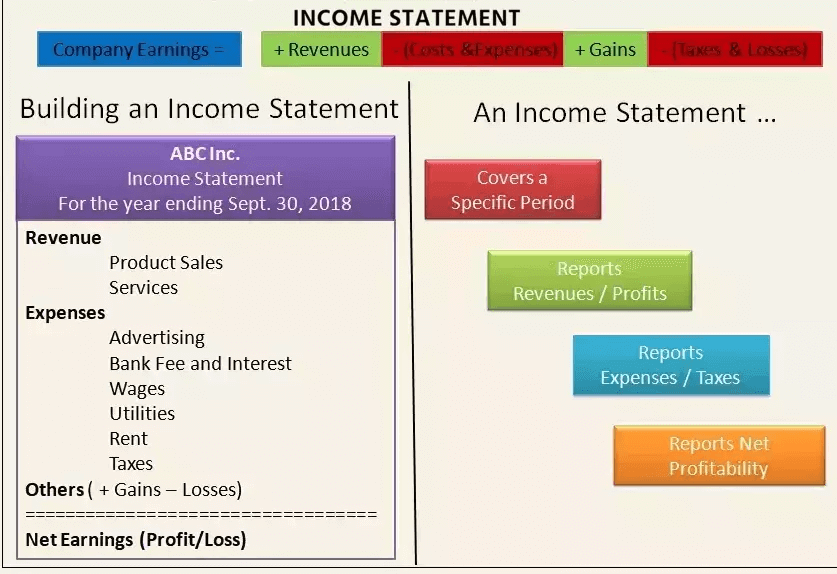

The process of reviewing a company's financial statements for decision-making purposes is known as financial statement analysis. External stakeholders use it to assess an organization's general health as well as its Financial Performance and business worth.

Users of Financial Statement Analysis

A variety of people use financial statement analysis. They are as follows:

The management of a firm: The finance controller of the company conducts ongoing research of the company's financial statements, mainly operational indicators, such as profit per product, cost per distribution channel, cost per delivery, and other metrics that aren't visible to outside parties.

Investors: Current and potential investors examine the organization's financial accounts to assess its health. They do this to understand the company's ability to pay dividends, create cash flows, and grow at least at the historical rate.

Creditors: A creditor, or anybody else for that matter, who has contributed funds to the company, will be curious about the company's ability to repay the debt and its various Cash Management strategies.

Authorities in charge of regulation: The Securities and Exchange Board of India (SEBI) audits financial statements of publicly traded firms to verify if they comply with Accounting standards and SEBI laws and recommendations.

Financial Statement Analysis Tools

It's crucial to remember that if you're using financial statements from multiple reporting periods, each one should be in a similar format so that you have all of the pertinent data in one place and can compare one period to the next.

Each of the strategies listed below provides visibility into various company trends and difficulties. However, they create concerns about the company, which must be addressed. The ultimate goals of financial statement analysis are to investigate the firm, establish logical causes for discrepancies, and make changes based on good or negative patterns.

Financial statement analysis can be done using a variety of approaches and procedures. However, the following are the most popular approaches:

1. Horizontal Analysis

A horizontal analysis compares the financial statements and their components over two years. It's also known as trend analysis, and it's frequently represented in monetary and percentage terms. This comparison gives analysts insight into the factors that could substantially impact the company's financial status or profitability.

2. Vertical Analysis

It is a financial statement analysis approach in which each financial statement line item is listed as a percentage depending on a figure inside the financial statement. The income statement line items can be expressed as a percentage of gross sales. In contrast, the Balance Sheet line items could be described as a percentage of total assets or liabilities. In cash flow, any cash inflow or outflow can be expressed as a percentage of total cash inflows. This research provides insight into the changes in the allocation and distribution of total assets. In benchmarking, this type of financial statement examination is also used to compare one organization to another.

Talk to our investment specialist

Financial Statement Ratio Analysis

The link between distinct statistics on the profit and loss account, balance sheet, Cash Flow Statement, or other accounting records is represented by a ratio between two values. It's a type of financial statement analysis utilized to provide a rapid picture of its financial performance in many areas. Ratio analysis has a lot of valuable qualities as a financial analysis tool. The information offered by the financial statements is easily accessible. The ratios make it possible to compare organizations of various sizes and compare an organization's financial performance to Industry averages.

Using trend analysis, ratios could also be used to identify areas within an organization where performance has deteriorated or improved over time. The following are the most important ratios:

1. Profitability Ratio

They assess a company's overall or day-to-day management performance and Efficiency. Gross profit margin, net profit margin, return on equity Capital, return on Capital Employed, Operating Ratio, Earnings Per Share, and Dividend Yield ratio are the most often used profitability ratios.

2. Liquidity Ratio

liquidity ratios assess a company's present solvency. These are used to determine if a company has the financial resources to meet its current obligations. The current ratio and quick ratio are two of the most frequent liquidity ratios.

3. Solvency Ratio

Solvency ratios assess a company's ability to meet long-term interest payments as well as repayment obligations. The equity ratio, debt-to-equity ratio, and interest coverage ratio are the most popular solvency ratios.

4. Activity Ratio

Activity ratios demonstrate how successfully management uses the company's resources and hence indicate the quality of management. accounts payable turnover ratio, accounts receivable turnover ratio, Fixed Asset turnover ratio, inventory turnover ratio, and working capital turnover ratio are the most critical activity ratios.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.