Table of Contents

Penny Stocks

What are Penny Stocks?

As the name suggests, penny stocks are stocks that trade for a penny, i.e. a very small amount. Penny stocks in India can have Market values below INR 10. In western markets, stocks trading below $5 are called penny stocks. They are also known as cent stocks. These stocks are very speculative in nature and are considered highly risky as they lack of liquidity, smaller number of shareholders, large bid-ask spreads and limited disclosure of information.

A penny stock generally trades below $10 a share and does not trade on major market exchanges such as the New York Stock Exchange (NYSE) and Nasdaq.

For instance, let's assume company XYZ is trading at $1 per share and is not listed on any national exchanges. Instead, it trades on the over-the-counter bulletin board. Therefore, company XYZ's stock is considered a penny stock.

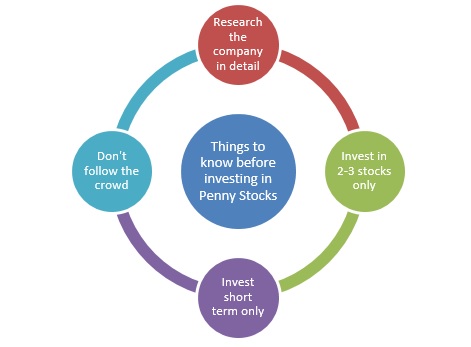

Things To Know About Penny Stocks

Now that you are familiar with the definition of penny stocks let’s have a look into a few basic points that should be known and understood before trading them.

- **Perfect for Novices

If you are just starting out and getting a hold of trading, penny stocks would be a good bet. They provide an improved level of freedom to experiment. Hence, you get to learn the ins and outs of trading easily. Considering that the prices of these stocks are low, you would not have to invest a lot to begin trading. This also keeps your losses minimum. To begin, all you would require is a Trading Account and a small amount.

- **Generation of Higher Returns

In contrast to the prevalent perspective, not all penny stocks Fail. There is an array of companies that are operating with adequate financials and better growth potential. You would have to identify these firms precisely and invest in them to generate higher returns. However, keep in mind that you may have to hold the investment for a long time period for adequate returns.

- **No Entry Barrier

When trading penny stocks, you will not need a lot to start. Mostly, the movement of price, concerning penny stocks, is speculative and doesn’t follow a methodical Technical Analysis. This way, if you are just making your entry, this would be a perfect choice. Neither you would need extensive knowledge nor any certification.

- **Low Liquidity Stocks

Considering that the market capitalization for these stocks is low, they are not often traded in the stock market. Because of low trade volume, you may find it challenging to discover both the sellers and the buyers. However, this issue can be overcome by holding the stocks for the long term. Also, you can use a staggered approach for buying or selling so as to exit or accumulate shares.

How to Choose Penny Stock?

- Research about the company

- Consider Investing in 2-3 stocks only

- Invest for a short time

Talk to our investment specialist

Reasons to Invest in Penny Stocks

Penny stocks can easily be regarded as miss or hit security. Companies that issue them may grow into larger organizations and acquire higher than average returns or slip down and incur losses. Despite all of such insinuations, penny stocks must be included in the Portfolio. Here are a few reasons justifying this statement.

- **Potential to Evolve

A majority of these stocks carry the possibilities to get evolved into multi-baggers. It simply means that these are such shares that yield multiple investment amounts. For instance, certain security has reaped double of its investment amount; it will be known as a double-bagger. And, if the return is ten times the investment value, it is known as a ten-bagger. Including these in the portfolio can increase the prospects of your return exponentially. There might be a possibility that your investment stocks may also outperform mid cap funds. However, before choosing any, thorough research must be done.

- **Inexpensive in Nature

Comparatively, investment in these stocks is inexpensive. Thus, you can invest without losing a substantial part of your investment. Allotting a minor part of your portfolio to buy the best penny stocks will let you get more results.

Risks Associated with Penny Stocks

Keeping in mind the scale whereat companies providing such stocks function, they could be prone to higher risks. Such stocks majorly rely upon market conditions to grow in terms of value. Along with basic risky factors, there are a few other things that may put you under the radar with penny stocks.

- **Restricted Amount of Information

Considering that companies that issue penny stocks are startups, there will be a lack of information when it comes to financial soundness, growth prospective, previous performance and more. People may invest half-wittingly. Hence, conducting thorough research before investing should not be avoided.

- **Scams

In financial history, penny stocks scams are nothing but common. Scammers and organizations buy a huge amount of penny stocks, leading to Inflation, which attracts other investors to follow suit. Once an adequate number of buyers have invested in stocks, such scammers and organizations dump shares. This results in an instant decrease in the value, followed by major losses.

Best Penny Stocks in India

2020 was definitely a roller coaster for most of the investors. While the pandemic made the year unprecedented, the stock market had a lot of surprises for investors.

In 2020, there were 10 major penny stocks that acquired more than 200%. So, here are the best ones that were trading less than Rs. 25 and had more than Rs. 100 crores of market cap at the end of 2019.

1. Alok Industries

In 2020, this stock increased by 602%. As of December 24, 2020, it cost Rs. 21.35.

2. Subex

The stock has increased up to 403% in the year 2020. As of December 24, 2020, it came to Rs. 29.70.

3. Karda Constructions

As of December 24, 2020, this stock saw an increase of up to Rs. 113.10, accomplishing an upsurge of 376%.

4. Kellton Tech Solutions

This stock saw an increase of 301% in 2020 and reached Rs. 72.40 as of December 24, 2020.

5. CG Power & Industrial Solutions

As of December 24, 2020, this stock is at Rs. 43.20, with an upsurge of 299%.

6. RattanIndia Infrastructure

This specific stock had an upsurge of 299%, and as of December 24, 2020, it has reached Rs. 6.61.

Conclusion

While for most people, penny stocks could be good in terms of investment, they do have a certain amount of risks, similar to every equity type. At times, the price movement of these stocks can turn unpredictable; thus, increasing the risk Factor. However, if you do your research and choose the right penny stock, these risks can easily be mitigated. Thus, make sure you don’t step back from conducting extensive technical and fundamental research.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.