+91-22-48913909

+91-22-48913909

Table of Contents

6 सर्वश्रेष्ठ मासिक आय योजना (एमआईपी) 2022

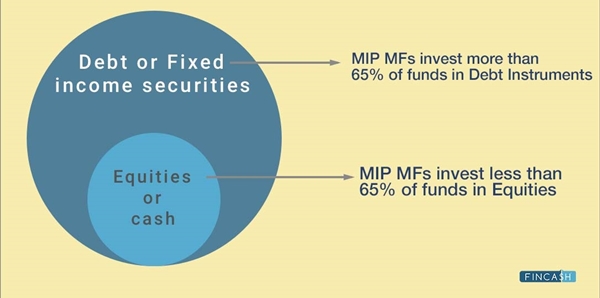

मासिक आय योजना एक ओपन-एंडेड म्यूचुअल फंड है जो मुख्य रूप से अपनी संपत्ति को फिक्स्ड में निवेश करता हैआय उपकरण। आम तौर पर, मासिक आय योजना ऋण और इक्विटी संपत्ति का एक संयोजन है, जिसमें 65% से अधिक संपत्ति का निवेश किया जाता हैनिश्चित आय उपज साधन। हालांकि, मासिक आय योजना की शेष संपत्ति इक्विटी से जुड़े उपकरणों में निवेश की जाती है, जैसे शेयर और स्टॉक, जो प्रदान करते हैंमंडी-लिंक्ड रिटर्न।

मासिक आय योजना का मूल उद्देश्य लोगों को नियमित आय प्रदान करना है। साथ ही, एक एमआईपी म्यूचुअल फंड मासिक के साथ-साथ त्रैमासिक आय का एक विकल्प प्रदान करता है, जिसे लोग अपनी सुविधा के अनुसार चुन सकते हैं।

यदि आप मासिक आय योजना में निवेश करना चाहते हैं, तो विभिन्न म्यूचुअल फंड कंपनियों द्वारा पेश की जाने वाली सर्वोत्तम मासिक आय योजना की सूची पर विचार करने की सलाह दी जाती है।

मासिक आय योजना (एमआईपी) में किसे निवेश करना चाहिए?

कोई भी मध्यम जोखिम-प्रतिकूलइन्वेस्टर जो निश्चित आय के साथ इक्विटी बाजारों में कुछ निवेश की तलाश में है, वह मासिक आय योजना में निवेश कर सकता है। निश्चित आय प्रदान करने के अलावा, मासिक आय योजना बाजार से जुड़े रिटर्न प्रदान करती है। इसके अलावा, एक मासिक आय योजना वरिष्ठ नागरिकों के लिए भी उपयुक्त है, जो निकट हैंनिवृत्ति.

इसलिए, यदि आप मासिक आय की तलाश में हैं, तो अभी सर्वश्रेष्ठ मासिक आय योजना में निवेश करें!

भारत में 6 सर्वश्रेष्ठ प्रदर्शन करने वाले मासिक आय म्युचुअल फंड वित्तीय वर्ष 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Since launch (%) ICICI Prudential MIP 25 Growth ₹74.0662

↑ 0.15 ₹3,127 2.9 3.4 9.9 9.9 10.9 11.4 10 DSP BlackRock Regular Savings Fund Growth ₹58.0761

↑ 0.03 ₹164 4.1 4.2 11.7 9.7 10.4 11 8.8 Baroda Pioneer Conservative Hybrid Fund Growth ₹30.2092

↑ 0.02 ₹33 -1.7 -1.2 3.3 9.1 7.8 6.5 Aditya Birla Sun Life Regular Savings Fund Growth ₹65.6325

↑ 0.15 ₹1,377 3.7 3.4 11 8.6 12.3 10.5 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

The Scheme seeks to generate regular income through investments primarily in debt and money market instruments. As a secondary objective, the Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the Scheme. However, there can be no assurance that the investment objectives of the Scheme will be realized. ICICI Prudential MIP 25 is a Hybrid - Hybrid Debt fund was launched on 30 Mar 04. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential MIP 25 Returns up to 1 year are on (Erstwhile DSP BlackRock MIP Fund) The scheme is seeking to generate an attractive return, consistent with prudent risk, from a portfolio which is substantially constituted of quality debt securities. The scheme will also seek to generate capital appreciation by investing a smaller portion of its corpus in equity and equity related securities of the 100 largest corporates by market capitalisation, listed in India. DSP BlackRock Regular Savings Fund is a Hybrid - Hybrid Debt fund was launched on 11 Jun 04. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Regular Savings Fund Returns up to 1 year are on (Erstwhile Baroda Pioneer MIP Fund) To generate regular income through investment in debt and money market instruments and also to generate long term capital appreciation by investing a portion in equity and equity related instruments. Baroda Pioneer Conservative Hybrid Fund is a Hybrid - Hybrid Debt fund was launched on 8 Sep 04. It is a fund with Moderate risk and has given a Below is the key information for Baroda Pioneer Conservative Hybrid Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life MIP II - Wealth 25 Plan) An Open-ended income scheme with the objective to generate regular income so as to make monthly payment or distribution to unit holders with the secondary objective being growth of capital. Monthly Income is not assured and is subject to availability of distributable surplus. Aditya Birla Sun Life Regular Savings Fund is a Hybrid - Hybrid Debt fund was launched on 22 May 04. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Regular Savings Fund Returns up to 1 year are on 1. ICICI Prudential MIP 25

