Table of Contents

How to Transact with NEFT/RTGS in Fincash.com

NEFT and RTGS Facility have helped people to transfer money across the globe in a very short span of time. NEFT means National Electronic Fund Transfer and RTGS means Real Time Gross Settlement. Both these terms are in context to transferring for funds through electronic modes. So, let us see how you can easily transact in Mutual Funds through Fincash.com via NEFT or RTGS.

In the article How to Choose Funds Through Fincash.com? we saw how to choose the funds. In this article, we will focus on how to make payment through NEFT or RTGS. So, let us see how you can easily transact in Mutual Funds through Fincash.com via NEFT or RTGS.

Investment Summary & Click Proceed

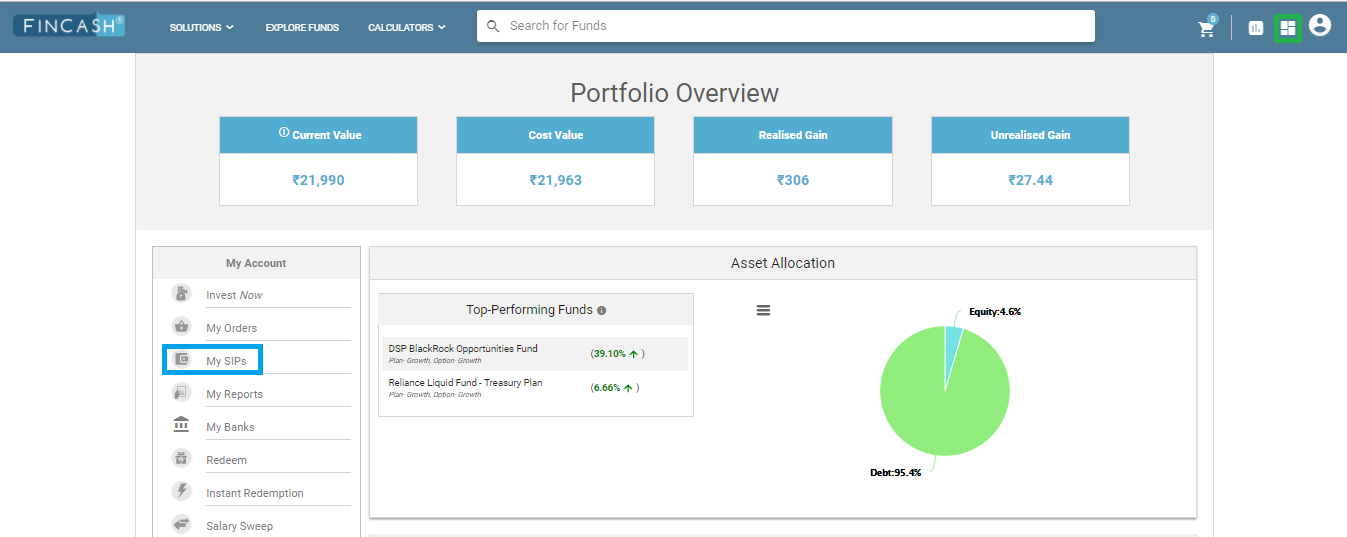

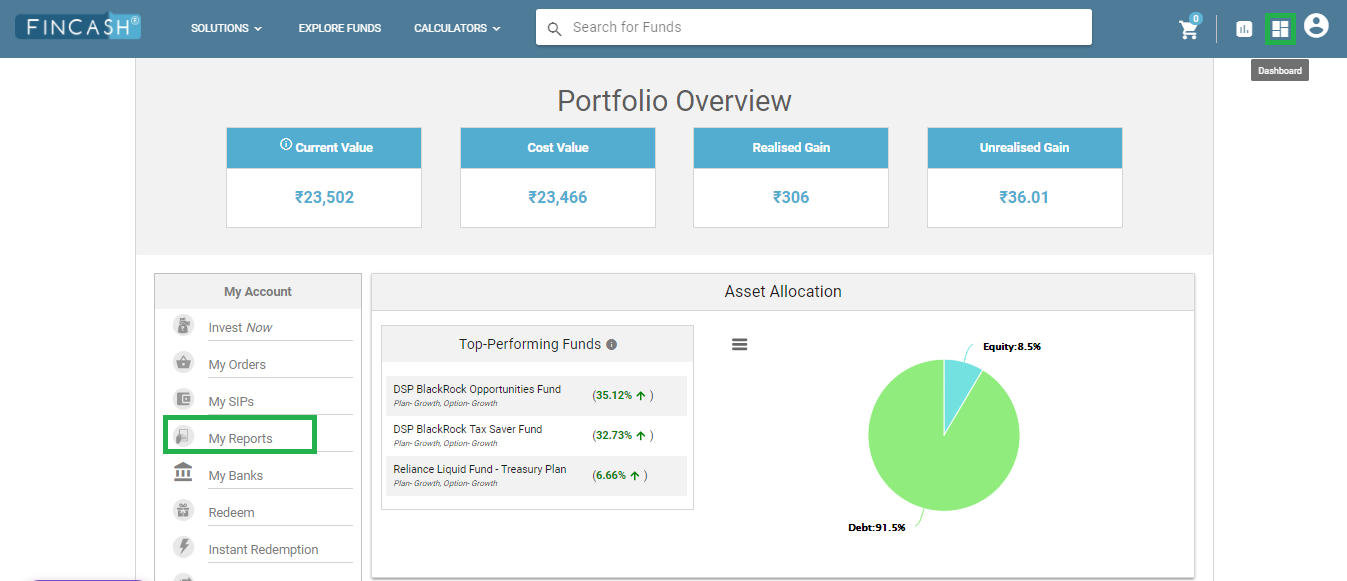

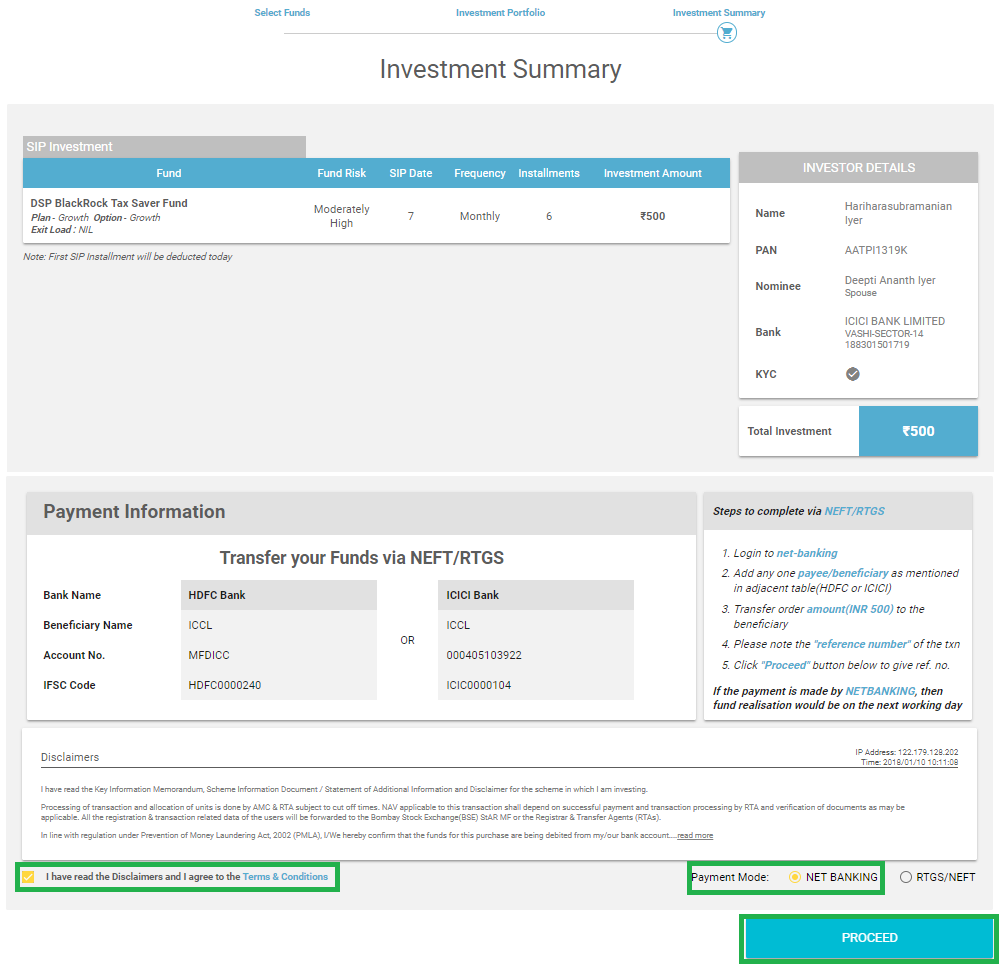

