Margin

What is Margin?

Margin is the difference between the total value of securities held in an investor's account and the loan amount from a broker. However, the word margin has several meanings, both in business stream and finance stream, as well as other situations. It can also mean the amount by which revenue from total sales exceeds costs in a business. It can even refer to the difference between the cost of a product and how much you sell it for.

Buying on margin is the act of borrowing money to buy securities/assets. The includes buying an asset where the buyer pays only a percentage of the asset's value and borrows the rest from the broker or Bank. The broker acts as a lender and the securities in the investor's account act as Collateral.

Margin percentages are usually estimated at 2%, 1%, or 0.5% for CIMA clients, or at 50%, 20%, 10%, 5% or 3.33% for CySEC and FCA clients.

Marginal Terms

Here are the examples appear in context with related terms including the following:

- Gross Profit

- Gross Margin

- Operating Profit

- Operating Margin

- Net Profit

- Profit Margin

- Investor Leverage

- Profitability

- Markup

Talk to our investment specialist

Margins in Investing

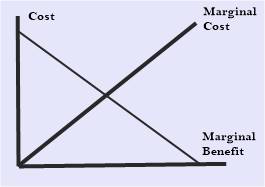

In investment term, margin refers to buying shares of stock with a combination of the investor's funds and borrowed funds. If the stock price changes between its purchase and sale, the result for the investor is leverage. Leverage stands for the investor's percentage gain/loss magnifies compared to the percentage gain/loss had the investor purchased shares without borrowing.

Margins in Business Commerce

As a general term in business and commerce, margin refers to the difference between selling price and the seller's costs for the goods or services on sale, expressed as a percentage of selling price.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.