Table of Contents

Interest Rates

What are Interest Rates?

An interest rate is the amount charged for borrowing money. It is expressed as a percentage of the total amount of the loan. Interest rates are typically noted on an annual Basis, known as the annual percentage rate (APR). The interest rate, set by your Bank and based on the Reserve Bank of India's official cash rate, determines how much interest you will earn or pay.

The assets borrowed could include cash, consumer goods, and large assets such as a vehicle or building.

Why do you Pay Interest?

You are paying the cost for the ability to use money you haven’t yet accumulated, so interest is an incentive for the bank or a lender to lend you money. Charging interest is one of the ways lenders make their profit.

Interest Rate Formula

The formula to find an interest rate of a loan is:

Interest Rate = (Total Repayment Amount - Amount Borrowed) / (Amount Borrowed)

Talk to our investment specialist

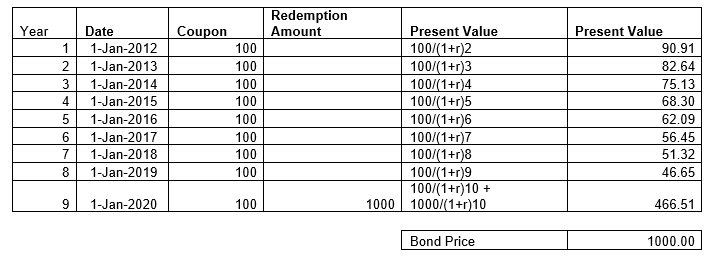

Interest Rate Calculation

Using the interest rate formula, let's make a calculation for illustration purpose.

Let's assume that you took a loan of INR 20,00,000 for personal purpose. If a lender agrees to lend you INR 20,00,000, but you have to pay INR 25,00,000 at the end of the year. Calculations -

(INR 25,00,000 repaid - INR 20,00,000 principal) to borrow the money.

This translates to:

Interest Rate = (INR 5,00,000) / (INR 20,00,000 ) =

25% interest

Types of Interest Rates

There are also a couple of different types of interest rates, they include:

Fixed Interest Rates

This type of interest rate is set at a specific rate and remains unchanged over the term of the loan or deposit.

Variable Interest Rates

A variable interest rate does just what the name suggests too - it varies. Depending on the Market and the RBI's official cash rate, your lender might raise or lower interest rates and those changes will affect the amount of interest you pay or receive.

Simple Interest Rate

This type of interest rate is calculated on the original principal amount only, and does not take into account the compounding of interest.

Compound Interest Rate

This type of interest rate is calculated on both the principal amount and the accumulated interest. Compound interest is often used for long-term savings and investment accounts.

Floating Interest Rate

This type of interest rate fluctuates with changes in the market or the Underlying benchmark rate. Floating interest rates are often used for adjustable-rate mortgages or variable-rate loans.

Nominal Interest Rate

This type of interest rate does not take into account Inflation and is expressed as a percentage of the original principal.

Real Interest Rate

This type of interest rate takes into account the effects of inflation and is expressed as a percentage of the purchasing power of the original principal.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Easy to learn.