Table of Contents

What is Operating Cash Flow Margin?

An important financial parameter called operating cash flow margin assesses how much cash a company's operations generate about its sales. It provides insight into a company's ability to generate cash flow and maintain its operations in the long term. By understanding the operating cash flow margin, investors and analysts can better understand a company's financial health and ability to generate value for shareholders. In short, the operating cash flow margin is a vital metric for anyone looking to assess the health and prospects of a company.

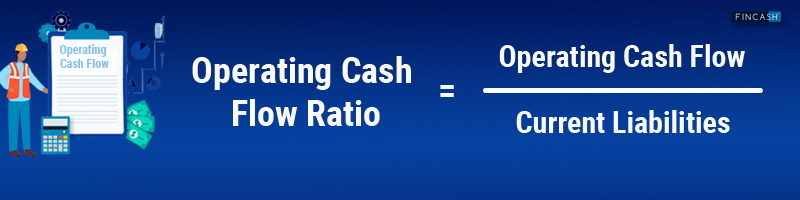

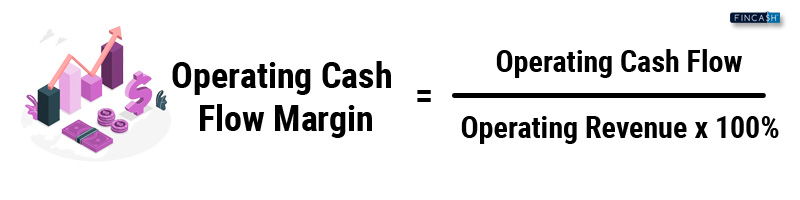

Formula for Calculating Operating Cash Flow Margin

This formula is used to determine the operating cash flow margin:

Operating Cash Flow Margin = Operating Cash Flow / Operating Revenue x 100%

Where:

- Operating Cash Flow = Operating Revenue - Operating Expenses +/- Changes in

- Working Capital +/- Depreciation and Amortisation

- Operating Revenue = Total revenue generated from a company's operations

- Operating Expenses = All expenses incurred in the normal course of business operations

- Changes in Working Capital = Changes in a company's current assets and liabilities over a period

- Depreciation and Amortisation = Non-cash expenses that represent the gradual loss of value of assets over time

Talk to our investment specialist

Factors That Affect Operating Cash Flow Margin

Several factors can affect a company's operating cash flow margin, including:

Sales Revenue

The level of sales revenue generated by a company's operations is a critical Factor that affects the operating cash flow margin. Higher revenue can lead to higher cash flow, all else being equal.

Operating Expenses

The level of operating expenses incurred by a company can impact its operating cash flow margin. Higher expenses can reduce cash flow, while lower expenses can increase it.

Changes in Working Capital

Changes in a company's current assets and liabilities can significantly impact its operating cash flow margin. For example, an increase in accounts receivable or inventory can reduce cash flow, while an increase in accounts payable can increase it.

Depreciation and Amortisation

Non-cash expenses like depreciation and amortisation can affect the operating cash flow margin. These expenses reduce net Income but do not impact cash flow, so excluding them from the calculation can lead to a more accurate assessment of cash generation.

Industry-Specific Factors

Industry-specific factors like seasonality, competition, and regulatory changes can impact a company's operating cash flow margin. For example, a retailer may experience higher cash flow during the holiday season due to increased sales, while a Manufacturing company may experience lower cash flow during a Recession due to reduced demand.

Analysing Operating Cash Flow Margin

Analysing operating cash flow margin is essential to evaluating a company's financial health and performance. Here are some steps you need to take:

Use the earlier formula to calculate the operating cash flow margin for the company you are evaluating. This will help you understand how much cash the company generates from its operations relative to its revenue.

Compare the company's operating cash flow margin with its peers in the same industry. This will help you understand how the company performs relative to its competitors and whether it generates more or less cash from its operations.

Analyse the trend in the company's operating cash flow margin over time. This will help you understand whether the company's cash flow is improving or deteriorating and identify potential risks or opportunities.

Identify the factors driving the company's operating cash flow margin, such as changes in revenue, expenses, or working capital. This will help you understand the Underlying factors that are impacting the company's Financial Performance.

Consider other financial metrics, such as net income, free cash flow, and Return on Investment, to gain a more comprehensive understanding of the company's financial health.

Operating Cash Flow vs. Net Income

Here are some key differences between operating cash flow and net income:

Cash vs. Accrual Basis

Operating cash flow is calculated on a cash Basis, while net income is calculated on an accrual basis. This means that operating cash flow focuses on actual cash flows, while net income includes non-cash items like depreciation and amortisation.

Timing of Revenue and Expenses

Operating cash flow and net income can differ due to differences in the timing of revenue and expenses. For example, a company may have high net income due to significant sales revenue, but if those sales are not collected in cash yet, the operating cash flow may be lower.

Non-Operating Items

Net income includes non-operating items like interest income and expenses, gains or losses from the sale of assets, and Taxes. Operating cash flow focuses only on cash generated from operations and excludes non-operating items.

Future Growth and Investment

Operating cash flow is an important metric for understanding a company's ability to fund future growth and investment, while net income is more focused on profitability.

Final Thoughts

Operating cash flow margin is a crucial financial metric that provides insights into a company's ability to generate cash from its operations. By analysing this metric and understanding the factors that affect it, investors and analysts can gain a deeper understanding of a company's financial health and prospects. However, it's important to consider the operating cash flow margin in the context of other financial metrics and industry-specific factors. By doing so, investors can make more informed investment decisions and mitigate potential risks.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.