Table of Contents

Book Value

What is Book Value?

Book value or carrying value is the Net worth of an asset that is recorded on the Balance Sheet. An asset's book value is equal to its carrying value on the balance sheet, and companies calculate it netting the asset against its accumulated depreciation. Book value is also the Net Asset Value of a company calculated as total assets minus intangible assets (patents, goodwill) and liabilities. For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales Taxes, service charges and so on.

Book value is a key measure that investors use to gauge a stock's valuation. The book value of a company is the total value of the company's assets, minus the company's outstanding liabilities.

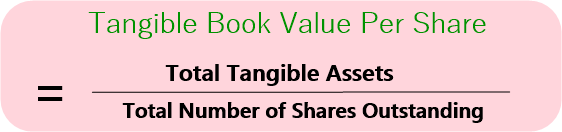

Formula for Book Value

The book value is calculated:

Book value = total assets - intangible assets - liabilities

Talk to our investment specialist

How Book Value Works?

Book value is calculated by taking a company's physical assets Iike Land, buildings, computers, etc., and subtracting out intangible assets such as patents and liabilities -- including preferred stock, debt, and accounts payable. The value left after this calculation represents what the company is intrinsically worth.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.