+91-22-48913909

+91-22-48913909

Table of Contents

Best Dividend Paying Balanced Mutual Funds 2025

Balanced Fund are Mutual Funds that invest more than 65% of their assets in equities and the remaining assets in debt instruments to yield good overall returns. Balanced Mutual Funds are beneficial for investors who are willing to take a Market risk while looking for some fixed returns as well. The assets invested in equities and stocks offer market-linked returns while the assets invested in debt instruments offer fixed returns. Being a combination of both Equity and Debt, investors should be very careful when Investing in these funds. Dividend option in these type of mutual funds can actually be good as they generate returns and pay them of as & when there is surplus is generated, This way these type of Option is good for investors looking for consistent Income from their investments. Below are some Best Dividend paying balanced mutual funds for year 2025

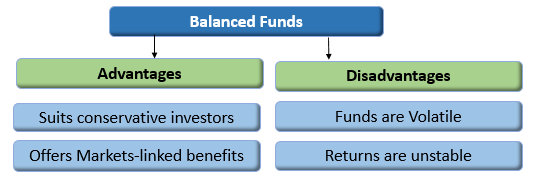

Advantages & Disadvantages Of Top Balanced Funds

Advantages

- Provides stable returns by investing 35-40% of the assets in Fixed Income options.

- Offers market-linked returns as swell by investing 60-65% of the assets in equities.

- Suitable for conservative investors willing to take moderate risk.

Disadvantages

- The funds invested in equities are volatile and have a high-risk Factor.

- The combined returns (returns of both debt and Equity Mutual Funds) may not yield very good returns in the long run.

Talk to our investment specialist

Top 6 Dividend Paying Balanced Mutual Funds for Regular Income

Fund NAV Net Assets (Cr) Rating 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Edelweiss Multi Asset Allocation Fund Normal Dividend, Payout ₹61.53

↑ 0.17 ₹2,487 ☆ 3.2 -0.4 14.5 21 28.2 23.7 JM Equity Hybrid Fund Normal Dividend, Payout ₹32.7959

↑ 0.09 ₹768 ☆ 1.4 -6.2 7 20.8 28.1 27 HDFC Balanced Advantage Fund Normal Dividend, Payout ₹38.668

↑ 0.03 ₹90,375 ☆☆☆☆ 3 0 9.6 19.4 25.8 16.7 UTI Multi Asset Fund Normal Dividend, Payout ₹28.3945

↑ 0.14 ₹5,285 ☆ 3.3 -0.3 9.7 18.2 18.2 20.7 UTI Hybrid Equity Fund Normal Dividend, Payout ₹42.7355

↑ 0.15 ₹5,910 ☆☆☆ 2.5 -1 12.6 16.8 23.3 19.5 Edelweiss Multi Asset Allocation Fund Normal Dividend, Payout ₹27.37

↑ 0.07 ₹2,487 ☆ 3.2 -0.7 12.3 16.6 22 20.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 25 Dividend Paying Balanced funds having AUM/Net Assets above 100 Crore. Sorted on Last 1 Year Return.

(Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Edelweiss Multi Asset Allocation Fund is a Hybrid - Multi Asset fund was launched on 16 Jun 09. It is a fund with Moderately High risk and has given a Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. JM Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 1 Apr 95. It is a fund with Moderately High risk and has given a Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on (Erstwhile HDFC Growth Fund and HDFC Prudence Fund) Aims to generate long term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. HDFC Balanced Advantage Fund is a Hybrid - Dynamic Allocation fund was launched on 11 Sep 00. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Balanced Advantage Fund Returns up to 1 year are on (Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. UTI Multi Asset Fund is a Hybrid - Multi Asset fund was launched on 21 Oct 08. It is a fund with Moderately High risk and has given a Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile UTI Balanced Fund) The scheme aims to invest in a portfolio of equity/equity related securities and fixed income securities (debt and money market securities) with a view to generating regular income together with capital appreciation. UTI Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 2 Jan 95. It is a fund with Moderately High risk and has given a Below is the key information for UTI Hybrid Equity Fund Returns up to 1 year are on (Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Edelweiss Multi Asset Allocation Fund is a Hybrid - Multi Asset fund was launched on 16 Sep 09. It is a fund with Moderately High risk and has given a Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on 1. Edelweiss Multi Asset Allocation Fund

