Table of Contents

GST Returns- Types of GST Returns & How to File GST Returns

Latest Update - From April 1, 2022, e-Invoice is made mandatory for companies with a turnover of more than Rs 20 crore under the Goods and Services Tax (GST). According to a circular of the Central Board of Indirect Taxes and Customs (CBIC) traders who do B2B business and whose annual turnover is more than Rs 20 crore, it will be necessary to generate electronic invoices from April 1.

GST return is one of the most transparent ways of maintaining tax Accountability. It is the Goods and Services Tax Return form that all types of taxpayers have to file with the income tax authorities of India under the new GST rules.

What's more? It can be done online. What's more convenient than this, right?

What is GST Returns?

GST return is a document with details about the Income that a registered taxpayer has to file with tax authorities. Tax authorities use this to calculate Tax Liability.

A taxpayer has to file the following details with GST Returns:

- Purchases

- Sales

- Input tax credit (includes the GST paid on purchases)

- Output GST (on sales)

Types of GST Returns

There are a total of 15 GST Returns. They are as follows:

1. GSTR-1

GSTR-1 is a detailed report about sales transactions made during a tax period. A normal taxpayer registered under the GST regime should file it. It also includes reporting any debit and credit notes issued. Any changes made to sales invoices should be included while reporting GSTR-1.

GSTR-1 should be filed monthly. However, taxpayers whose turnover is up to Rs. 1.5 cr in the previous financial year can file this every quarter.

2. GSTR-2A

GSTR-2A is a return containing details of all purchases made from registered suppliers during a tax period. This is a read-only return. This data is directly reflected in your report based on the data entered by the registered suppliers in their GSTR-1 return.

Talk to our investment specialist

3. GSTR-2

GSTR-2 is the reporting of all purchases made from registered suppliers during a tax period. All the details are directly reflected in GSTR-2 from GSTR-2A. This is to be filed by all normal taxpayers. The filing of GSTR-2 has been temporarily suspended.

4. GSTR-3

This is a monthly summary return with summarised details about all outward supplies, purchases, input tax credit claimed, along with any tax liability and taxes paid. This is auto-generated based on your GSTR-1 and GSTR-2 filing.

GSTR-3 has been temporarily suspended.

5. GSTR-3B

This has to be filed by all normal taxpayers registered under GST. It is a monthly self-declaration with summarised details about outward supplies, input tax credit claimed, tax liability and taxes paid.

6. GSTR-4/CMP-08

GSTR-4 is the return that the taxpayers have to file if they have opted for the Composition scheme.

CMP-08 is the return that has replaced the former GSTR-4. This has to be filed every quarter.

7. GSTR-5

This is a return that has to be filed by Non-Resident foreign taxpayers who carry out business transactions in India. It is a return with details about all outward supplies, purchases, input tax credit claimed, along with any tax liability and taxes paid.

GSTR-5 has to be filed monthly by the taxpayer registered under the GST in India.

8. GSTR-6

This is a return that is to be filed monthly by an Input Service distributor (ISD). It contains details about the input tax credit received and distributed by ISD.

9. GSTR-7

This is a monthly return to be filed by those who are required to deduct TDS (Tax Deducted at Source). This will contain details about TDS deducted, TDS liability that is payable/paid and TDS Refund claimed.

10. GSTR-8

E-commerce operators, who are required to collect tax at source (TCS) are to file this monthly. It will contain the details of all the supplies made on the e-commerce platform and the TCS collected.

11. GSTR-9

Taxpayers registered under GST have to pay this return annually.

12. GSTR-9A

Taxpayers registered under the Composition Scheme have to file this return annually.

13. GSTR-9C

This is a Reconciliation statement that taxpayers whose turnover is more than Rs. 2 Cr every financial year are to file.

14. GSTR-10

Any taxable person whose registered status has been cancelled or surrendered is to file this.

15. GSTR-11

This is to be filed by those who have been issued a Unique Identity Number (UIN) to avail refund under GST for the purchase of good and services in India.

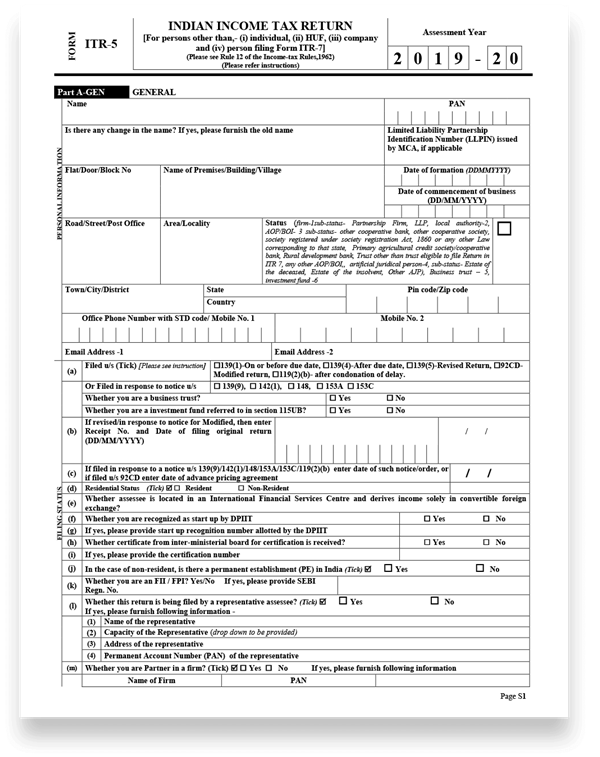

How to File GST Returns?

You can file GST returns online by simply following the following steps.

- Visit www. gst.gov.in

- You will be issued a 15-digit GST ID number based on your PAN Card number and state code.

- Upload your invoices onto the portal. You will be issued a separate invoice number for each invoice.

- After that fill out the outward return, inward return and monthly return. You can rectify it and refile the returns if any error is made.

- Remember to fill the outward supply returns in GSTR-1 form through the information section of the GST Common Portal on or before the 10th of the following month.

- Details of outward supplies entered by the supplier will be made available to the recipient in GSTR-2A.

- The recipient is required to verify, validate and modify the details of the outwards supplies and file the details of the debit and credit notes.

- The recipient has to enter the details of inwards supplies in the GSTR-2 form.

- The supplier can then accept or reject any modification of the details done by the recipient in GSTR-1A.

Are there GST Penalties?

Yes, there are penalties applicable in case you file the returns late. The penalty is called a Late Fee. According to the GST law, you will be charged Rs. 200 as a penalty for each day with Rs.100 for CGST and SGST each.

If there are any changes in the penalty rates, you will be notified. The maximum amount of fine chargeable is Rs.5000. In addition to the late fees, the taxpayer is to pay an interest rate of 18% p.a. This interest has to be calculated on the total amount of tax to be paid.

The late fees period will be calculated from the date of deadline to the date of actual payment.

Conclusion

GST Returns are a transparent method to keep financial transactions accountable. And since it can be done online, it gives the advantage of the ease of access and flexibility.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.