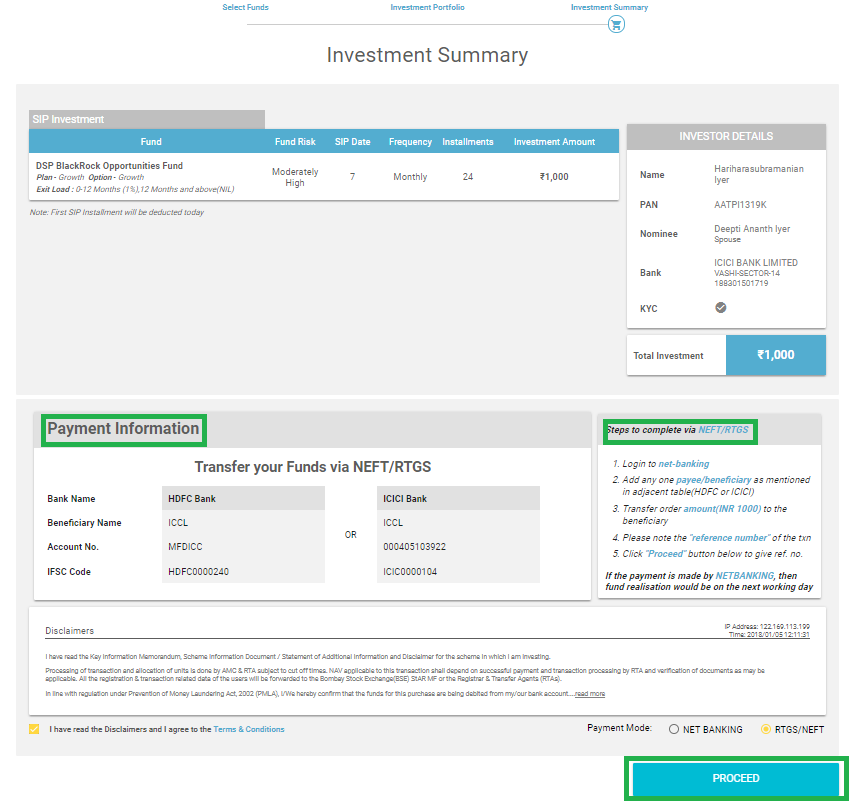

This is the last step that deals with placing the order. In this step, people can see their Investment Summary. Once you scroll down the screen, you need to select the RTGS/NEFT Option. Also, you need to put a Tick Mark on the disclaimer which is at the bottom left of the investment summary and the Click on Proceed. Since you are selecting RTGS/NEFT option, you can find the Payment Information which contains the account details in which you need to deposit money. Both the given accounts are Domestic current accounts. Additionally, it is recommended that you use the ICICI Account as beneficiary for transactions. Also, there is a small snippet step that shows how to transact using NEFT or RTGS. The image representation of this step is as follows where Payment Information, Steps to Complete a transaction via NEFT/ RTGS and Proceed Button are circled in Green. Also, do not use IMPS or UPI payment option.

About ICCL?

ICCL or Indian Clearing Corporation Limited is a wholly owned subsidiary of Bombay Stock Exchange. It takes care of the clearing and settlement of the transactions related to Mutual Fund segment and debt Market segment of BSE.

For more details about ICCL, log on to the website of ICCL

Completing Bank Transaction

This part deals with the Bank wherein; you need to make the payment through NEFT or RTGS. This can be done either through Net Banking or by Physically Visiting the Bank. The procedure for completing the bank transaction with both Net Banking or physically visiting the bank are as follows.

Through Net Banking

In case of doing NEFT or RTGS through Net Banking, the steps are listed below as follows.

