What Does Total Return Mean?

Total Return is the full return on an investment over a given period, including the Income generated from interest, dividend, rental payments, and any gains or losses from a change in the asset’s Market value. It is the Return on Investment including price appreciation with reinvested dividends or income over a specific period of time.

Total return is typically expressed as a percentage of the amount that was invested. It is the sum of all the different benefits resulting from Investing in an asset, including any change in that asset’s market value – Capital gains – as well as income paid to the investor.

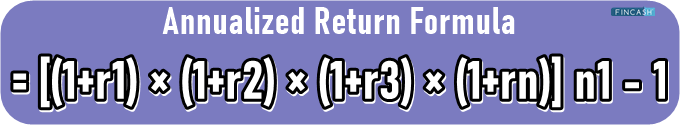

Total Return Formula

Total return formula is-

Capital gains ÷ Initial Investment x 100 = Total Return

The income usually consists of the dividends, interest, and securities lending fees. The term contrasts with price return, which only takes into account an investment’s Capital Gain.

Talk to our investment specialist

Total Return Calculation

With the formula, let's take an example-

Imagine you purchase 100 shares of in XYZ stocks of INR 50 per share for an initial value of INR 5000. XYZ shares pay a 5 percent dividend, which you reinvest, i.e., you purchase five more shares. After twelve months, XYZs share price appreciates to INR 55.

What is your total return? You divide the total investment gains by the investment’s initial value, and then multiply the result by 100 to get a percentage return.

Total investment gain is

INR 775(105 shares x INR 55 per share = INR 5,775. Minus the initial value of INR 5000 = INR 775 gain).The investment’s initial value was INR 5000

The equation is:

INR 775 (gain) ÷ INR 5000 (initial investment) x 100 = 15.5 percent

Your total return is 15.5 percent.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.