Table of Contents

Profit and Loss Statement (P&L)

Every business looks forward to knowing the earned incomes and incurred expenses during a specific period. This type of calculation, generally happens toward the end of the year. And, to help companies in this scenario, a Profit & Loss statement or accounts that showcase profits and losses come into the play.

Generally, such a statement and account are used for:

- Knowing the profits and losses of a company

- It could be a statutory requirement by the Partnership Act, Companies Act, or ny other law.

In this post, let’s find out all about a Profit and Loss statement and how it can be prepared.

What is a Profit and Loss Statement (P&L)?

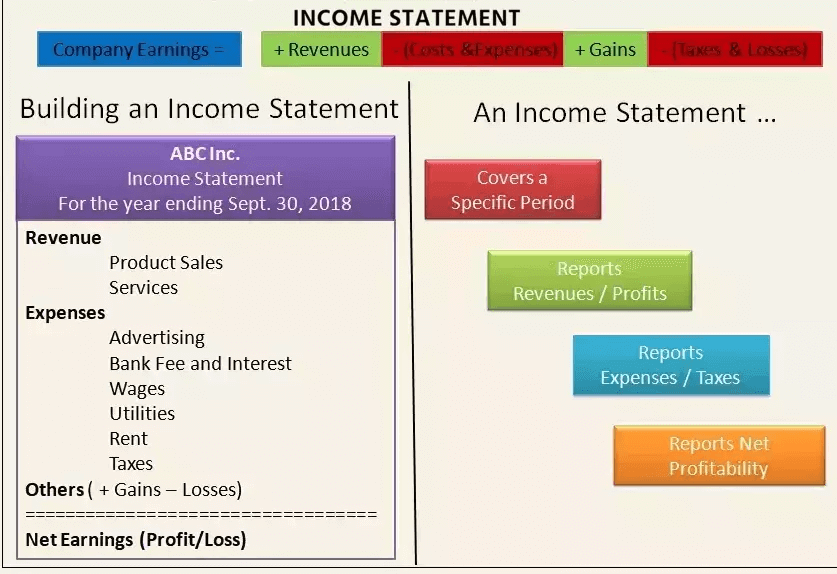

The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs and expenses incurred during a specified period, usually a fiscal quarter or year. The P&L statement is synonymous with the income statement. These records provide information about a company's ability or inability to generate profit by increasing revenue, reducing costs or both.

Some refer to the P&L statement as a statement of profit and loss, Income statement, statement of operations, statement of financial results or income, Earnings statement or expense statement.

P&L Statement Details

The P&L statement is one of three financial statements every public company issues quarterly and annually, along with the Balance Sheet and the cash flow statement. The income statement, like the Cash Flow Statement, shows changes in accounts over a set period. The balance sheet, on the other hand, is a snapshot, showing what the company owns and owes at a single moment. It is important to compare the income statement with the cash flow statement since under the accrual method of Accounting, a company can log revenues and expenses before cash changes hands.

The income statement follows a general form as seen in the example below. It begins with an entry for revenue, known as the top line, and subtracts the costs of doing business, including the cost of goods sold, operating expenses, tax expenses and interest expenses. The difference, known as the bottom line, is net income, also referred to as profit or earnings. You can find many templates for creating a personal or business P&L statement online for free.

It is important to compare income statements from different accounting periods, as the changes in revenues, operating costs, research and development spending and net earnings over time are more meaningful than the numbers themselves. For example, a company's revenues may grow, but its expenses might grow at a faster rate.

One can use the income statement to calculate several metrics, including the gross profit margin, the operating profit margin, the net profit margin and the Operating Ratio. Together with the balance sheet and cash flow statement, the income statement provides an in-depth look at a company's Financial Performance and position.

Parts of a Profit and Loss Report

When making a P&L account report, make sure it comprises the following components:

1. Revenue

It signifies the turnover or the net sales during an accounting period. Revenue includes earnings from the primary activity of the organization, non-Operating Revenue and gains on the long-term business assets’ sales.

2. Cost of Sold Goods

It signifies the cost of services and products.

3. Gross Profit

Also called as gross margin or gross income, it represents the net revenue minus the sales cost.

4. Operating Expenses

These are the selling, General and Administrative Expenses that are linked to running a business for a certain period of time. The operating expenses comprise utilities, payroll, rental expenditure and more needed to run the business efficiently. This may also include non-cash expenditure, like depreciation.

5. Operating Income

This one is referred to as the Earnings Before Interest, Taxes, depreciation and authorization. To calculate the operating income, operating expenses are deducted from the gross profit.

6. Net Profit

It is referred to as the total earned amount after subtracting the expenditure. To calculate this Factor, you would have to deduct the total expenditure from the gross profit.