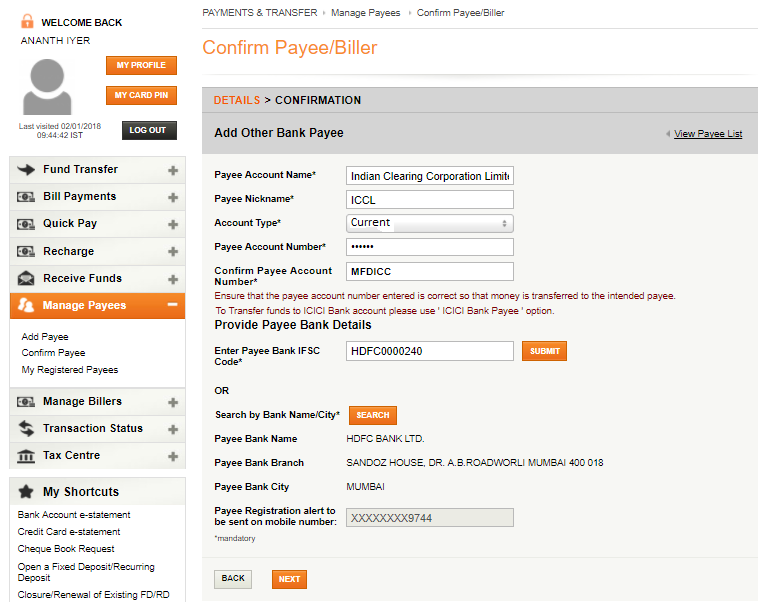

- Step1: Log in Net Banking and Add Beneficiary This is the first step, where you need to login in net banking, go to funds transfer section and add Beneficiary Details. The beneficiary details are available in the Payment Information as shown in the image of Investment Summary. The same details need to be added to the beneficiary section and select beneficiary. The image of the beneficiary form is shown as follows. It would be reiterated that though in the given image HDFC Bank is used however, clients are asked to use ICICI Bank.

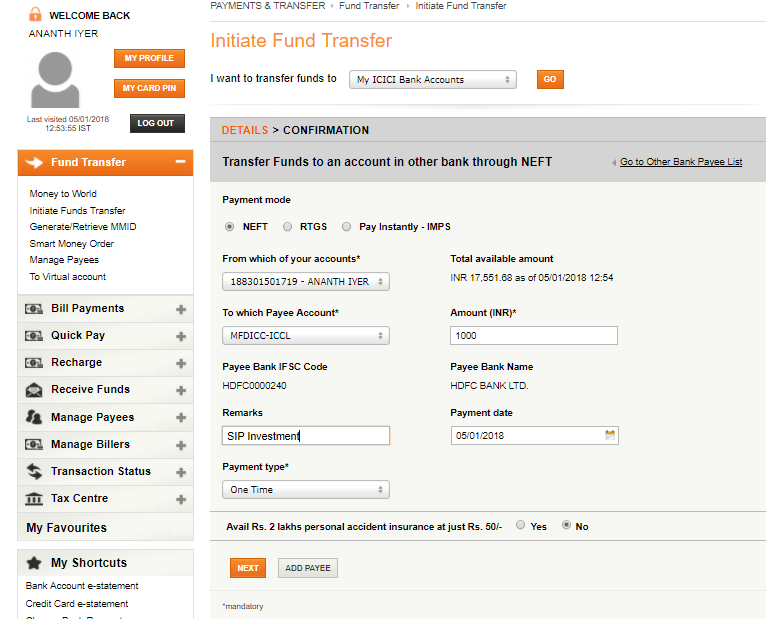

- Step2: Transfer The Desired Investment Amount In this step, after adding the beneficiary, you need to transfer the desired investment amount to the beneficiary. This amount should match your investment summary amount. The image for this step is given below as follows.

