Table of Contents

Law of One Price

What is the Law of One Price?

In Economics, the law of one price meaning says that the price of similar products will remain the same in all countries. This law assumes a frictionless Market with no telecommunication and transportation costs, legal issues, and transaction costs. Even the currency exchange rates remain stable for global transactions. The main purpose of the law of price is to eliminate all kinds of differences between the costs of identical products in a different region.

It goes without saying that the changes in the price of a similar commodity are mainly because of the transportation costs and currency exchange rates. Besides that, suppliers tend to manipulate the price of the commodity and assets. This especially happens because of the arbitrage opportunity. No seller would want to sell the commodity at a lower than purchased price. They rather purchase the products from a market where it is available at a reasonable price and sell the same in the market where it is sold at a high price. That’s how they make the best of the arbitrage opportunity.

How Does the Law of One Price Work?

The law is also the base of the purchasing power parity. It suggests that the currency exchange rate is stable and the currency value of different countries is the same when the products are sold at the same price in different countries. For example, a basket full of identical goods must be available for global buyers at the same price to achieve the law of one price. This law helps buyers gain the same purchasing power no matter where they shop.

Talk to our investment specialist

While it seems to balance the price of the products for each customer, purchasing power parity cannot be achieved practically. That’s because the goods are associated with the transportation, trading, currency exchange, and other such extra costs that can raise its value in other countries. The main use of the purchasing power parity is to compare the cost of identical products in different trading markets. Now that the currency exchange rate tends to change frequently, you might need to re-compute the purchase power parity to find out the differences in the pricing strategies of different trading markets across the world.

Example of the Purchasing Power Parity

As mentioned above, people use these differences to their advantage by purchasing the product from the market where it is sold at a cheaper price and selling it at a high rate in another market. Let’s take an example. Suppose you find a commodity worth Rs. 10 in market A. The same commodity is sold for Rs. 20 in market B due to regional differences, transportation costs, and market factors.

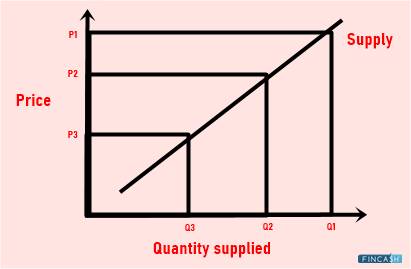

Now, the investor can buy the product for Rs. 10 from Market A and sell it at Rs. 20 in Market B to make a profit of Rs. 10. One of the major factors that lead to the changes in the price of these commodities is the fluctuations in the demand and supply of the product.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.