What is Operational Efficiency in Business?

Operational Efficiency is a metric used to assess how effectively profits are generated concerning operational expenses. A company or investment is more profitable, the more operationally efficient it is. This is because the entity can provide more Income or returns than an alternative for the same or less money. Reducing transaction fees and costs improve operating efficiency in the financial markets. An "internally efficient Market" is another term for a market that is operationally efficient.

Operation Efficiency Strategy

The transaction costs related to investments are often the focus of operational efficiency in the investment markets. General business procedures for operational efficiency in Manufacturing can be used to compare operational efficiency in investment markets. The most profitable exchanges have the most significant margins, meaning that investors must pay the least to make the most money. Similarly, businesses want to produce their products at the lowest cost possible to achieve the most considerable gross margin profit. Almost often, Economies of Scale can increase operational efficiency. Lowering the fee per share in the stock market may entail purchasing additional shares of an investment at a set trading cost.

A market is operationally efficient when circumstances permit players to carry out transactions and obtain services at a cost that fairly reflects the expenditures incurred to deliver them. Competitive marketplaces are frequently a result of operationally efficient markets. Regulation that aims to regulate fees to shield investors from high expenses may also impact operationally efficient markets.

Talk to our investment specialist

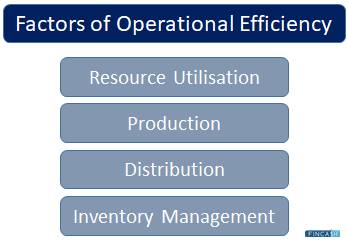

Factors of Operational Efficiency

A business can increase operational efficiency by streamlining its core functions cost-effectively while eliminating wasteful procedures. Usually, this is accomplished by focusing on the following:

- Resource Utilisation: The goal of resource utilisation in the production and operational areas is to reduce waste

- Production: Production focuses on creating the most orderly production environment feasible. The enhanced output ensures that personnel and machinery are operating as effectively as possible

- Distribution: The distribution goal is to ensure that the final product is handled effectively, especially throughout routing and delivery

- Inventory Management: Producing and managing as little surplus inventory as possible while maintaining sufficient inventory to fulfil demand is part of inventory management

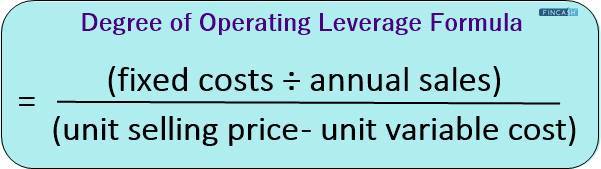

Operational Efficiency Formula

The ratio of your company's inputs (the costs of generating its goods and services) to outputs (the revenues generated by selling those services and products) is known as operational efficiency.

Simply put, your operational efficiency is x/y if your costs are x and your revenues are y.

How can Operational Efficiency be Implemented?

Several strategies exist to improve operational efficiency based on the type of organisation you work in.

You can include the most recent technology developments into your system to simplify customer interactions. Software on the market can open up new possibilities, boost sales numbers, improve client experiences, and ultimately increase revenue

The most recent software combines systems and aids in the more efficient management of daily operations. The more sophisticated features will assist the workforce in data analysis and information gathering to turn it into insightful knowledge and follow a customer's journey

Now that the relationships with clients are easier to manage, sales will increase. This motivates staff members and associated teams to become more engaged and, thus, more productive to produce the most significant outcomes

Operational Efficiency and Effectiveness

Doing things correctly is key to operational efficiency. To put it another way, it entails ensuring that the workflows are error-free to avoid delays and cost increases brought on by rework. It may also highlight keeping customers from receiving goods and services that fall short of expectations. Basically, operational efficiency refers to an organisation's capacity to provide goods or services to clients in the most effective way feasible while maintaining the highest standards for those goods, services, and support. Performing the proper actions is key to operational effectiveness. It centres on ensuring that the firm's core value stream is adequately planned and that everything adds value for the end client.

The idea of organisational effectiveness refers to how successfully a company produces its desired results and concerns HOW work is done.

Conclusion

Monitoring a company's inputs and outputs as performance indicators is necessary to measure operational efficiency. These performance metrics frequently involve effectiveness, quality, or value, and these are a few examples of customer satisfaction, quality indices, and automation accuracy. These metrics should be compiled into operational and efficiency reports demonstrating how efficiently a business operates and manages volume. Every report must include information that can be utilised to locate performance bottlenecks, including the average turnaround time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.