Table of Contents

Marginal Analysis

What is Marginal Analysis?

Marginal analysis refers to the advantages of the particular activity in comparison with the total expenses they incurred on the same activity. It is mainly used to increase profits. It is considered as one of the crucial decision-making tools that result in a careful examination of the difference between the benefits and cost of the activity. Marginal is defined as the benefit or expenses of another unit. For instance, marginal help you calculate the expenses incurred for the production of another unit of the same product. Similarly, the revenues you earn from hiring a new employee refers to the marginal.

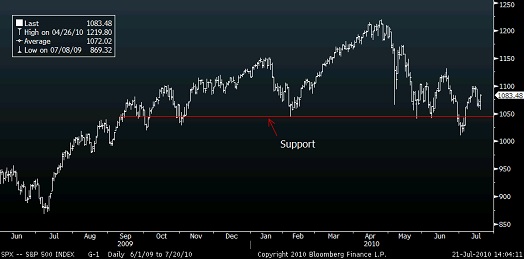

Another application of marginal analysis is in investments. You can conduct the analysis when there are two investment opportunities, but you have only limited funds. In such a case, it works as the decision-making tool that makes it easier for you to select the right investment product that can make you substantial profits. By using the marginal analysis, you can determine if one investment product can result in lower expenses and higher profits than the other one.

Marginal Analysis in Microeconomics

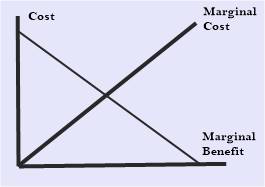

The concept is extensively used in microeconomics. Most analysts use marginal analysis to identify how the marginal value can have an impact on the complex system. In other words, marginal analysis is used especially to figure out the impact of the small changes on the company. The concept is also used to determine how a particular financial decision or activity led to the changes in the organization. Did it raise the expenses or increased the profit?

Talk to our investment specialist

How Small Changes affect the Organization as a Whole?

In the microeconomics contexts, marginal analysis is used to find out the changes in the business procedures or the output due to the small changes. For instance, a company could decide to change the quality and quantity of the raw material to see a growth in the product output by 1-2 percent. They can use marginal analysis to notice how the changes affected the final output. If they notice a growth in the output by 2 percent, then they can follow the same procedure to get the same output. These small changes in the production strategies can make it easier for the business to establish the best production rate.

Opportunity Cost

Decisions can’t be made based on the marginal analysis alone. You are also supposed to take the Opportunity Cost into consideration when making important business or investment decisions. Let’s say the HR department of a company is planning to bring a new employee to the company. They have the budget to hire a new worker. Besides, they know that a factory employee can bring substantial profits to the company.

While everything seems to be in the favor of hiring this employee, it doesn’t necessarily make the factory employee recruitment the right decision. In this case, an experienced employee that is more expensive to your firm can prove a lucrative investment given that they bring a larger profit to the company.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.