Table of Contents

ELSS Calculator

Introduction

ELSS is an open-ended Equity Mutual Fund that not only is great for tax saving purposes but also creates a growth opportunity for your investment. These schemes are promoted by the Government of India to inculcate a habit of long-term investment among people. As is evident from the name, the major portion of the fund in Equity Linked Savings Schemes is invested in equities or equity-related products. When you plan on making equity investments it is a wise decision to determine the performance of the investment prior to Investing. This can be done by a tool referred to as an ELSS Calculator.

What is an ELSS Calculator?

An ELSS calculator is an extremely helpful tool that plays an important role in helping you make the right decisions with regards to choosing the best investment in an ELSS scheme. T=You will be able to evaluate how effective or not an investment will be. Depending on the type of scheme you choose, there are a number of ELSS Calculators that you can make use of.

ELSS Calculator: Past Performance of SIP work?

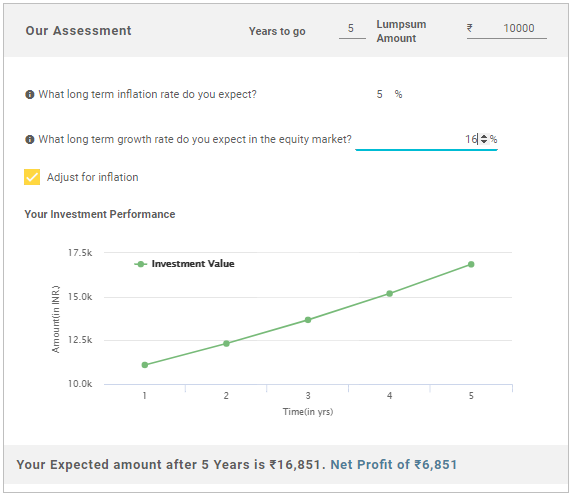

The Past Performance sip calculator is a significant tool in providing insights on the historical performance of your SIP. The calculator takes into account certain details like:

- SIP investment amount

- Starting month and year of the SIP

- Maturity month and year of the SIP

- Valuation date

- Name of the Asset Management Company

With the above details, an ELSS SIP Past Performance Calculator will generate an estimate of how much your SIP investment will be worth at the time of maturity. Such an evaluation is a good means to determining how a fund performs during different Market cycles. The long run performance is also a good insight into gauging where the fund might be heading in terms of future prospects. Though it must be clarified that past performances are no guarantee to the returns in the future, they do however help by showing how the fund held up during adverse market conditions.

Know Your SIP Returns

Talk to our investment specialist

Top ELSS Funds

To provide medium to long term capital gains along with income tax relief to its Unitholders, while at all times emphasising the importance of capital appreciation.. Tata India Tax Savings Fund is a Equity - ELSS fund was launched on 13 Oct 14. It is a fund with Moderately High risk and has given a Below is the key information for Tata India Tax Savings Fund Returns up to 1 year are on To generate long-term capital growth from a diversified portfolio of predominantly equity and equity-related securities. L&T Tax Advantage Fund is a Equity - ELSS fund was launched on 27 Feb 06. It is a fund with Moderately High risk and has given a Below is the key information for L&T Tax Advantage Fund Returns up to 1 year are on To build a high quality growth-oriented portfolio to provide long-term capital gains to the investors, the scheme aims at providing returns through capital appreciation. Principal Tax Savings Fund is a Equity - ELSS fund was launched on 31 Mar 96. It is a fund with Moderately High risk and has given a Below is the key information for Principal Tax Savings Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on 1. Tata India Tax Savings Fund

CAGR/Annualized return of 14.5% since its launch. Ranked 1 in ELSS category. Return for 2024 was 19.5% , 2023 was 24% and 2022 was 5.9% . Tata India Tax Savings Fund

Growth Launch Date 13 Oct 14 NAV (17 Apr 25) ₹41.5516 ↑ 0.60 (1.46 %) Net Assets (Cr) ₹4,053 on 28 Feb 25 Category Equity - ELSS AMC Tata Asset Management Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 0 Sharpe Ratio -0.19 Information Ratio -0.07 Alpha Ratio 3.07 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,724 31 Mar 22 ₹20,336 31 Mar 23 ₹20,326 31 Mar 24 ₹27,013 31 Mar 25 ₹29,622 Returns for Tata India Tax Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 6.1% 3 Month -2.3% 6 Month -8.5% 1 Year 9.2% 3 Year 13.6% 5 Year 22.7% 10 Year 15 Year Since launch 14.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.5% 2022 24% 2021 5.9% 2020 30.4% 2019 11.9% 2018 13.6% 2017 -8.4% 2016 46% 2015 2.1% 2014 13.3% Fund Manager information for Tata India Tax Savings Fund

Name Since Tenure Sailesh Jain 16 Dec 21 3.21 Yr. Tejas Gutka 9 Mar 21 3.98 Yr. Data below for Tata India Tax Savings Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 32.98% Consumer Cyclical 15.28% Industrials 12.78% Technology 7.77% Basic Materials 7.15% Energy 5.32% Communication Services 3.91% Health Care 3.49% Utility 2.65% Real Estate 2.39% Consumer Defensive 1.48% Asset Allocation

Asset Class Value Cash 4.81% Equity 95.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 10 | HDFCBANK7% ₹299 Cr 1,725,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK6% ₹256 Cr 2,125,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 18 | INFY5% ₹196 Cr 1,160,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 18 | RELIANCE4% ₹162 Cr 1,350,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 18 | SBIN4% ₹150 Cr 2,175,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 19 | BHARTIARTL4% ₹148 Cr 940,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 18 | 5322153% ₹132 Cr 1,300,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 16 | LT3% ₹111 Cr 352,147 NTPC Ltd (Utilities)

