Table of Contents

Defining Operating Earnings

Operating Earnings are used in corporate Accounting and finance to describe the profits generated by a company's primary operations. It refers to the profit generated from revenues after deducting expenses like:

- Cost Of Goods Sold (COGS)

- General and Administrative (G&A) expenses

- Marketing and selling charges

- Research and development cost

- Depreciation

- Other operational costs

Operating earnings are a crucial indicator of a company's profitability. As it removes non-operating expenses, like interest and Taxes, the statistic can assess how effectively the company's main lines of business are performing. These are at the centre of internal and external analyses of how a firm makes money and how much it makes. Individual Operating Cost components can be compared to total operating expenses or total revenues to aid management in running a business.

Typically, operating earnings are found near the conclusion of the Income statement in a company's financial accounts. Operating earnings aren't the pretty renowned "bottom line," revealing how well or poorly a company is doing. That distinction pertains to a company's net income, with "net" denoting what remains after taxes, interest charges, loan repayments, and other non-operating debts have been deducted.

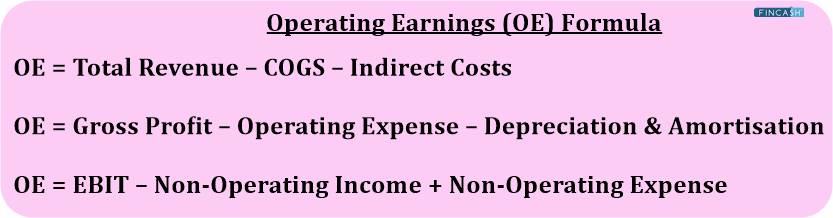

Operating Earnings Formula

Here are the three formulas for operating income calculator:

Operating Earnings = Total Revenue – COGS – Indirect Costs

Operating Earnings = Gross Profit – Operating Expense – Depreciation & Amortisation

Operating Earnings = EBIT – Non-Operating Income + Non-Operating Expense

Talk to our investment specialist

Operating Earnings Example

Assume that firm ABC generated Rs. 3,50,000 in sales revenue this year. The cost of items sold was Rs. 50,000; maintenance fees were Rs. 3,000, rent was Rs. 15,000, insurance was Rs. 5,000, and employee net compensation was Rs. 50,000.

To begin, we compute operating costs as follows:

Rent + Insurance + Maintenance + Salaries = Operating Expenses

Rs. 15,000 + Rs. 5,000 + Rs. 3,000 + Rs. 50,000 = Rs. 73,000

Revenue from operations would be:

Sales Revenue - (COGS + Operating Expenses) = Operating Income

Rs. 3,50,000 - (Rs. 73,000 + Rs. 50,000) = Rs. 2,27,000

The company's operational income is Rs. 2,27,000.

Importance

Here is why operating earnings are essential:

- It is an excellent indicator of how well a company is doing

- It's also utilised to figure out different financial ratios

- Investors, creditors, and management all keep a careful eye on the company's Earnings Before Interest and Tax (EBIT) to track its performance

- Investors can evaluate various companies at their functional level, which is crucial to consider when making an investment decision

- The operating profit of a company is an indirect measure of its profitability

- The higher a company's operating income, the more the profitable

Issues with Adjusted Operating Earnings

When a company offers its operating earnings to investors, it may be tempted to highlight this detail above its net income values (including functional and financing results). An excessive focus on operating earnings might distort the investor's perception of a company's performance. This is frequently done when a company has a high operating profit but a low net profit.

Operating Earnings vs EBIT

EBIT is the business's net income from operations before taxes, and Capital structure is considered. EBIT is frequently confused with operating income. Non-operating expenses and other income generated by the company are included in EBIT in some businesses. However, only operating income is taken into consideration for determining operating income. Furthermore, EBIT is not an official Generally Accepted Accounting Principle (GAAP) measure, while operating income is.

Businesses utilise the operating income to determine the profitability of their operations. The items connected to day-to-day managerial decisions, like pricing strategy and labour expenses, directly impact revenue, they also assess a manager's Efficiency and adaptability. However, you must note that some industries have higher labour and material expenses than others. This is why comparing operating income among companies in the same Industry is advantageous.

Operating Earnings vs Net Income

Although operating income and net income indicate a company's earnings, they are two unique expressions of earnings. Both measurements have advantages, but their calculations include distinct deductions and credits. By analysing the two data, investors can establish where a company began generating a profit or incurring a loss.

Operating Income vs Revenue

Before any expenses are removed, revenue is the complete amount of income generated by a firm from selling its goods or services. Operating income is the overall profit after removing a company's normal, recurrent costs and expenses.

Operating income and sales are essential financial indicators that illustrate how much money a company makes. However, the two numbers represent different ways of measuring a firm's earnings, and their computations require different deductions and credits. Nonetheless, revenue and operating income are important in determining whether a company is performing effectively.

Conclusion

Operating earnings is a crucial notion for understanding a company's financial health. Although Net Profit is vital in determining a company's financial health, operating profit provides a more accurate picture when comparing organisations with varied tax and finance structures.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.