CAGR/Annualized return of 10% since its launch. Ranked 2 in Hybrid Debt category. Return for 2024 was 11.4% , 2023 was 11.4% and 2022 was 5.1% . ICICI Prudential MIP 25

Growth Launch Date 30 Mar 04 NAV (23 Apr 25) ₹74.0662 ↑ 0.15 (0.20 %) Net Assets (Cr) ₹3,127 on 31 Mar 25 Category Hybrid - Hybrid Debt AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.74 Sharpe Ratio 0.48 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹11,737 31 Mar 22 ₹12,839 31 Mar 23 ₹13,399 31 Mar 24 ₹15,374 31 Mar 25 ₹16,728 Returns for ICICI Prudential MIP 25

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2% 3 Month 2.9% 6 Month 3.4% 1 Year 9.9% 3 Year 9.9% 5 Year 10.9% 10 Year 15 Year Since launch 10% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.4% 2023 11.4% 2022 5.1% 2021 9.9% 2020 10.9% 2019 9.6% 2018 5.1% 2017 12.9% 2016 10.9% 2015 6.4% Fund Manager information for ICICI Prudential MIP 25

Name Since Tenure Manish Banthia 19 Sep 13 11.45 Yr. Akhil Kakkar 22 Jan 24 1.11 Yr. Roshan Chutkey 2 May 22 2.83 Yr. Sharmila D’mello 31 Jul 22 2.59 Yr. Data below for ICICI Prudential MIP 25 as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 8.32% Equity 22.06% Debt 69.31% Other 0.3% Equity Sector Allocation

Sector Value Financial Services 6.39% Consumer Cyclical 3.53% Health Care 3.32% Basic Materials 2.53% Consumer Defensive 1.79% Communication Services 1.57% Utility 0.88% Energy 0.75% Industrials 0.74% Technology 0.53% Debt Sector Allocation

Sector Value Corporate 45.9% Government 22.68% Cash Equivalent 7.56% Securitized 1.5% Credit Quality

Rating Value A 8.38% AA 38.71% AAA 52.9% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.18% Govt Stock 2033

Sovereign Bonds | -9% ₹265 Cr 25,815,500 7.53% Govt Stock 2034

Sovereign Bonds | -5% ₹167 Cr 16,574,750 State Bank Of India

Debentures | -3% ₹98 Cr 1,000 7.38% Govt Stock 2027

Sovereign Bonds | -3% ₹92 Cr 9,000,000 L&T Metro Rail (Hyderabad) Limited

Debentures | -3% ₹79 Cr 800 360 One Prime Limited

Debentures | -2% ₹75 Cr 7,500 Small Industries Development Bank of India

Debentures | -2% ₹70 Cr 1,500

↑ 1,500 Yes Bank Limited

Debentures | -2% ₹64 Cr 650 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 19 | ICICIBANK2% ₹61 Cr 489,871 7.26% Govt Stock 2033

Sovereign Bonds | -2% ₹55 Cr 5,297,450 2. DSP BlackRock Regular Savings Fund

CAGR/Annualized return of 8.8% since its launch. Ranked 22 in Hybrid Debt category. Return for 2024 was 11% , 2023 was 12% and 2022 was 3.5% . DSP BlackRock Regular Savings Fund

Growth Launch Date 11 Jun 04 NAV (23 Apr 25) ₹58.0761 ↑ 0.03 (0.05 %) Net Assets (Cr) ₹164 on 31 Mar 25 Category Hybrid - Hybrid Debt AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 1.14 Sharpe Ratio 0.84 Information Ratio 0.59 Alpha Ratio 1.81 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹11,955 31 Mar 22 ₹12,825 31 Mar 23 ₹13,152 31 Mar 24 ₹14,990 31 Mar 25 ₹16,604 Returns for DSP BlackRock Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 1.8% 3 Month 4.1% 6 Month 4.2% 1 Year 11.7% 3 Year 9.7% 5 Year 10.4% 10 Year 15 Year Since launch 8.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 11% 2023 12% 2022 3.5% 2021 7.8% 2020 9.3% 2019 6.9% 2018 -5.3% 2017 11% 2016 10.7% 2015 4.8% Fund Manager information for DSP BlackRock Regular Savings Fund

