How to Create Business Financial Plan?

Learning about a Financial plan for your business can appear daunting and scary at first; however, it is fairly simple if you educate yourself and understand the various components of a plan and how they work together. A financial plan is essentially an assessment of your business's present finances and future prospects of growth.

These plans are essential for operating a profitable business, acquiring money via investors and securing loans, and planning for the future. This article will explain what it is, why it is essential, and so on.

Financial Plan: Meaning and Definition

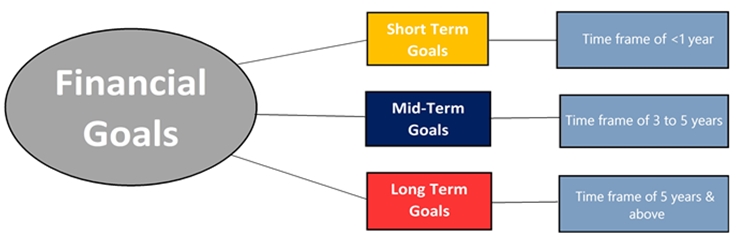

A financial plan is a detailed blueprint of the current finances, Financial goals and strategies devised to attain those goals. With a financial plan, you get a better understanding of finances and how they are utilised to attain objectives, how to adjust if any unforeseen event occurs, and begin building a financial-based strategy for expanding your firm.

A good financial plan is one that gives a detailed blueprint of the following:

Here is the definition of a financial plan:

“Financial plan is a roadmap to achieve the financial goals while determining the current status of finances and future prospects of growth. It is the process of creating financial policies for a company's purchase, investment, and management of finances”.

Talk to our investment specialist

Objectives of Financial Plan

Financial management is a systematic process that will minimise your Financial Stress, support your present requirements, and assist you with long-term goals such as retirement. The objectives of the financial plan are as follow:

- The primary objective is the availability of funds as and when required to meet the requirements of a business.

- The secondary objective is to ensure that the funds are used efficiently and effectively.

Why is a Financial Plan Crucial?

financial planning is crucial because it allows you to efficiently use the resources while also ensuring that you accomplish your long-term objectives. Here are major key points jotted down to understand the importance of a financial plan:

- Financial planning aids in the development of growth and expansion plans, which aid in the long-term survival of the firm.

- It aids in eliminating the uncertainty that might impede a company's progress. This contributes to the company's stability and profitability.

- Financial planning guarantees that money suppliers can readily invest in firms that use financial planning.

- It lowers concerns associated with shifting Market patterns, which can be readily addressed with adequate finances.

- Financial planning assists in maintaining stability by keeping a fair balance between outflow and inflow of cash.

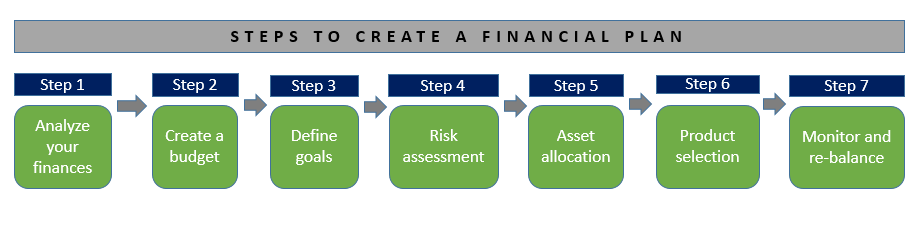

Step by Step Guide for a Sound Financial Plan

1 - Setting up realistic financial goals after proper brainstorming sessions.

2 - Tracking your monthly cash flow while figuring out how you can save better and make good investments.

3 - Keep some money aside as emergency funds to meet any unforeseen event.

4 - Tackle down all your high interest consuming debts.

5 - Start Investing at a regular interval to build up your savings.

These all steps are just a starting point to set you and your family free from any financial setbacks. Once these things come into your habit and you have a hike in your career, start planning for a future prospect as well. You can start contributing to retirement accounts, creating an emergency fund to meet 3-6 monthly expenses, get insurance for financial stability and so on.

The Bottom Line

A financial plan is a dynamic concept; it changes according to the requirements. It is a tool that can be helpful in tracking success; you must make the adjustments as per your requirements. It's a good idea to re-evaluate your financial plan after big life events such as marriage, beginning a new career, having a kid, or losing a loved one. No one can advise you on how to prioritise these objectives. However, a competent financial planner, on the other hand, can be able to help you pick a precise savings strategy and particular investments that will allow you to have a sound financial status.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.