+91-22-48913909

+91-22-48913909

Table of Contents

निवेश करके 10 करोड़ कैसे प्राप्त करें

मासिक म्यूचुअल फंड एसआईपी के माध्यम से निवेश

निवेश एक इक्विटी म्यूचुअल फंड योजना में an . के माध्यम सेसिप अपने दीर्घकालिक लक्ष्यों को प्राप्त करने का सबसे अच्छा तरीका है। इसमें अन्य परिसंपत्ति वर्गों की तुलना में बेहतर रिटर्न देने की क्षमता है। यह आपको हराने में भी मदद कर सकता हैमुद्रास्फीति जो दीर्घकालिक लक्ष्यों को प्राप्त करने के लिए आवश्यक है। वे अनुकूल कराधान का भी आनंद लेते हैं। अब, लंबी अवधिराजधानी एक वर्ष में किए गए निवेश पर लाभ कर कर-मुक्त था (वित्त वर्ष 18-19 के केंद्रीय बजट से 1 फरवरी से 1 लाख से अधिक वर्ष में लाभ पर @ 10% कर लगाया जाएगा, अर्थात यदि किसी को एक वित्तीय वर्ष में लंबे समय में 1.1 लाख का लाभ होता है- अवधिपूंजीगत लाभ उसे कर का भुगतान करना होगा:1,10,000 - 1,00,000 = 10,000। 10,000 पर 10% = 1,000 इंचकरों).

म्यूचुअल फंड में 10 करोड़ का निवेश कैसे प्राप्त करें

विभिन्न समय-सीमाओं में 10 करोड़ कैसे प्राप्त करें, इसके उदाहरण नीचे दिए गए हैंएसआईपी में निवेश (व्यवस्थितनिवेश योजना) कासर्वश्रेष्ठ म्युचुअल फंड.