Name Since Tenure Abhishek Singh 31 May 21 3.84 Yr. Shantanu Godambe 1 Aug 24 0.66 Yr. Data below for DSP BlackRock Regular Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 21.39% Equity 22.72% Debt 54.61% Other 1.28% Equity Sector Allocation

Sector Value Financial Services 10.7% Consumer Cyclical 3.02% Health Care 2.54% Utility 1.44% Consumer Defensive 1.15% Basic Materials 0.92% Energy 0.85% Technology 0.77% Industrials 0.76% Communication Services 0.57% Debt Sector Allocation

Sector Value Government 49.83% Cash Equivalent 21.39% Corporate 4.78% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.32% Govt Stock 2030

Sovereign Bonds | -13% ₹21 Cr 2,000,000 7.1% Govt Stock 2029

Sovereign Bonds | -6% ₹10 Cr 1,000,000 7.06% Govt Stock 2028

Sovereign Bonds | -6% ₹10 Cr 1,000,000 Power Grid Corporation Of India Limited

Debentures | -6% ₹10 Cr 100 Rural Electrification Corporation Limited

Debentures | -6% ₹10 Cr 100 Power Finance Corporation Limited

Debentures | -5% ₹8 Cr 250 7.1% Govt Stock 2034

Sovereign Bonds | -3% ₹5 Cr 500,000 7.37% Govt Stock 2028

Sovereign Bonds | -3% ₹5 Cr 500,000 7.02% Govt Stock 2031

Sovereign Bonds | -3% ₹5 Cr 500,000 5.74% Govt Stock 2026

Sovereign Bonds | -3% ₹5 Cr 500,000 3. Baroda Pioneer Conservative Hybrid Fund

CAGR/Annualized return of 6.5% since its launch. Ranked 44 in Hybrid Debt category. . Baroda Pioneer Conservative Hybrid Fund

Growth Launch Date 8 Sep 04 NAV (11 Mar 22) ₹30.2092 ↑ 0.02 (0.06 %) Net Assets (Cr) ₹33 on 31 Jan 22 Category Hybrid - Hybrid Debt AMC Baroda Pioneer Asset Management Co. Ltd. Rating ☆☆ Risk Moderate Expense Ratio 2.08 Sharpe Ratio 0.85 Information Ratio -0.38 Alpha Ratio 0.25 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹11,222 Returns for Baroda Pioneer Conservative Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month -1.1% 3 Month -1.7% 6 Month -1.2% 1 Year 3.3% 3 Year 9.1% 5 Year 7.8% 10 Year 15 Year Since launch 6.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Baroda Pioneer Conservative Hybrid Fund

Name Since Tenure Data below for Baroda Pioneer Conservative Hybrid Fund as on 31 Jan 22

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 4. Aditya Birla Sun Life Regular Savings Fund

CAGR/Annualized return of 9.4% since its launch. Ranked 4 in Hybrid Debt category. Return for 2024 was 10.5% , 2023 was 9.6% and 2022 was 5.3% . Aditya Birla Sun Life Regular Savings Fund

Growth Launch Date 22 May 04 NAV (23 Apr 25) ₹65.6325 ↑ 0.15 (0.22 %) Net Assets (Cr) ₹1,377 on 31 Mar 25 Category Hybrid - Hybrid Debt AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.89 Sharpe Ratio 0.67 Information Ratio -0.12 Alpha Ratio 0.91 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹12,856 31 Mar 22 ₹14,310 31 Mar 23 ₹14,672 31 Mar 24 ₹16,387 31 Mar 25 ₹17,944 Returns for Aditya Birla Sun Life Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.6% 3 Month 3.7% 6 Month 3.4% 1 Year 11% 3 Year 8.6% 5 Year 12.3% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.5% 2023 9.6% 2022 5.3% 2021 13.4% 2020 9.2% 2019 5.8% 2018 -2.2% 2017 15.5% 2016 13.1% 2015 5.4% Fund Manager information for Aditya Birla Sun Life Regular Savings Fund

Name Since Tenure Mohit Sharma 31 Oct 24 0.33 Yr. Harshil Suvarnkar 22 Mar 21 3.95 Yr. Data below for Aditya Birla Sun Life Regular Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 2.87% Equity 23.86% Debt 72.93% Other 0.34% Equity Sector Allocation

