Table of Contents

What is Operating Leverage?

Operating leverage measures the ability to increase net Income by increasing operating expenses. It is calculated by dividing the change in net income by the change in total assets. The higher the operating leverage, the more sensitive the company's Earnings are to changes in its operating expenses. Low operating leverage indicates that it is relatively easy for a company to increase its net income by increasing operating expenses and vice versa.

Operation Leverage helps analyse the level of Efficiency achieved by a company. The higher the operating leverage, the better for a company as it will be able to earn more profits from its operations. High operating leverage means fewer costs involved in producing a unit of output, leading to lesser costs per unit of production.

High Operating Leverage

Operating leverage is how a company's income or net income changes in response to changes in sales volume. It is the percentage change in operating income or net income resulting from a one-percentage-point change in sales volume. An increase in operating leverage means that a company will experience more significant growth when its sales increase.

If a company has high operating leverage, its operating income will increase more than its net income when sales increase by 1%. A company with low operating leverage will have less of an increase in earnings for each additional rupee of revenue earned.

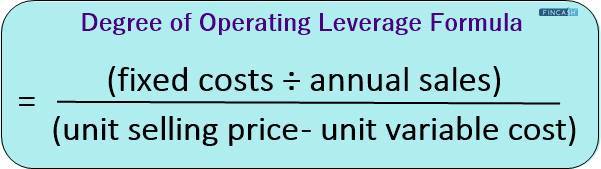

Degree of Operating Leverage

Degree of Operating Leverage (DOL) measures a company's operating efficiency. It depicts the revenue proportion generated by each rupee of sales. A high DOL means that each rupee in sales results in more profit than a low DOL.

DOL = (fixed costs ÷ annual sales) / (unit selling price - unit variable cost)

A high degree of operating leverage indicates that changes in sales will have a significant impact on profits, while a low degree suggests that changes in sales will have a smaller impact on profits.

Talk to our investment specialist

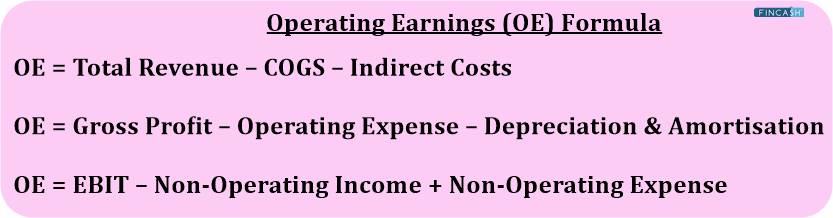

Operating Leverage and Financial Leverage Formula

The best way to understand operating leverage is by looking at the below-mentioned formula. The operating leverage formula is:

Operating leverage = (Quantity x (Price – Variable cost per unit)) / ((Quantity x (Price – Variable Cost Per Unit)) – Fixed Operating Costs)

And the financial leverage formula is:

Company Debt/Equity

Operating Leverage Example

A business has fixed costs as it continues to develop and do marketing for its products. The sum of these costs is Rs. 500,000 as it is used to pay salaries and wages. The price per unit is Rs. 0.05. The concerned business will sell 25,000 units at a rate of Rs. 10 each.

Now that you have fixed costs, variable cost per unit, quantity, and price, you can compute the operating leverage using its formula.

| Operating Leverage |

|---|

| = ( 25,000 x ( 10 – 0.05 ) ) / ( 25,000 x ( 10 – 0.05 ) – 500,000 ) |

| = 248,7500 / 251,250 |

| = 0.99 |

| = 99% |

What is meant by this?

A 10% increase in business sales will equate to a 9.9% increase in profits and revenue.

You may also check the operating leverage by altering the price to check out how much profit you make as the fixed costs remain the same. This lets you check out how much profit you will earn as soon as the price per unit changes and the number of units sold differs. You can use the Operating Leverage calculator for the calculation.

Operating Leverage and Beta

Beta measures the systematic risk associated with movements in the overall Market. Operating leverage is a measure of the specific risk, that is, the risk associated with individual companies or industries. Companies with low operating leverage are "high-beta" stocks because they tend to have volatile stock prices relative to their earnings growth rates or multiples. High-beta stocks swing wildly in value and increase their P/E multiples substantially during the bull market phases.

Conclusion

The operational leverage indicates that you are pricing your items effectively such that all costs are met while still making profits. The items are often priced so cheap that even while sales are more than ever, they cannot cover the high fixed and variable expenses. Businesses must understand and consider strategies to utilise their fixed expenses wisely since these costs will stay constant despite the number of sales made. Companies may boost their operational leverage by finding methods to increase profitability with current fixed assets.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.