Table of Contents

How Interest Rates Affect Bonds

We have seen what are Bonds. To recall, a bond is debt security with a fixed Income return till the maturity period.

So How Do Bond Prices get Affected by Interest Rates?

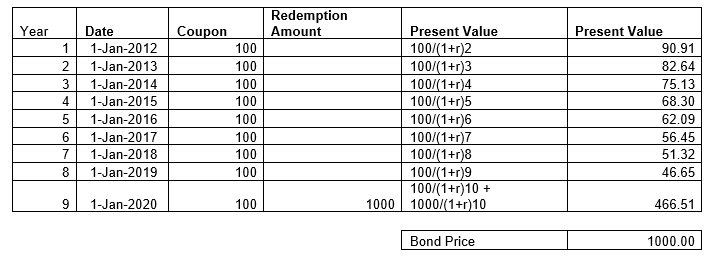

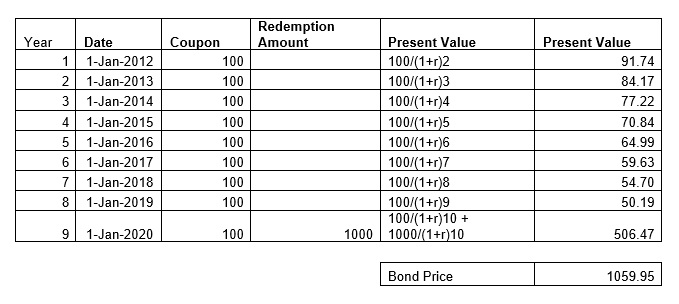

So let’s take an example of a 10-year bond issued on 1st Jan 2011 INR 1000 at 10%. Now let’s look at the bond one year from the issue date, i.e. the time left to maturity is 9 years. We will use the formula for compound interest.

Amount = Principal (1 + r/100)t

r = interest rate in %

t = time in years

Bond value calculated at the Interest Rate of 10%

Bond value calculated at the Interest Rate of 10%

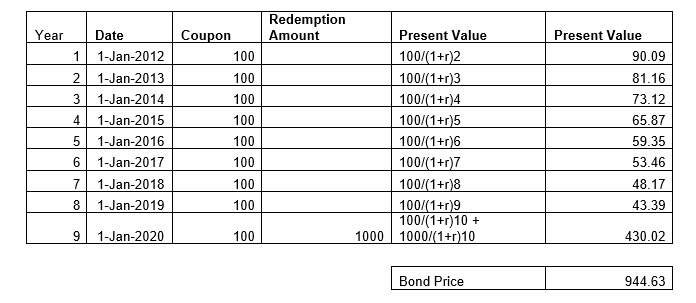

However, let’s look at the scenario, where the interest rates in the Economy have changed. Say if the interest rates moved up to 11%

Bond value calculated at the Interest Rate of 11%

Bond value calculated at the Interest Rate of 11%

Thus the bond price is Rs. 944

And now, if the interest rates move down to 9%

Bond value calculated at the Interest Rate of 9%

Bond value calculated at the Interest Rate of 9%

Thus, we can see that the bond price is INR 1059.

To tabulate at different levels of the prevailing interest rate:

| discount Rate | Bond Price |

|---|---|

| 10% | 1000 |

| 9% | 1059 |

| 11% | 944 |

Table: Interest Rate to Bond Price

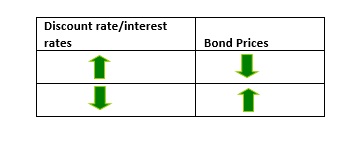

So clearly there is an inverse relationship between interest rates and bond prices. So in summary,

Relation between Interest Rates and Bond Price

Relation between Interest Rates and Bond Price

Now probably you can appreciate the fact that when RBI raises or lowers rates in the economy how the bond prices get affected.

Talk to our investment specialist

How do Bonds of Different Tenures get Affected by Changes in Interest Rates?

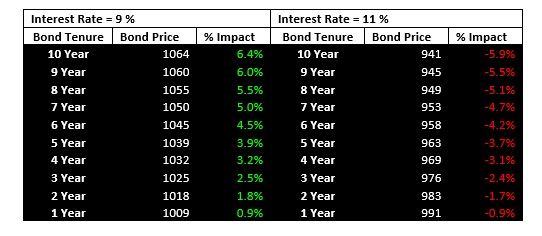

You have the cash flows of bonds from tenures of 10 years to 1 year. As per the table, the prevailing interest rate is 10%, but supposing the rates were to get lower to 9% or to increase by 1% to 11%, then what happens, the values are as below:

Clearly, the impact is more in the 10-year category than the other lower tenures and this order of impact is the same whether interest rates go up or down. Hence we’re seeing a clear relationship that bond prices of longer tenure bonds get impact more if rates go up or down.

Hence from a fund manager’s perspective if you want to take a view on interest rates, for a bigger impact one would take longer tenure bonds in their Portfolio.

A fund manager holds a number of bonds in his portfolio, so how do we see the impact of interest rate affecting the bonds?

One can add all the cash flows (coupons & Redemption payments) and discount them to get the bond price, and hence we can see how the price changes with rates.

However, we’ve also seen earlier that the tenor or maturity of the fund has an impact on how bond price moves with interest rates. The weighted average maturity of the fund is calculated and used to measure the interest rate sensitivity of the portfolio. This maturity period is called “Duration”.

Hence greater the duration greater the impact on the fund when interest rates move. Whenever seeing a fund, always look at the duration of the fund to see its sensitivity to interest rates. Whether its long-term income funds or long-term Gilt Funds, the duration of these funds are typically high, implying a high impact in the portfolio when interest rates move.