Sector Value Financial Services 8.15% Technology 3.07% Energy 2.02% Basic Materials 1.93% Industrials 1.81% Consumer Cyclical 1.69% Health Care 1.61% Real Estate 1.27% Communication Services 1.07% Consumer Defensive 0.92% Utility 0.32% Debt Sector Allocation

Sector Value Corporate 44.02% Government 28.91% Cash Equivalent 2.87% Credit Quality

Rating Value AA 15.13% AAA 84.87% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cholamandalam Investment And Fin. Co. Ltd

Debentures | -4% ₹60 Cr 6,000 07.49 Tn SDL 2034

Sovereign Bonds | -2% ₹31 Cr 3,000,000 Bajaj Housing Finance Limited

Debentures | -2% ₹30 Cr 300 LIC Housing Finance Limited

Debentures | -2% ₹30 Cr 3,000 Nuvama Wealth Finance Ltd

Debentures | -2% ₹30 Cr 3,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK2% ₹29 Cr 232,335 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 17 | HDFCBANK2% ₹29 Cr 169,353 Rural Electrification Corporation Limited

Debentures | -2% ₹26 Cr 250 Bharti Telecom Limited

Debentures | -2% ₹25 Cr 2,500 Tata Capital Housing Finance Limited

Debentures | -2% ₹25 Cr 2,500

एमआईपी म्युचुअल फंड योजना में जोखिम

पहलेनिवेश उपर्युक्त सर्वोत्तम मासिक आय योजनाओं में से किसी में, आपको मासिक आय योजना के जोखिमों के बारे में पता होना चाहिए।

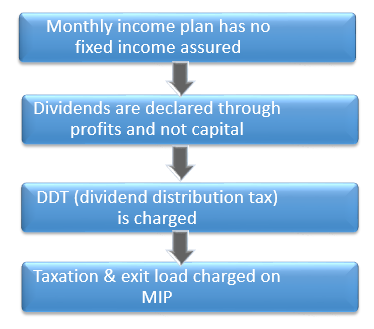

कोई निश्चित आश्वासन नहीं

यह एक आम धारणा है कि मासिक आय योजना मासिक निश्चित आय प्रदान करती है। लेकिन, ऐसे म्यूचुअल फंड में सुनिश्चित रिटर्न की कोई गारंटी नहीं होती है। चूंकि यह योजना भी निवेश करती हैइक्विटीज, रिटर्न फंड के प्रदर्शन और बाजार की स्थिति पर निर्भर करता है।

Talk to our investment specialist

लाभांश की घोषणा मुनाफे के माध्यम से की जाती है न कि पूंजी से

मासिक आय योजना के लिए लाभांश का भुगतान केवल अतिरिक्त आय से किया जा सकता है न किराजधानी निवेश। उदाहरण के लिए, यदि शुद्ध संपत्ति मूल्य (नहीं हैं) फंड की से बढ़ जाती हैINR 10 से INR 13, यह योजना केवल 3 रुपये में से घोषित कर सकती है जिसे उसने पूंजीगत प्रशंसा में अर्जित किया है। इसलिए, यदि बाजार की चाल के कारण योजना का एनएवी धीरे-धीरे बढ़ता है या गिरता है, तो यह लाभांश की घोषणा बिल्कुल भी नहीं कर सकता है।

डीडीटी चार्ज किया जाता है

यदि आप लाभांश के साथ एमआईपी का विकल्प चुनते हैं, तो लाभांश के रूप में आप समय-समय पर जो आय अर्जित करते हैं, उस पर लाभांश वितरण कर (डीडीटी) लगाया जाता है। तो, रिटर्न पूरी तरह से कर-मुक्त नहीं हैं।

एमआईपी पर कराधान और निकास भार

कुछ मासिक आय योजनाओं की लॉक-इन अवधि तीन वर्ष जितनी अधिक होती है, इसलिए यदि योजना परिपक्वता अवधि से पहले बेची जाती है तो एक निश्चित निकास भार लागू होता है। साथ ही, एमआईपी अपनी अधिकांश संपत्ति डेट इंस्ट्रूमेंट्स में निवेश करते हैं, इसलिए डेट निवेश के अनुसार उन पर टैक्स लगता है।

मासिक आय योजनाओं में ऑनलाइन निवेश कैसे करें?

Fincash.com पर आजीवन मुफ्त निवेश खाता खोलें।

अपना पंजीकरण और केवाईसी प्रक्रिया पूरी करें

Upload Documents (PAN, Aadhaar, etc.). और, आप निवेश करने के लिए तैयार हैं!

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।

You clarified nicely that MIP is not about regular monthly income as its returns works like regular mutual fund schemes. But is this MIP having risk with the capital too. Do we lose capital in case market performance is poor ie same as MFs

Best information is given for investment

Please advise for investment regards

Excellent understand ing