Offsetting Transaction

What is Offsetting Transaction?

The offsetting transaction is the term used to define the new positions that cancel the effects of the original transactions. It is mainly used in the share Market (for derivatives). The investor can either close the stock transaction or choose an opposite direction that can terminate the first one. In other words, offsetting transactions will remove all kinds of benefits and risks associated with the specific transaction. It will remove the options and futures you have canceled from your investment Portfolio.

It is mainly used when the investor can face high risks if they don’t cancel the transactions that are highly likely to result in losses. By canceling these transactions, investors can mitigate the risks associated with trading. It is important to note that the institutional or individual investor cannot cancel the options and other such financial products over and over again. The complexity of your investment also determines if it’s possible to Offset transaction.

How Does Offset Transaction Work?

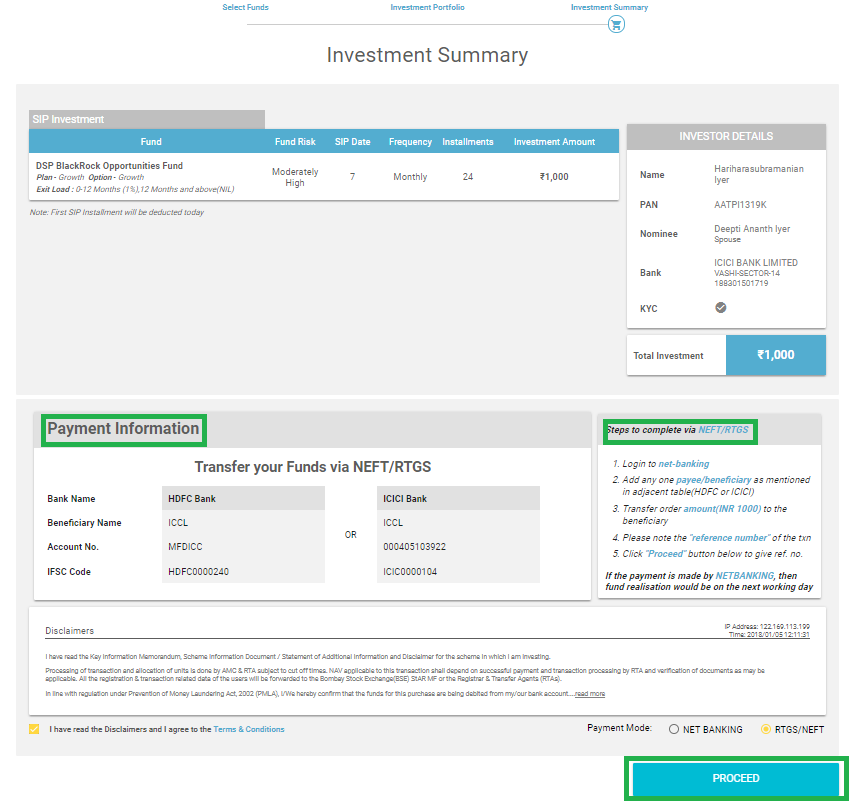

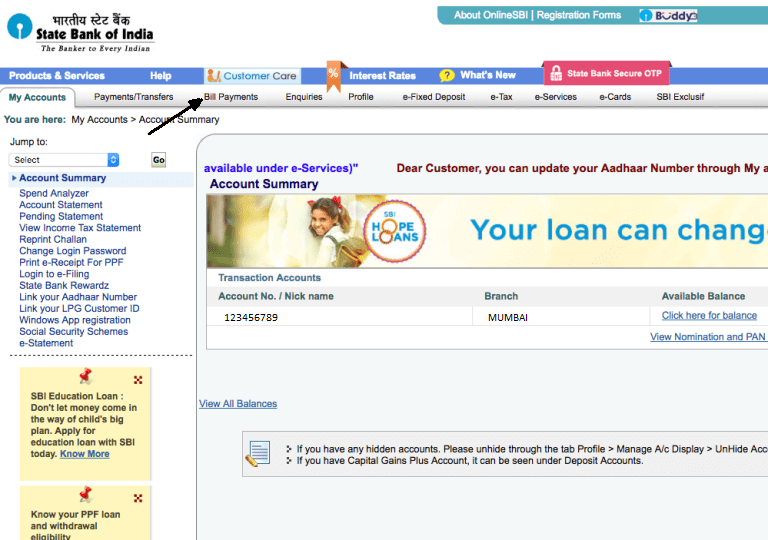

The investor doesn’t have to get permission from third-parties when it comes to closing out the transaction. You don’t have to inform the brokerage firm or the company that issued the shares when canceling your position. Now that you have removed yourself from the position, the market fluctuations in the prices of these trades will not be reflected on your investment portfolio. Note that the position will exist, however, the events associated with the transaction will have no effect on your trading activities. Options, futures, and other such complex instruments can be used to offset the position. However, it is important that these instruments are issued by the same company, and they have the same maturity term.

The maturity term, issuing company, and coupon rate must be the same for Bonds (if you decide to trade bonds to offset a transaction). It simply suggests that the trader is no longer interested in the previous transaction. As mentioned before, these types of transactions do not work for complex financial instruments. If the financial product doesn’t have a high-liquidity, then it might get a little challenging for the investor to offset the instrument for the equal but opposite transaction. For example, offsetting the swap transaction is difficult.

Talk to our investment specialist

Example

Suppose you write the Call Option on 200 shares with the Intrinsic Value of INR 10,000. The transaction will expire in September. In order to offset this transaction, you have to purchase the options that will expire around the same time. Besides, you must buy them from the same company. The price of the options must be INR 10,000. If you manage to find the options that have the same features as the original position, then you can cancel the original transaction. You could also buy these shares from another trader who purchased them from you in the first place.

Now that you have offset this transaction, it will no longer appear in your account. That doesn’t mean the position has closed. The transaction can reflect on the account of the person who initially purchased the options from you.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.