What is a Hedge Fund?

Hedge fund firms are always in the news, either due to its high profile investors or because of its returns. They have a reputation of outperforming the Market to deliver superlative returns. In this article, we shall have a deeper look into what is a hedge fund, their background in India, the pros and cons, and their taxation.

Hedge Fund: Definition

A hedge fund is a privately pooled investment fund that uses various strategies to optimise returns. As the name suggests, a hedge fund “hedges” i.e. attempts to reduce the market risk. The main aim of the hedge fund is to maximise returns. The hedge fund value is based on the fund’s NAV (Net Asset Value). They are similar to Mutual Funds since both of them collect money from investors to invest in different avenues. But the similarity ends here. Hedge funds employ different and complex strategies to optimise returns. On the other hand, mutual funds resort to simple Asset Allocation to maximise returns.

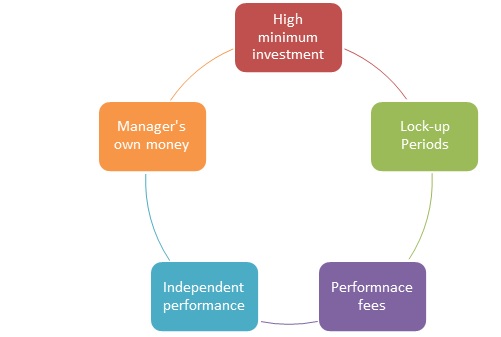

Characteristics of Hedge Funds

Minimum Investment

Generally, hedge funds tend to cater to high Net worth individuals because of the minimum investment requirement of INR 1 crore or $1 million in Western markets.

Lockup Periods

A hedge fund generally has a lock-up period that is quite restrictive. They usually allow withdrawals only on a monthly or quarterly Basis and may have initial lock-in periods.

Performance Fees

A hedge fund is actively managed by a fund manager. They are paid an annual Management Fee (typically 1% of the fund’s assets) along with a performance fee.

Independent Performance

The performance of a hedge fund is measured in absolute terms. The measure is uncorrelated to a benchmark, index or the market direction. Hedge funds are also called "Absolute Return" products due to this.

Manager's Own Money

Most managers tend to invest their own money along with the investors. They align their own interests with that of the investor.

Talk to our investment specialist

Hedge Fund Background in India

A hedge fund falls under Category III of the Alternative Investment Fund (AIF) in India. AIFS were introduced in India in 2012 by Securities and Exchange Board of India (SEBI) in 2012 under the SEBI (Alternative Investment Funds) Regulations, 2012. It was introduced in order to have more transparency in the functioning of AIFs. To be classified as a hedge fund, a fund needs to have a minimum corpus of INR 20 crore and a minimum investment of INR 1 crore by each investor.

An alternative investment is an investment product apart from traditional investments like cash, stocks or and Bonds. AIFs include venture Capital, private equity, option, futures, etc. basically, anything that doesn’t fall under the traditional categories of property, equity or fixed Income.

Benefits of Investing in a Hedge Fund

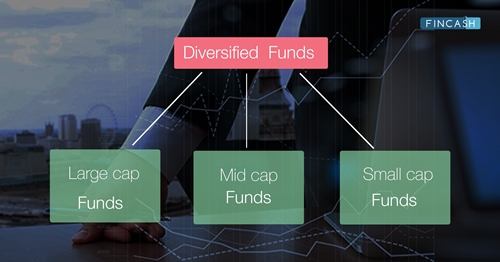

Diversification

Hedge funds make use of complex and sophisticated investment strategies and have better Risk assessment methods compared to traditional investments. Also, hedge funds may have multiple managers rather than a single manager for the fund. This naturally reduces the risk related to a single manager and results in diversification.

Managerial Expertise

Hedge fund managers are responsible for huge amounts. A small mistake can result in loss of at least crores. Hence, they are chosen with extreme prejudice based on their performances and experience. This ensures that your money is in good and experienced hands.

Personalised Portfolio

Since the minimum investment amount itself is quite huge, investors are given the best of services. One of the benefits of this is a personalised Portfolio.

Low Correlation to Traditional Assets

Hedge funds function independently of the Market Index. This makes them less sensitive to market fluctuations compared to other forms of investments like bonds or shares. They help in improving portfolio returns by relying less on Fixed Income markets. This reduces the overall portfolio Volatility.

Disadvantages of Investing in a Hedge Fund

High Minimum Investment

The minimum amount of investment in a hedge fund must not be less than INR 1 crore. Such a huge amount of investment is not possible for the middle class. Hence, hedge funds remain a viable investment option for the rich and famous only.

Liquidity Risks

Hedge funds generally have lock-in periods and less availability of frequent transaction. This affects the liquidity of the investment, due to this nature hedge funds are considered as a long-term Investing option.

Manage Risk

A fund manager actively manages a hedge fund. He decides the strategies and the investment avenues. The manager may Fail to meet the investment objectives resulting in average returns.

Top Hedge Funds in India

Some of the top hedge funds in India are:

| Name of the Hedge Fund Firm | AUM |

|---|---|

| blackrock Advisors | $1001.7 BB (2022-04-22) |

| Citadel LLC | $253.4 BB (2022-03-31) |

| Bridgewater Associates | $235.5 BB (2022-05-16) |

| AQR Capital Management | $145.5 BB (2022-03-30) |

| Man Group PLC | 14,330 crores USD (2022) |

| Renaissance Technologies | $121.8 BB (2022-03-31) |

| DE Shaw & Co LP | $128.0 BB (2022-03-31) |

| Tiger Global Management | $124.7 BB (2022-06-14) |

| Two Sigma Investments LP | $81.2 BB (2022-03-31) |

| Millennium Management | $341.0 BB (2022-03-31) |

| Elliott Asset Management | $83.5 BB (2022-06-30) |

| Davidson Kempner Asset Management | $44.1 BB (2022-06-14) |

| Lone Pine Capital Management | $35.5 BB (2022-03-31) |

| Baupost Group Asset Management | $31.6 BB (2022-03-29) |

| Point 72 Asset Management | $138.5 BB (2022-05-02) |

Hedge Fund Taxation in India

As per the Central Board of Direct Taxes (CBDT), if the Deed of the Category III of AIFs does not name the investors, or does not specify the beneficial interest, the entire income of the fund shall be taxed at the Maximum Marginal Rate (MMR) of income tax in the hands of the trustees of the fund in their capacity as a representative assessee. Hedge funds are not a suitable option for retail investors since their investment requirements are quite high. Mutual funds, bonds, Debt fund, etc. are a much more suitable and safer option for them. Evaluate your options based on your investment goals and income level. So, do not be blinded by the high returns of a hedge fund. Invest your hard-earned money wisely!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Thanks... Usefull...