Table of Contents

What is a Common Size Financial Statement?

The common size financial statement document is mainly drafted to help show the revenues, expenses, and other variables in the percentage form. It helps companies compare their Financial Performance over several periods. The main purpose of drafting the statement is to analyze the overall performance of the organization and compare it with other businesses’ performance. However, this method works only when the competitors use the same approach.

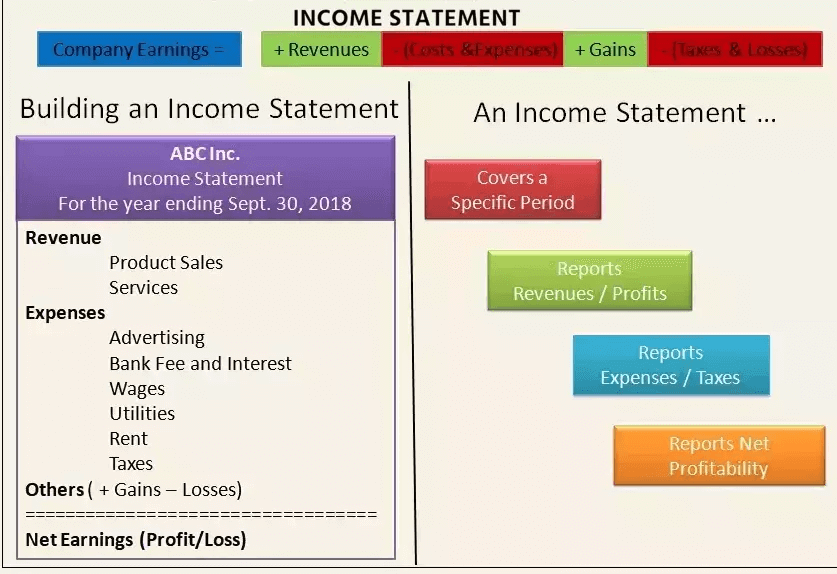

Usually, most businesses do not present their financial data in the common size format. However, it is quite beneficial for the companies to prepare the common size financial statements, as it works as a tool for comparing different companies. Another advantage of presenting the financial statement in this format is that it prevents bias. As everything is mentioned in the percentage format, the common size statement allows you to measure the value of everything and analyze how the value of the objects has changed over time. The common components of the financial statement include the cash flow statement, Balance Sheet, and income statement.

How does the Common Size Financial Statement Work?

It includes the balance sheet, which offers a detailed overview of the assets, liabilities, and equities of the company for the particular period. Basically, the balance sheet of the common size financial statement shows you the total percentage of assets. Then, there is the Cash Flow Statement that displays the methods the company uses its cash. It is divided into different sections, each part showing the data about how the cash is used in different activities.

There are mainly two ways to perform common size analysis – vertical analysis and horizontal analysis. The common size financial statement is the vertical analysis, in which the particular line items are evaluated on the Basis of the base item in the same financial period. For instance, you could calculate the proportion of the inventory by considering the total assets as the base. In the common size balance sheet, the value of the total assets is commonly used as the base value. The value of the liabilities in the balance sheet is equal to the value of assets. This information is, then, used by the company to compare its financial performance with that of the rivals.

Talk to our investment specialist

Uses of Common Size Financial Statement

The major benefit of using the common size financial statement is that it provides the investors with an opportunity to spot sudden changes in the financial statement of the company. This is mainly applicable when you are trying to compare the finances of the company for the past 3-4 years.

Usually, investors take a look at the common size financial statement of the organization to get an idea of how well the business is performing over the past few years. For instance, any major drop in the financial performance of the organization will indicate that the company is experiencing a downturn. Based on this information, an investor might refrain from Investing in the company.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.