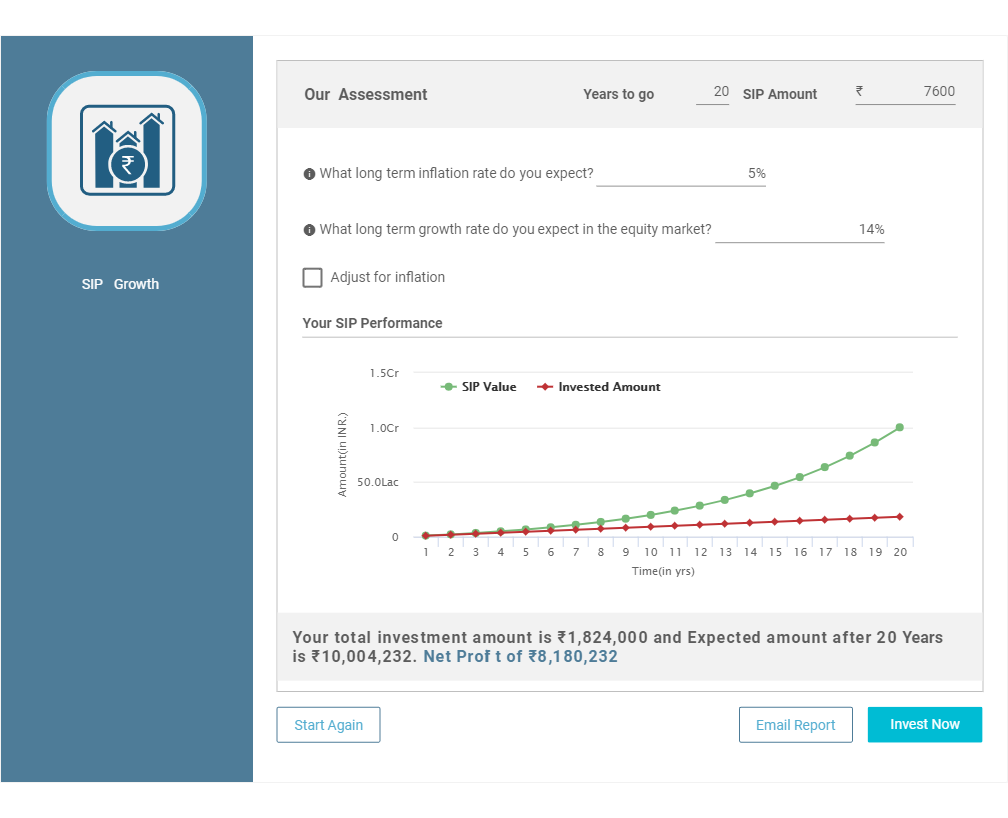

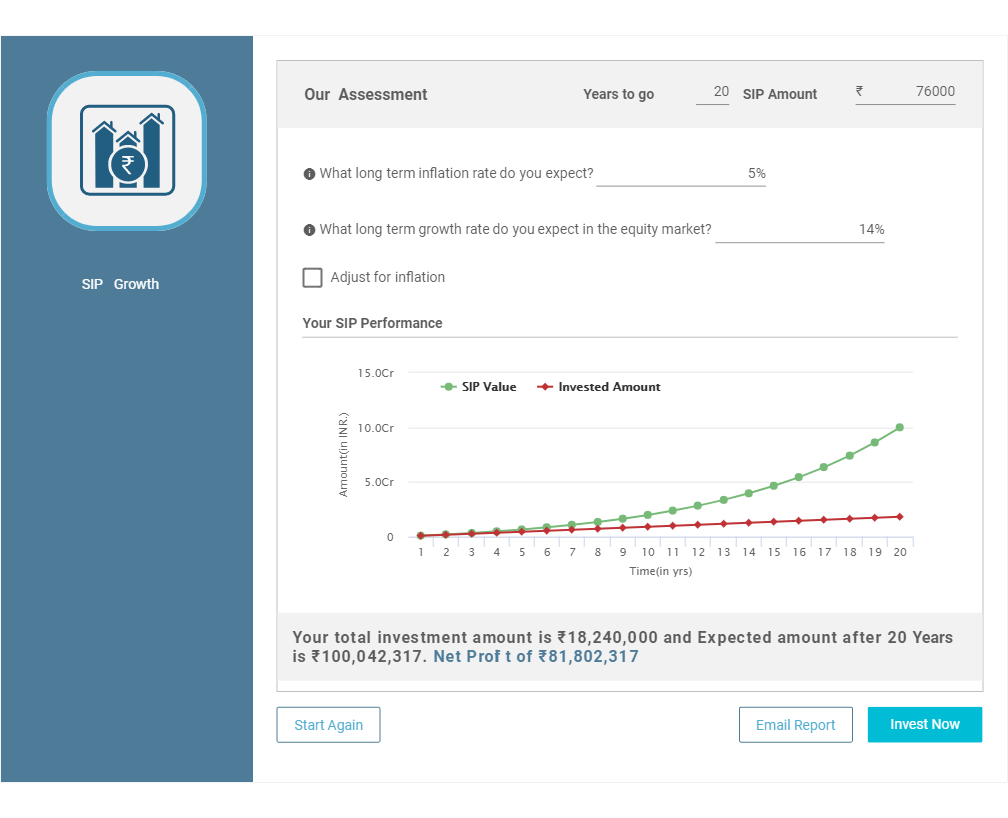

1. 20 साल में 10 करोड़ कैसे पाएं

रुपये के म्यूचुअल फंड एसआईपी के माध्यम से निवेश शुरू करें। 76,000 प्रति माह

यदि आप रुपये बचा सकते हैं। 76,000 हर महीने, तुरंत एक एसआईपी शुरू करेंइक्विटी म्यूचुअल फंड. यदि आपको योजनाओं के चयन में सहायता की आवश्यकता है, तो आप हमारे अनुशंसित इक्विटी म्यूचुअल फंड पोर्टफोलियो की जांच कर सकते हैं और अपने आधार पर एक पोर्टफोलियो चुन सकते हैंजोखिम उठाने का माद्दा और एसआईपी राशि। यदि आपका पोर्टफोलियोम्यूचुअल फंड्स 14 प्रतिशत का वार्षिक रिटर्न देने का प्रबंधन करता है (जो कि से कम है)सीएजीआर बीएसई सेंसेक्स द्वारा 1979 में स्थापना के बाद से पेश किया गया), आप 20 वर्षों में 10 करोड़ रुपये का एक कोष बनाने में सक्षम होंगे जैसा कि नीचे दिखाया गया है।

ऐतिहासिक रिटर्न के आधार पर मुख्य अनुमान नीचे दिए गए हैं:

| मान्यताओं | आंकड़े |

|---|---|

| विकास दर | 14% |

| मुद्रास्फीति | फैक्टर नहीं |

| निवेश राशि (दोपहर) | 76,000 |

| समय सीमा | 20 साल |

| निवेश की गई राशि | 1,82,40,000 |

| कुल कोष | 10,00,42,317 |

| शुद्ध लाभ | 8,18,02,317 |

अधिक विवरण हमारे द्वारा हमारे द्वारा काम किया जा सकता हैघूंट कैलकुलेटर नीचे दिए गए बटन पर क्लिक करके-