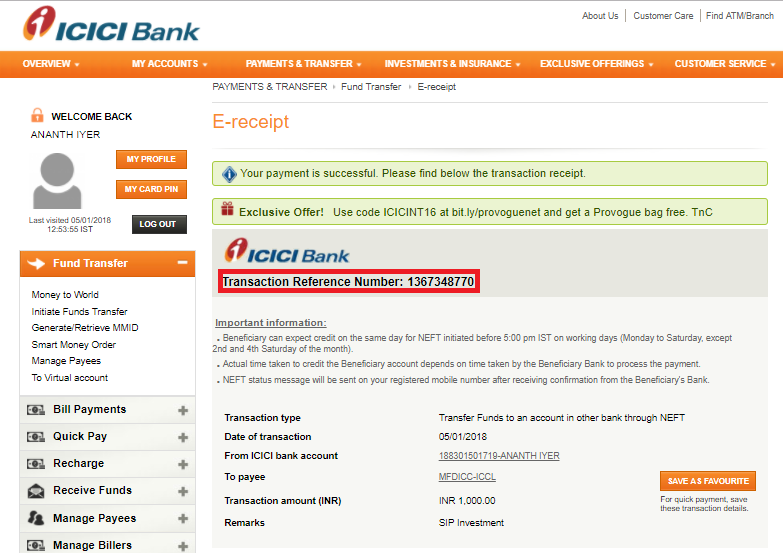

Step3: Note the Transaction Reference Number This is the most important step in the entire bank transaction. Once you complete your transaction, you will receive a NEFT/RTGS Transaction Number. This is the most important number as it will be entered further initiating the payment in Fincash.com. The image of this step is given below as follows where the transaction Reference Number is circled in Red.

By Visiting Bank Physically

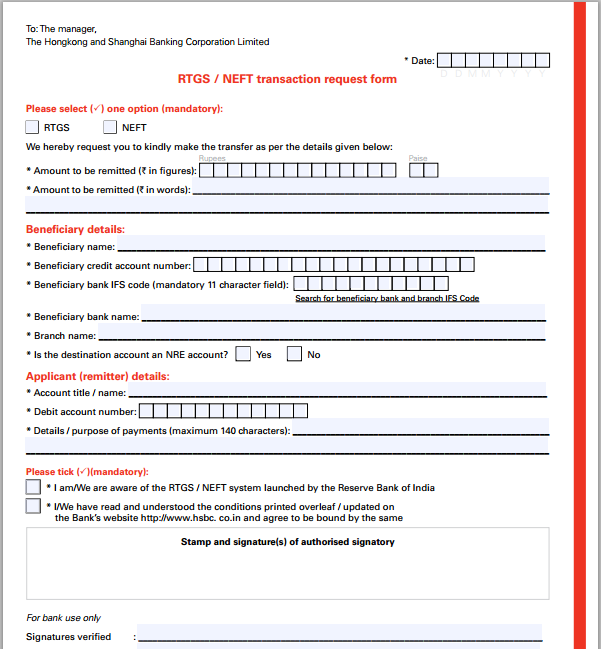

In this case, when you choose to visit the bank and complete the transaction, the second and third step of Part A that deals with Initiating the Payment and Noting the Transaction Reference Number remain the same. However, the only difference is in Step1 where instead of filling the beneficiary details online, you need to fill the NEFT/RTGS paper form by visiting the bank. The sample format of RTGS/NEFT form is as follows.

Go Back to Fincash.com Website & Complete the Transaction

This is the last phase of completing your transaction. Here, you will be completing the transaction by adding the reference ID of the NEFT or RTGS transaction. To complete the transaction, let’s rewind the Summary Checkout where you had to click on “Proceed” Button.

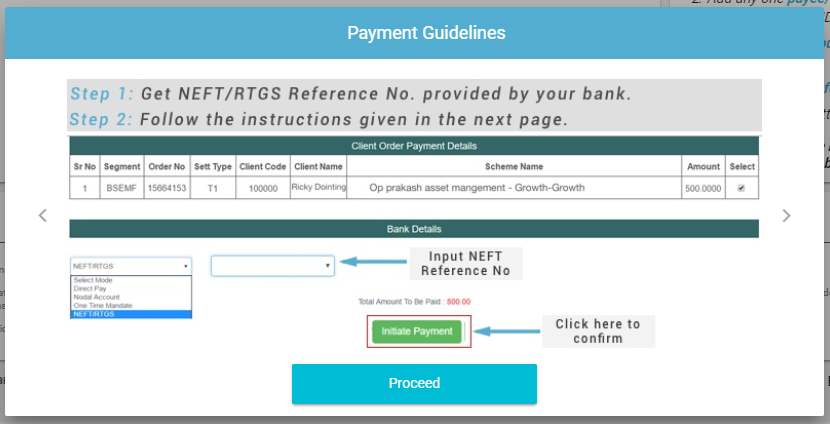

- Step1: Click on Proceed Here, once you click on proceed button, a popup opens which shows how to enter your NEFT/RTGS details. In this popup, you again need to click on the Proceed Button. The image of this popup is given below as follows.