CAGR/Annualized return of 15.3% since its launch. Ranked 71 in Multi Asset category. Return for 2024 was 23.7% , 2023 was 31.2% and 2022 was 10.4% . Edelweiss Multi Asset Allocation Fund

Normal Dividend, Payout Launch Date 16 Jun 09 NAV (22 Apr 25) ₹61.53 ↑ 0.17 (0.28 %) Net Assets (Cr) ₹2,487 on 31 Mar 25 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 0.45 Information Ratio 3.08 Alpha Ratio 4.88 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,277 31 Mar 22 ₹20,567 31 Mar 23 ₹22,596 31 Mar 24 ₹31,696 31 Mar 25 ₹35,685

Purchase not allowed Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 3% 3 Month 3.2% 6 Month -0.4% 1 Year 14.5% 3 Year 21% 5 Year 28.2% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.7% 2022 31.2% 2021 10.4% 2020 34.7% 2019 22.7% 2018 14% 2017 1.1% 2016 33% 2015 6.5% 2014 3.9% Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Bhavesh Jain 14 Oct 15 9.47 Yr. Bharat Lahoti 1 Oct 21 3.5 Yr. Rahul Dedhia 1 Jul 24 0.75 Yr. Pranavi Kulkarni 1 Aug 24 0.66 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 11.4% Equity 72.92% Debt 15.68% Equity Sector Allocation

Sector Value Financial Services 23.16% Health Care 10.35% Technology 8.42% Consumer Cyclical 7.48% Industrials 6.21% Energy 3.61% Utility 3.51% Consumer Defensive 3.04% Basic Materials 2.94% Communication Services 2.91% Real Estate 0.7% Debt Sector Allocation

Sector Value Corporate 13.46% Government 8.73% Cash Equivalent 4.87% Securitized 0.01% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | ICICIBANK6% ₹141 Cr 1,167,577 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK5% ₹111 Cr 641,975

↑ 56,593 National Bank For Agriculture And Rural Development

Debentures | -4% ₹90 Cr 9,000,000 Hdb Financial Services Ltd.

Debentures | -3% ₹74 Cr 7,500,000 6.54% Govt Stock 2032

Sovereign Bonds | -3% ₹74 Cr 7,500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL3% ₹67 Cr 423,781

↑ 29,775 Infosys Ltd (Technology)

Equity, Since 31 May 15 | INFY3% ₹58 Cr 340,862

↑ 114,430 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 19 | SUNPHARMA2% ₹55 Cr 343,006

↑ 20,348 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | 5325552% ₹53 Cr 1,714,490 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 May 15 | TCS2% ₹45 Cr 129,421

↑ 52,575 2. JM Equity Hybrid Fund

CAGR/Annualized return of 11.6% since its launch. Ranked 35 in Hybrid Equity category. Return for 2024 was 27% , 2023 was 33.8% and 2022 was 8.1% . JM Equity Hybrid Fund

Normal Dividend, Payout Launch Date 1 Apr 95 NAV (22 Apr 25) ₹32.7959 ↑ 0.09 (0.27 %) Net Assets (Cr) ₹768 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.36 Sharpe Ratio 0.07 Information Ratio 1.04 Alpha Ratio 0.04 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,786 31 Mar 22 ₹20,451 31 Mar 23 ₹21,644 31 Mar 24 ₹32,246 31 Mar 25 ₹34,500 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 3.1% 3 Month 1.4% 6 Month -6.2% 1 Year 7% 3 Year 20.8% 5 Year 28.1% 10 Year 15 Year Since launch 11.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 27% 2022 33.8% 2021 8.1% 2020 22.9% 2019 30.5% 2018 -8.1% 2017 1.7% 2016 18.5% 2015 3% 2014 -0.4% Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 0.5 Yr. Asit Bhandarkar 31 Dec 21 3.25 Yr. Chaitanya Choksi 20 Aug 21 3.61 Yr. Ruchi Fozdar 4 Oct 24 0.49 Yr. Data below for JM Equity Hybrid Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 12.53% Equity 69.26% Debt 18.22% Equity Sector Allocation

