+91-22-48913909

+91-22-48913909

Table of Contents

How to Invest in ELSS Smartly: What Not to Do

Generally, investors invest in ELSS funds to either save tax or grow their money by earning good returns. Equity Linked Savings Scheme or ELSS Mutual Fund majorly invests its assets in equity instruments that offer Market-linked returns. As per reports, the investors who invested in ELSS generated over 18.69% annual returns in the past three years and over 17.46% annual returns in the past five years. Apart from good returns, those who invest in ELSS funds are liable for tax benefits under Section 80C of the income tax Act. This makes ELSS one of the most popular Tax Saving Investment options. However, the investors often make certain mistakes when Investing in ELSS.

Talk to our investment specialist

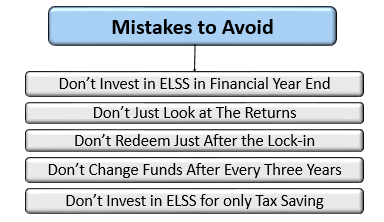

Invest in ELSS: Know the Mistakes to Avoid

Some of the common mistakes are mentioned below. Take a look to avoid them in future.

1. Don't Invest in ELSS in Financial Year End

One of the most common mistakes that the investors make is investing in ELSS late in the Financial Year to save tax. In such a case, the investors are forced to invest a lump sum amount in ELSS funds. Doing this not only causes cash flow related problems but also enhances the risk of market timing. Once you invest in the wrong ELSS fund you will not have the option of correcting it in the next three years. So, it is suggested to invest in ELSS via SIP mode. The earlier you start the more time you get to research about the how and where to invest in ELSS.

2. Don't Just Look at the Returns

Mutual Fund returns are the primarily the most important Factor that the investors look for before investing in any mutual fund. But it is important to analyse that if the investment philosophy actually matches your needs or not. For example, a mutual fund scheme that takes a very high market risk to top the performance chart may not be suitable for a conservative investor. Such an investor would instead want a conservative investment.

3. Don't Redeem Just after the Lock-in

As the lock-in period of the ELSS funds is three years, some investors pull out their money as soon as the lock-in period is over. However, if the fund is performing well, the investors should refrain themselves from doing so. It is advised to stay invested in ELSS for at least 5-7 years to earn good returns. As per the analysis, ELSS funds give best returns when invested for a longer duration.

4. Don't Change Funds after Every Three Years

Another popular mistake by investors investing in ELSS is that they move from one scheme to another as soon as their lock-in ends. Jumping to another fund only to earn good returns is a very wrong practice. The investors should analyse the long-term performance of the fund and the market conditions before moving to another fund.

5. Don't Invest in ELSS for only Tax Saving

Many people invest in ELSS Mutual funds to save tax under section 80C. However, if you wish to invest in Mutual Funds just to save tax you must research well first. As ELSS funds are market-linked, the returns are volatile and fluctuate over short periods. So, it is suggested, if you are wishing to make any tax saving investments like ELSS, be careful about its various factors like lock-in period, the risk involved, returns etc.

Don't Miss Considering Top Performing Tax Saving Schemes

Top performing funds are reliable. Most people don’t know how to pick the right mutual fund schemes. Hence, many times top rated Mutual Funds are designed to help investors quickly identify funds that have performed well in the past and are good to consider for the investment.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹41.5516

↑ 0.60 ₹4,053 -4.1 -10.8 7.7 13 23 19.5 IDFC Tax Advantage (ELSS) Fund Growth ₹143.679

↑ 2.16 ₹6,232 -1 -9.6 2.6 12.3 28.5 13.1 DSP BlackRock Tax Saver Fund Growth ₹133.473

↑ 1.68 ₹14,981 0.8 -6.9 14.6 17.3 27.3 23.9 L&T Tax Advantage Fund Growth ₹124.049

↑ 1.28 ₹3,604 -4.7 -11.7 10.2 15.7 23.8 33 Aditya Birla Sun Life Tax Relief '96 Growth ₹55.61

↑ 0.84 ₹13,629 -1.3 -10 6.5 10.5 16 16.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

Want to invest in ELSS? Just make sure to avoid the above-mentioned mistakes. invest smart or regret later!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.