Par Value

What is Par Value?

Par Value is the Face Value of a bond. Par value is important for a bond or fixed-Income instrument because it determines its maturity value as well as the dollar value of coupon payments. Par value for a bond is typically Rs. 1,000 or Rs. 100. The Market price of a bond may be above or below par, depending on factors such as the level of interest rates and the bond’s credit status.

Par value for a share refers to the stock value stated in the corporate charter. Shares usually have no par value or very low par value, such as 1 cent per share. In the case of equity, par value has very little relation to the shares' market price.

Par value is also known as nominal value or face value.

Details of Par Value

Par Value of Bonds

One of the most important characteristics of a bond, is its par value. The par value is the amount of money that bond issuers promise to repay bondholders at the maturity date of the bond. A bond is essentially a written promise that the amount loaned to the issuer will be repaid.

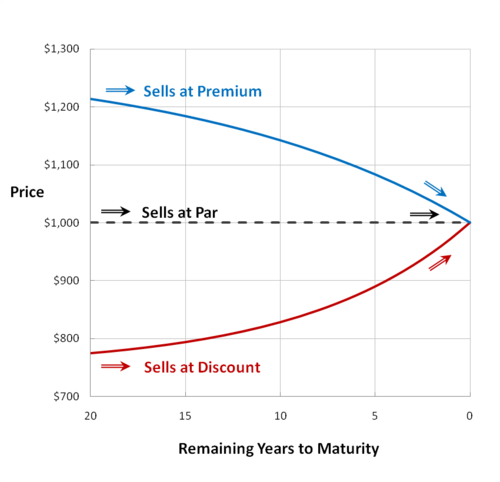

Bonds are not necessarily issued at their par value. They could also be issued at a premium or at a discount depending on the level of interest rates in the Economy. A bond that is trading above par is said to be trading at a premium, while a bond trading below par is trading at a discount. During periods when interest rates are low or have been trending lower, a larger proportion of bonds will trade above par or at a premium. When interest rates are high, a larger proportion of bonds will trade at a discount. For example, a bond with a face value of Rs. 1,000 that is currently trading at Rs. 1,020 will be said to be trading at a premium, while another bond trading at Rs. 950 is considered a discount bond. If an investor buys a taxable bond for a price above par, the premium can be amortized over the remaining life of the bond, offsetting the interest received from the bond and, hence, reducing the investor’s Taxable Income from the bond. Such premium amortization is not available for tax-free bonds purchased at a price above par.

Talk to our investment specialist

The coupon rate of a bond as compared to the interest rates in the economy determines whether a bond will trade at par, below par, or above its par value. The coupon rate is the interest payments that are made to bondholders, annually or semi-annually, as compensation for loaning the issuer a given amount of money. For example, a bond with par value of Rs. 1,000 and a coupon rate of 4% will have annual coupon payments of 4% x Rs. 1,000 = Rs. 40. A bond with par value of Rs. 100 and a coupon rate of 4% will have annual coupon payments of 4% x Rs. 100 = Rs. 4. If a 4% coupon bond is issued when interest rates are 4%, the bond will trade at its par value since both interest and coupon rates are the same.

However, if interest rates rise to 5%, the value of the bond will drop, causing it to trade below its par value. This is because the bond is paying a lower interest rate to its bondholders compared to the higher interest rate of 5% that similar-rated bonds will be paying out. The price of a lower-coupon bond therefore must decline to offer the same 5% yield to investors. On the other hand, if interest rates in the economy falls to 3%, the value of the bond will rise and trade above par since the 4% coupon rate is more attractive than 3%.

Regardless of whether a bond is issued at a discount or premium, the issuer will repay the par value of the bond to the investor at the maturity date. Say, an investor purchases a bond for Rs. 950 and another purchases the same bond for Rs.1,020. On the bond's maturity date, both of the investors will be repaid Rs. 1,000 par value of the bond.

While the par value of a corporate bond is usually stated as either Rs. 100 or Rs. 1,000, municipal bonds have par values of Rs. 5,000 and federal bonds often have Rs. 10,000 par values.

Par Value of Stocks

Some states require that companies cannot sell shares below the par value of these shares. To comply with state regulations, most companies set a par value for their stocks to a minimal amount. For example, the par value for shares of Reliance Industries is Rs. 0.00001 and the par value for ITC stock is Rs. 0.01. Shares cannot be sold below this value upon initial public Offering - this way, investors are confident that no one is receiving a favorable price treatment.

Some states allow the issuance of a stock with no par value. For these stocks, there is no arbitrary amount above which a company can sell. An investor can identify no par stocks on stock certificates as they will have "no par value" printed on them. The par value of a company's stock can be found in the shareholders' Equity section of the Balance Sheet.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.