Sector Value Financial Services 22.12% Consumer Cyclical 11.89% Technology 9.76% Health Care 8.86% Consumer Defensive 4.28% Basic Materials 4.23% Communication Services 3.55% Industrials 3.18% Debt Sector Allocation

Sector Value Cash Equivalent 11.24% Government 10.52% Corporate 8.99% Credit Quality

Rating Value AA 0.7% AAA 99.3% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5000346% ₹43 Cr 50,004

↑ 7,000 Infosys Ltd (Technology)

Equity, Since 30 Nov 20 | INFY5% ₹34 Cr 200,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK4% ₹29 Cr 167,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | ICICIBANK4% ₹29 Cr 240,114

↑ 40,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIARTL4% ₹26 Cr 165,000 6.92% Govt Stock 2039

Sovereign Bonds | -4% ₹26 Cr 2,550,000

↑ 1,000,000 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5329773% ₹25 Cr 31,280 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 25 | KOTAKBANK3% ₹23 Cr 120,000

↑ 60,000 Voltas Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | VOLTAS3% ₹20 Cr 150,000

↑ 75,000 Jubilant Foodworks Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | JUBLFOOD2% ₹18 Cr 285,000

↓ -15,000 3. HDFC Balanced Advantage Fund

CAGR/Annualized return of 6.1% since its launch. Ranked 23 in Dynamic Allocation category. Return for 2024 was 16.7% , 2023 was 31.3% and 2022 was 18.7% . HDFC Balanced Advantage Fund

Normal Dividend, Payout Launch Date 11 Sep 00 NAV (22 Apr 25) ₹38.668 ↑ 0.03 (0.08 %) Net Assets (Cr) ₹90,375 on 28 Feb 25 Category Hybrid - Dynamic Allocation AMC HDFC Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.43 Sharpe Ratio -0.27 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,693 31 Mar 22 ₹18,992 31 Mar 23 ₹21,507 31 Mar 24 ₹30,028 31 Mar 25 ₹32,611 Returns for HDFC Balanced Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 2.8% 3 Month 3% 6 Month 0% 1 Year 9.6% 3 Year 19.4% 5 Year 25.8% 10 Year 15 Year Since launch 6.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 16.7% 2022 31.3% 2021 18.7% 2020 26.4% 2019 7% 2018 5% 2017 -11.7% 2016 22.6% 2015 -3.7% 2014 -10.5% Fund Manager information for HDFC Balanced Advantage Fund

Name Since Tenure Anil Bamboli 29 Jul 22 2.59 Yr. Gopal Agrawal 29 Jul 22 2.59 Yr. Arun Agarwal 6 Oct 22 2.4 Yr. Srinivasan Ramamurthy 29 Jul 22 2.59 Yr. Nirman Morakhia 15 Feb 23 2.04 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Balanced Advantage Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 8.45% Equity 60.71% Debt 30.84% Equity Sector Allocation

Sector Value Financial Services 21.86% Industrials 7.75% Energy 7.1% Technology 6.26% Consumer Cyclical 5.72% Utility 4.22% Health Care 4.2% Communication Services 2.69% Consumer Defensive 2.59% Basic Materials 2.04% Real Estate 1.57% Debt Sector Allocation

Sector Value Government 15.74% Corporate 14.63% Cash Equivalent 8.92% Credit Quality

Rating Value AA 0.91% AAA 99.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | HDFCBANK6% ₹5,160 Cr 29,787,551

↓ -4,127,200 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK4% ₹3,373 Cr 28,010,724

↓ -830,900 Infosys Ltd (Technology)

Equity, Since 31 Oct 09 | INFY3% ₹3,104 Cr 18,390,088

↑ 2,000,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 21 | RELIANCE3% ₹2,960 Cr 24,664,288

↓ -459,500 State Bank of India (Financial Services)

Equity, Since 31 May 07 | SBIN3% ₹2,718 Cr 39,455,000 7.18% Govt Stock 2033

Sovereign Bonds | -3% ₹2,342 Cr 228,533,300 NTPC Ltd (Utilities)

Equity, Since 31 Aug 16 | 5325552% ₹2,191 Cr 70,337,915 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT2% ₹2,103 Cr 6,645,683

