Kangaroo Bond

Kangaroo Bond can be referred to as a specialized type of foreign bond operating in the Australian Market by non-Australian organizations. It is denominated in the form of Australian currency.

The Kangaroo Bond issuance could be subject to the regulations of securities of Australia. It is also known to go by the name as “Matilda Bond.”

How does a Kangaroo Bond Work?

Bond issuers seeking access to lenders and investors in the debt market of Australia would issue the bond that is referred to as the Kangaroo Bond. The bond has been named in recognition of Kangaroo –the national animal of the country. This bond is a type of foreign bond that gets issued in the form of Australian dollars by entities that are non-domestic –including governments, corporations, and financial institutions.

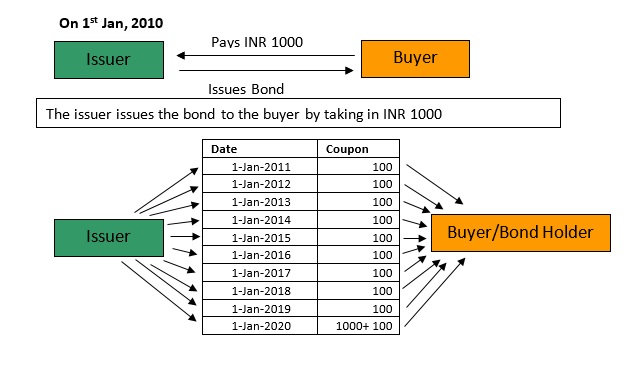

A foreign bond gets issued in the domestic market by some foreign issuer in the domestic country’s currency. Foreign Bonds are primarily utilized for providing issuers with the overall access to some other Capital market that might be out of their own for raising capital.

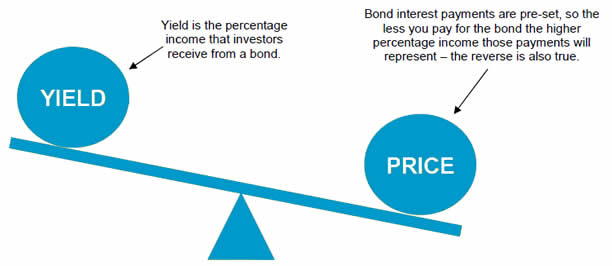

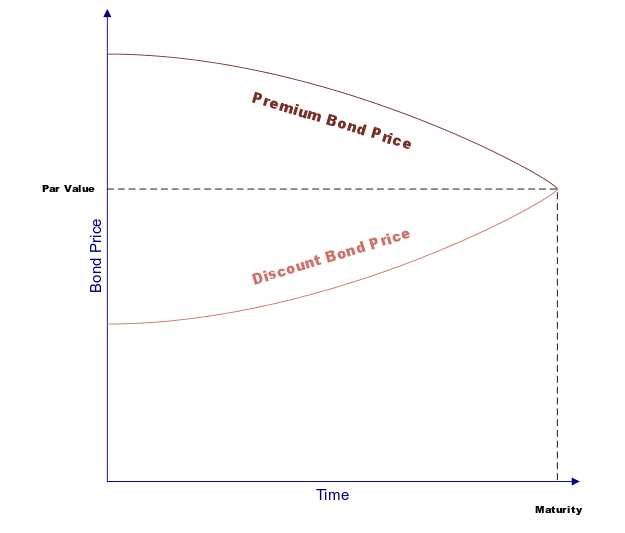

Major investment firms and corporations that look forward to diversifying the respective holdings and improving the currency exposures can think about utilizing Kangaroo Bonds for raising funds in terms of Australian dollars. Kangaroo Bonds are known to be typically issued when the rates of interests in Australia tend to be relatively lower in comparison to the domestic rates of foreign corporations. Therefore, this helps in lowering the overall cost of borrowing and interest expense of the foreign issuer.

Talk to our investment specialist

Benefits of the Kangaroo Bond

An organization can consider entering the foreign market if it is in the belief that it will be receiving attractive rates of interests in the given market or in case it would require some foreign currency. When the company would decide tapping into the foreign market, it can achieve the same by issuing foreign bonds. These are bonds that are dominated in the currency of the target market.

A Kangaroo Bond serves to be a lucrative investment venture for the domestic investors who might not be exposed to the ongoing currency risk as the bonds tend to be denominated in the respective local currency. Moreover, investors who are looking forward to diversifying the respective portfolios beyond the local borders might choose the given bonds to earn incremental yield. Kangaroo Bonds are known to provide an opportunity for Investing in foreign companies without having the need to manage the effects of fluctuations in currency exchange.

Most issuers might not necessarily have the requirement for Australian dollars upon issuing Kangaroo Bonds. Proceeds out of the sale of the given bonds are generally converted to the currency required by the issuer with the help of financial instruments including cross-currency swaps.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.