Talk to our investment specialist

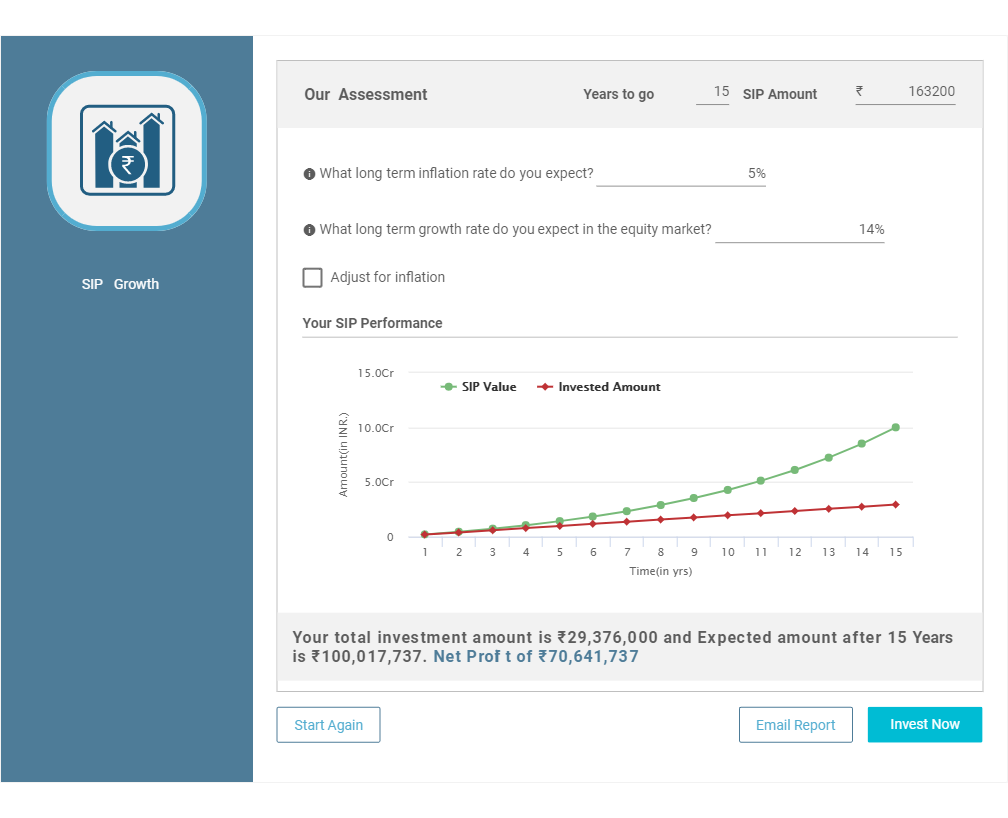

2. 15 साल में 10 करोड़ कैसे पाएं

रुपये के म्यूचुअल फंड एसआईपी के माध्यम से निवेश शुरू करें। 1,63,200 प्रति माह

अगर आप हर महीने 1,63,200 रुपये बचा सकते हैं, तो इक्विटी म्यूचुअल फंड में तुरंत एसआईपी शुरू करें। यदि आपको योजनाओं के चयन में सहायता की आवश्यकता है, तो आप हमारे अनुशंसित इक्विटी म्यूचुअल फंड पोर्टफोलियो की जांच कर सकते हैं और अपनी जोखिम लेने की क्षमता और एसआईपी राशि के आधार पर एक पोर्टफोलियो चुन सकते हैं। यदि आपका म्यूचुअल फंड का पोर्टफोलियो 14 प्रतिशत का वार्षिक रिटर्न देने का प्रबंधन करता है (जो कि 1979 में अपनी स्थापना के बाद से बीएसई सेंसेक्स द्वारा पेश किए गए सीएजीआर से कम है), तो आप नीचे दिखाए गए अनुसार 15 वर्षों में 10 करोड़ रुपये का कोष बना पाएंगे। .