↓ -168,950 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 20 | BHARTIARTL2% ₹2,069 Cr 13,179,354

↑ 300,000 Coal India Ltd (Energy)

Equity, Since 31 Jan 18 | COALINDIA2% ₹2,063 Cr 55,854,731 4. UTI Multi Asset Fund

CAGR/Annualized return of 12.5% since its launch. Ranked 34 in Multi Asset category. Return for 2024 was 20.7% , 2023 was 29.1% and 2022 was 4.4% . UTI Multi Asset Fund

Normal Dividend, Payout Launch Date 21 Oct 08 NAV (22 Apr 25) ₹28.3945 ↑ 0.14 (0.48 %) Net Assets (Cr) ₹5,285 on 31 Mar 25 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.62 Sharpe Ratio 0.2 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,697 31 Mar 22 ₹15,063 31 Mar 23 ₹15,776 31 Mar 24 ₹22,030 31 Mar 25 ₹23,916 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 3.3% 3 Month 3.3% 6 Month -0.3% 1 Year 9.7% 3 Year 18.2% 5 Year 18.2% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 20.7% 2022 29.1% 2021 4.4% 2020 11.8% 2019 12.9% 2018 2.7% 2017 -1.1% 2016 17.1% 2015 7.3% 2014 -3.7% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 3.39 Yr. Jaydeep Bhowal 1 Oct 24 0.5 Yr. Data below for UTI Multi Asset Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 7.25% Equity 61.69% Debt 19.56% Other 11.49% Equity Sector Allocation

Sector Value Consumer Cyclical 11.63% Technology 10.47% Financial Services 9.26% Consumer Defensive 8.2% Health Care 6.03% Industrials 5.67% Basic Materials 4.75% Energy 4.14% Communication Services 4.12% Real Estate 0.81% Utility 0.64% Debt Sector Allocation

Sector Value Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -12% ₹613 Cr 81,477,316 ICICI Bank Ltd (Financial Services)

Equity, Since 29 Feb 24 | ICICIBANK5% ₹250 Cr 1,851,484 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 24 | RELIANCE3% ₹184 Cr 1,440,963 7.1% Govt Stock 2034

Sovereign Bonds | -3% ₹170 Cr 1,650,000,000

↓ -850,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL3% ₹166 Cr 956,567 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY3% ₹156 Cr 996,311

↑ 45,652 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS3% ₹141 Cr 390,986

↑ 8,545 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC2% ₹126 Cr 3,073,184 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Oct 22 | M&M2% ₹124 Cr 464,775

↑ 17,551 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5002512% ₹123 Cr 231,768 5. UTI Hybrid Equity Fund

CAGR/Annualized return of 14.3% since its launch. Ranked 12 in Hybrid Equity category. Return for 2024 was 19.5% , 2023 was 25.3% and 2022 was 5.5% . UTI Hybrid Equity Fund

Normal Dividend, Payout Launch Date 2 Jan 95 NAV (22 Apr 25) ₹42.7355 ↑ 0.15 (0.35 %) Net Assets (Cr) ₹5,910 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.91 Sharpe Ratio 0.33 Information Ratio 1.56 Alpha Ratio 2.99 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,131 31 Mar 22 ₹19,317 31 Mar 23 ₹20,103 31 Mar 24 ₹26,806 31 Mar 25 ₹29,629 Returns for UTI Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 3.1% 3 Month 2.5% 6 Month -1% 1 Year 12.6% 3 Year 16.8% 5 Year 23.3% 10 Year 15 Year Since launch 14.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.5% 2022 25.3% 2021 5.5% 2020 30.3% 2019 13% 2018 0.1% 2017 -6.4% 2016 25.7% 2015 8.8% 2014 2.4% Fund Manager information for UTI Hybrid Equity Fund

Name Since Tenure V Srivatsa 24 Sep 09 15.53 Yr. Sunil Patil 5 Feb 18 7.15 Yr. Data below for UTI Hybrid Equity Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 2.71% Equity 69.34% Debt 27.95% Other 0% Equity Sector Allocation