Equity, Since 30 Jun 21 | 5325553% ₹107 Cr 3,451,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Mar 22 | 5000342% ₹91 Cr 107,000 2. L&T Tax Advantage Fund

CAGR/Annualized return of 14.1% since its launch. Ranked 7 in ELSS category. Return for 2024 was 33% , 2023 was 28.4% and 2022 was -3% . L&T Tax Advantage Fund

Growth Launch Date 27 Feb 06 NAV (17 Apr 25) ₹124.049 ↑ 1.28 (1.04 %) Net Assets (Cr) ₹3,604 on 28 Feb 25 Category Equity - ELSS AMC L&T Investment Management Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.89 Sharpe Ratio 0.04 Information Ratio 0.32 Alpha Ratio 7.41 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,157 31 Mar 22 ₹20,223 31 Mar 23 ₹19,900 31 Mar 24 ₹27,682 31 Mar 25 ₹31,345 Returns for L&T Tax Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 6.9% 3 Month -3.4% 6 Month -9.5% 1 Year 11.3% 3 Year 16.1% 5 Year 23.5% 10 Year 15 Year Since launch 14.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 33% 2022 28.4% 2021 -3% 2020 30.3% 2019 13.5% 2018 4.6% 2017 -8.1% 2016 42.3% 2015 8.1% 2014 2.9% Fund Manager information for L&T Tax Advantage Fund

Name Since Tenure Gautam Bhupal 26 Nov 22 2.26 Yr. Sonal Gupta 21 Jul 21 3.61 Yr. Abhishek Gupta 1 Mar 24 1 Yr. Data below for L&T Tax Advantage Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 24.8% Consumer Cyclical 19.28% Industrials 16.35% Technology 11.48% Basic Materials 6.73% Health Care 5.79% Energy 4.26% Consumer Defensive 3.25% Utility 3.16% Communication Services 2.03% Real Estate 1.44% Asset Allocation

Asset Class Value Cash 1.39% Equity 98.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 06 | HDFCBANK6% ₹201 Cr 1,162,500 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 09 | ICICIBANK4% ₹139 Cr 1,155,500 Infosys Ltd (Technology)

Equity, Since 31 Mar 06 | INFY4% ₹131 Cr 774,900 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 21 | RELIANCE3% ₹114 Cr 951,812 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jul 22 | LT3% ₹95 Cr 301,450 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN2% ₹80 Cr 1,291,500 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL2% ₹73 Cr 467,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jul 21 | PERSISTENT2% ₹71 Cr 133,000

↓ -27,000 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5433202% ₹70 Cr 3,150,000 State Bank of India (Financial Services)

Equity, Since 31 Jan 19 | SBIN2% ₹68 Cr 984,432 3. Principal Tax Savings Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 8 in ELSS category. Return for 2024 was 15.8% , 2023 was 24.5% and 2022 was 4.3% . Principal Tax Savings Fund

Growth Launch Date 31 Mar 96 NAV (17 Apr 25) ₹480.587 ↑ 6.74 (1.42 %) Net Assets (Cr) ₹1,212 on 28 Feb 25 Category Equity - ELSS AMC Principal Pnb Asset Mgmt. Co. Priv. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 2.26 Sharpe Ratio -0.34 Information Ratio -0.29 Alpha Ratio 0.68 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,162 31 Mar 22 ₹21,396 31 Mar 23 ₹21,311 31 Mar 24 ₹29,041 31 Mar 25 ₹30,850 Returns for Principal Tax Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 7.1% 3 Month 1.5% 6 Month -4.7% 1 Year 8.4% 3 Year 13.3% 5 Year 23.7% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 15.8% 2022 24.5% 2021 4.3% 2020 32.1% 2019 18.9% 2018 2.5% 2017 -9.2% 2016 48.8% 2015 6.2% 2014 2.7% Fund Manager information for Principal Tax Savings Fund

Name Since Tenure Sudhir Kedia 29 Oct 19 5.42 Yr. Rohit Seksaria 1 Jan 22 3.25 Yr. Data below for Principal Tax Savings Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 32.55% Industrials 11.74% Consumer Cyclical 10.61% Technology 8.27% Health Care 6.81% Consumer Defensive 5.77% Energy 5.37% Basic Materials 5.31% Communication Services 4.95% Utility 1.37% Asset Allocation

Asset Class Value Cash 6.71% Equity 93.29% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 09 | HDFCBANK9% ₹112 Cr 644,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹89 Cr 737,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 21 | RELIANCE4% ₹52 Cr 434,000 Infosys Ltd (Technology)

Equity, Since 31 Jan 09 | INFY4% ₹52 Cr 306,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 13 | LT3% ₹42 Cr 134,000

↑ 19,000 State Bank of India (Financial Services)

Equity, Since 30 Apr 05 | SBIN3% ₹37 Cr 532,000

↑ 88,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 17 | 5322153% ₹32 Cr 311,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Oct 22 | INDIGO2% ₹28 Cr 63,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Jan 14 | 5325382% ₹27 Cr 27,000 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 30 Nov 21 | 8901572% ₹25 Cr 221,000

↓ -62,000 4. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,787

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

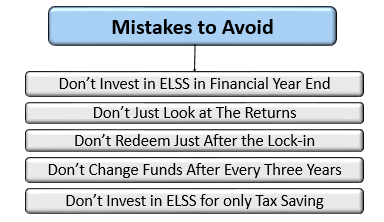

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.