Idiosyncratic Risk

What is Idiosyncratic Risk?

Commonly known as unsystematic risk, Idiosyncratic risk meaning refers to a common form of risk on the individual’s investment and assets. It is quite common on a single asset, a couple of assets, and a rare type of asset. Note that idiosyncratic risk is different from the systematic risk that happens because of the changes in the stock prices, Inflation, and fluctuating interest rates.

Let’s understand the concept with a detailed example.

Example of idiosyncratic risk

Suppose a company notices sudden changes in its prices for certain reasons. However, these reasons have nothing to with the organization’s workforce or managerial power. For example, the changes in the tax policy, inflation, customer demands, and interest rates are some of the factors that affect the company’s stock price but have nothing to do with its managerial skills. Most importantly, it isn’t something the company can control or avoid. Here, these factors do not only affect the stock price of a particular company, but they have an impact on the entire stock Market. That being said, these risks are systematic and inevitable.

Now, if the investor plans on trading the stock of this company, then they will have to deal with systematic risk. Idiosyncratic risk, on the other hand, are more about the company’s managerial skills, marketing strength, supply chain, and other such factors that are under the company’s control. This results in the idiosyncratic risks since the reasons that cause this risk are not systematic. It only affects the prices and Volatility rate of a particular company.

Talk to our investment specialist

Overview of the Idiosyncratic Risk

Systematic risk is something that each investor has to bear at some point. That’s because they don’t have another choice. When the inflation, changes in the taxation policy, and other such factors fluctuate the stock market, then the prices of the stock of each company will be affected. However, when these prices fluctuate because of the company’s standards or lack of managerial skills, then that can lead to idiosyncratic risk.

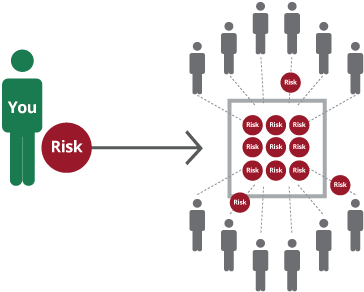

Most experts believe that one way to control the idiosyncratic risk is by Investing in different types of securities. In other words, diversification can help you mitigate this risk to some extent. By investing in multiple stocks, you can diversify your investment Portfolio and reduce the volatility.

According to the research, a majority of the fluctuations you notice in the particular stock over a short period occur mainly because of the idiosyncratic risk. It is important to note that idiosyncratic risk does not affect Macroeconomics. These risks are limited to a particular type of stock. Simply put, idiosyncratic risk refers to the factors that have an impact on a small portion of the stock, probably the stocks of a particular company. The managerial decisions and changes in the investment policy are two of the common reasons that result in idiosyncratic risk. These risks are unpredictable and restricted to a smaller portion of the Economy. Unlike idiosyncratic risks, systematic risks affect the larger economy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.