How to Write the Profit and Loss Statement?

There are two simple methods to create a profit and loss report. They are:

Single-Step Method

Majorly used by small businesses and service-based companies, this method comprehends net income by deducting expenditure and losses from gains and revenues. It makes use of a single subtotal for all of the revenue-oriented items and single subtotal for all of the expenditure-oriented items. The net loss or gain is put towards the end of the report.

Net income = (Gains + Revenue) – (Losses + Expenses)

Multi-Step Method

This specific method distinguishes the operating expenditure and operating revenue from other expenditure and revenue. This is generally done to evaluate the gross profit. Also, this method is adequate for businesses that run on an inventory. This process includes:

- Calculating the gross profit by deducting the sold goods’ cost from the net sales.

- Calculating the operating income by deducting the operating expenditure from the gross profit.

- Combining the net amount of non-operating gains and revenues with the non-operating losses and expenses to evaluate the net income.

L&P Format for Partnership Companies and Sole Traders

When it comes to partnership companies and sole traders, there is no specific format. A P&L Account can be created in any form. However, whatever has been created should represent the net profit and gross profit – mentioned separately. Generally, such entities choose T shaped form to prepare a P&L account. T-shape form has two different sides – Credit & Debit.

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To Opening Stock | xx | By Sales | xx |

| To Purchases | xx | By Closing Stock | xx |

| To Direct | Expenses | xx | |

| To Gross | Profit | xx | |

| xx | xx | ||

| To Operating Expenses | xx | By Gross Profit | xx |

| To Operating Profit | xx | ||

| xx | xx | ||

| To Non-operating Expenses | xx | By Operating Profit | xx |

| To Exceptional Items | xx | By Other Income | xx |

| To Finance Cost | xx | ||

| To Depreciation | xx | ||

| To Net Profit Before Tax | xx | ||

| xx | xx |

P&L Account Format for Companies

As per the Schedule III of Companies Act, 2013, companies must prepare a Profit & Loss Account. Below-mentioned is the specific format as described by the authorities.

| Note No. | Figures for the Current Reporting Period | Figures for the Previous Reporting Period | |

|---|---|---|---|

| INCOME | xx | xx | xx |

| Revenue From Operations | xx | xx | xx |

| Other Income | xx | xx | xx |

| Total Income | xx | xx | xx |

| EXPENSES | |||

| Cost of Materials Consumed | xx | xx | xx |

| Purchases of Stock-in-Trade | xx | xx | xx |

| Changes in Inventories of Finished Goods, Stock-in-Trade and Work-in-Progress | xx | xx | xx |

| Employee Benefits Expense | xx | xx | xx |

| Finance Costs | xx | xx | xx |

| Depreciation and Amortisation Expenses | xx | xx | xx |

| Other Expenses | xx | xx | xx |

| Total Expenses | xx | xx | xx |

| Profit / (Loss) Before Exceptional Items and Tax | xx | xx | xx |

| Exceptional Items | xx | xx | xx |

| Profit / (Loss) Before Tax | xx | xx | xx |

| Tax Expense | xx | xx | xx |

| Current Tax | xx | xx | xx |

| Deferred Tax | xx | xx | xx |

| Profit (Loss) For The Period From Continuing Operations | xx | xx | xx |

| Profit / (Loss) From Discontinued Operations | xx | xx | xx |

| Tax Expenses of Discontinued Operations | xx | xx | xx |

| Profit/(loss) from Discontinued operations (after tax) | xx | xx | xx |

| Profit/(loss) for the period | xx | xx | xx |

| Other Comprehensive Income | |||

| A. (i) Items that will not be reclassified to profit or loss | xx | xx | xx |

| (ii) income tax relating to items that will not be reclassified to profit or loss | xx | xx | xx |

| B. (i) Items that will be reclassified to profit or loss | xx | xx | xx |

| (ii) income tax relating to items that will be reclassified to profit or loss | xx | xx | xx |

| Total Comprehensive Income for the period Comprising Profit (Loss) and other comprehensive Income for the period ) | xx | xx | xx |

| Earnings per equity share (for continuing operation): | |||

| (1) Basic | |||

| (2) Diluted | |||

| Earnings per equity share (for discontinued operation): |

In the notes section, you will have to disclose the following information:

- Revenue from operations’ amount

- Finance cost

- Other income

- Changes in surplus’ revaluation

- Defined benefit plans’ remeasurements

- Equity instruments through comprehensive incomes

- Others

Form 23ACA

To submit the P&L account to the registrar, a firm must file an eForm, which is 23ACA. Along with the form, an audited copy of the Profit & Loss Account has to be attached. The form should be signed digitally by a CS, CMA or a CA, who is in practice full-time and is certified to audit the P&L account.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.