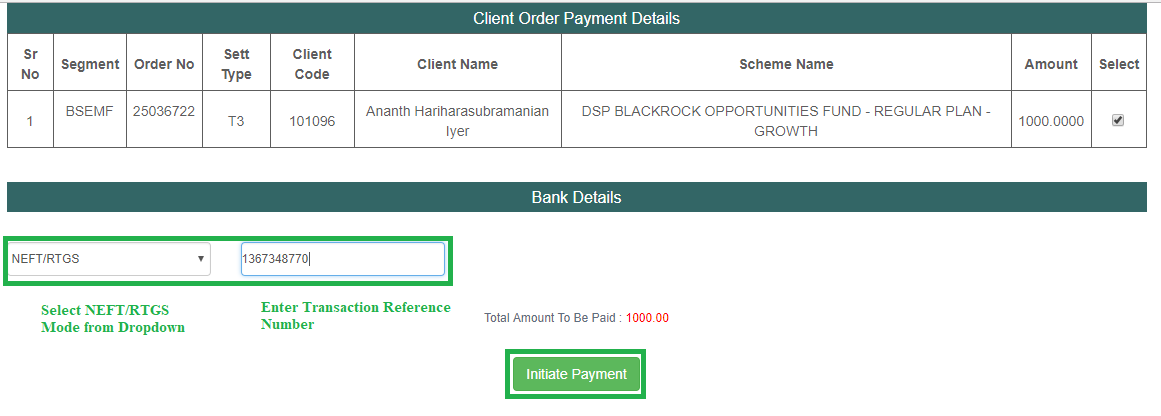

- Step2: Enter The Transaction Reference Number Once you click on Proceed Button, a new screen opens up where you need to select a NEFT/RTGS Option from the drop-down and Enter the Transaction Reference Number pertaining to NEFT or RTGS. Once this number is entered then click on Make Payment option to initiate payment for the investment. The image for this step is given below as follows where the selection mode, Reference Number Box, and Make Payment option buttons are circled in Green.

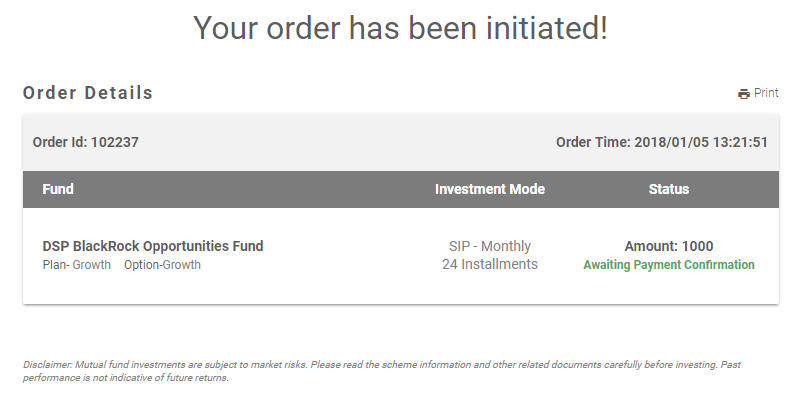

- Step3: Get Final Confirmation This is the last step in the entire transaction process where you get a confirmation that the transaction is complete stating that the Your Order has been Initiated. In this image, you will find the Order ID which can be quoted for further references. The image for this step is as follows.

Thus, from the above-mentioned steps, you can find that the mode of conducting the transaction through NEFT/RTGS is simple.

In case, if you still have any queries, feel free to contact our Customer Support on 8451864111 on any working day between 9.30am to 6.30 pm or write a mail to us anytime at support@fincash.com.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.