Sector Value Financial Services 23.1% Consumer Cyclical 8.26% Basic Materials 6.52% Technology 6.17% Industrials 4.96% Consumer Defensive 4.81% Communication Services 4.64% Health Care 4.26% Energy 4.01% Utility 1.68% Real Estate 0.92% Debt Sector Allocation

Sector Value Government 21.22% Corporate 6.77% Cash Equivalent 2.67% Credit Quality

Rating Value AA 1.09% AAA 98.91% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 29 Feb 20 | HDFCBANK7% ₹406 Cr 2,223,431

↓ -105,271 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 10 | ICICIBANK6% ₹326 Cr 2,418,644 7.23% Govt Stock 2039

Sovereign Bonds | -4% ₹241 Cr 2,300,000,000

↓ -300,000,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 06 | INFY3% ₹185 Cr 1,174,984 ITC Ltd (Consumer Defensive)

Equity, Since 31 Aug 06 | ITC3% ₹178 Cr 4,343,319

↑ 101,169 7.18% Govt Stock 2037

Sovereign Bonds | -3% ₹148 Cr 1,425,000,000

↓ -1,200,000,000 Vedanta Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5002952% ₹136 Cr 2,924,350 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 May 24 | KOTAKBANK2% ₹132 Cr 608,061

↑ 75,070 6.92% Govt Stock 2039

Sovereign Bonds | -2% ₹128 Cr 1,250,000,000 7.32% Govt Stock 2030

Sovereign Bonds | -2% ₹125 Cr 1,200,000,000 6. Edelweiss Multi Asset Allocation Fund

CAGR/Annualized return of 11.7% since its launch. Ranked 71 in Multi Asset category. Return for 2024 was 20.1% , 2023 was 25.4% and 2022 was 5.3% . Edelweiss Multi Asset Allocation Fund

Normal Dividend, Payout Launch Date 16 Sep 09 NAV (22 Apr 25) ₹27.37 ↑ 0.07 (0.26 %) Net Assets (Cr) ₹2,487 on 31 Mar 25 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 0.3 Information Ratio 1.61 Alpha Ratio 2.84 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,021 31 Mar 22 ₹17,988 31 Mar 23 ₹18,841 31 Mar 24 ₹25,317 31 Mar 25 ₹27,933 Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 2.2% 3 Month 3.2% 6 Month -0.7% 1 Year 12.3% 3 Year 16.6% 5 Year 22% 10 Year 15 Year Since launch 11.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 20.1% 2022 25.4% 2021 5.3% 2020 27% 2019 12.3% 2018 9.7% 2017 -0.1% 2016 25.9% 2015 0.3% 2014 2.2% Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Bhavesh Jain 14 Oct 15 9.47 Yr. Bharat Lahoti 1 Oct 21 3.5 Yr. Rahul Dedhia 1 Jul 24 0.75 Yr. Pranavi Kulkarni 1 Aug 24 0.66 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 6.14% Equity 74.94% Debt 18.91% Other 0.01% Equity Sector Allocation

Sector Value Financial Services 20.33% Health Care 10.18% Industrials 8.88% Consumer Cyclical 8.46% Technology 6.96% Basic Materials 5.31% Utility 3.63% Consumer Defensive 3% Energy 2.93% Communication Services 2.8% Real Estate 0.71% Debt Sector Allocation

Sector Value Government 12.27% Corporate 7.58% Cash Equivalent 5.19% Securitized 0.01% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity National Bank For Agriculture And Rural Development

Debentures | -8% ₹190 Cr 19,000,000

↑ 10,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | ICICIBANK6% ₹143 Cr 1,063,939

↓ -103,638 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK5% ₹128 Cr 699,107

↑ 57,132 Edelweiss Liquid Dir Gr

Investment Fund | -4% ₹100 Cr 298,946

↑ 298,946 6.54% Govt Stock 2032

Sovereign Bonds | -3% ₹75 Cr 7,500,000 Hdb Financial Services Ltd.

Debentures | -3% ₹75 Cr 7,500,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | 5325552% ₹61 Cr 1,714,490 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 19 | SUNPHARMA2% ₹60 Cr 343,006 Infosys Ltd (Technology)

Equity, Since 31 May 15 | INFY2% ₹59 Cr 373,077

↑ 32,215 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL2% ₹58 Cr 333,781

↓ -90,000

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.