ऐतिहासिक रिटर्न के आधार पर मुख्य अनुमान नीचे दिए गए हैं-

| मान्यताओं | आंकड़े |

|---|---|

| विकास दर | 14% |

| मुद्रास्फीति | फैक्टर नहीं |

| निवेश राशि (दोपहर) | 1,63,200 |

| समय सीमा | पन्द्रह साल |

| निवेश की गई राशि | 2,93,76,000 |

| कुल कोष | 10,00,17,737 |

| शुद्ध लाभ | 7,06,41,737 |

नीचे दिए गए बटन पर क्लिक करके हमारे एसआईपी कैलकुलेटर का उपयोग करके अधिक विवरण पर काम किया जा सकता है-

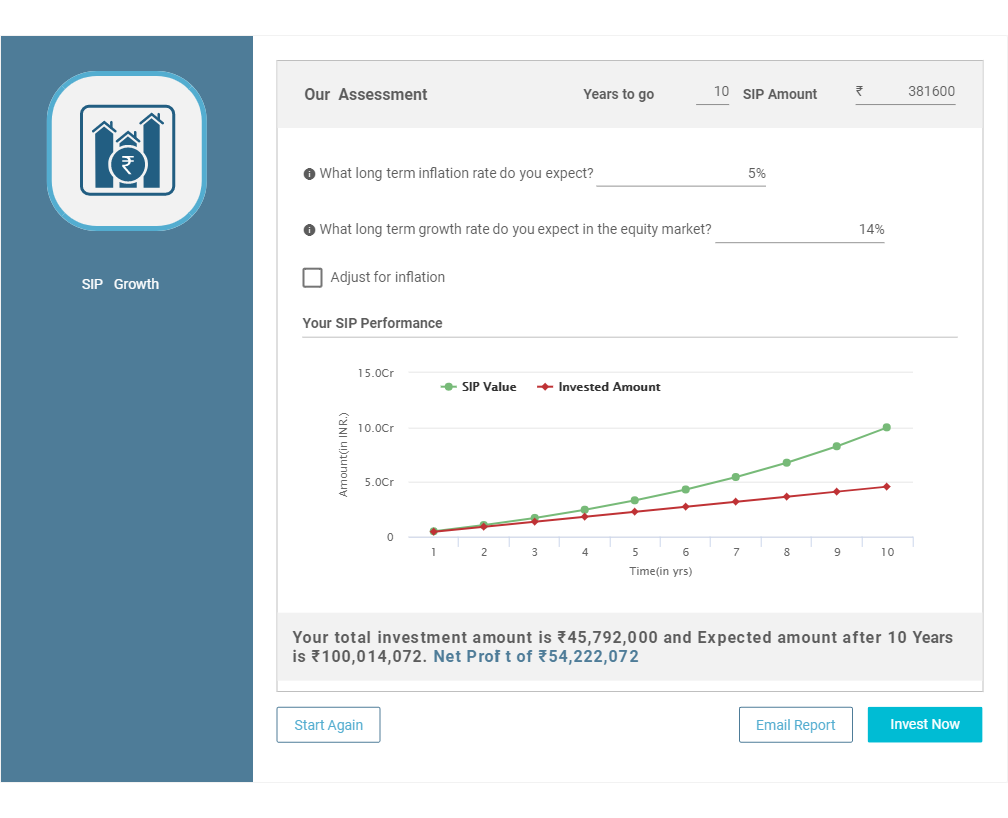

3. 10 साल में 10 करोड़ कैसे पाएं

रुपये के म्यूचुअल फंड एसआईपी के माध्यम से निवेश शुरू करें। 3,81,600 प्रति माह

अगर आप हर महीने 3,81,600 रुपये बचा सकते हैं, तो इक्विटी म्यूचुअल फंड में तुरंत एसआईपी शुरू करें। यदि आपको योजनाओं के चयन में सहायता की आवश्यकता है, तो आप हमारे अनुशंसित इक्विटी म्यूचुअल फंड पोर्टफोलियो की जांच कर सकते हैं और अपनी जोखिम लेने की क्षमता और एसआईपी राशि के आधार पर एक पोर्टफोलियो चुन सकते हैं। यदि आपका म्यूचुअल फंड का पोर्टफोलियो 14 प्रतिशत का वार्षिक रिटर्न देने का प्रबंधन करता है (जो कि 1979 में अपनी स्थापना के बाद से बीएसई सेंसेक्स द्वारा पेश किए गए सीएजीआर से कम है), तो आप नीचे दिखाए गए अनुसार 10 वर्षों में 10 करोड़ रुपये का कोष बना पाएंगे। .

ऐतिहासिक रिटर्न के आधार पर मुख्य अनुमान नीचे दिए गए हैं-

| मान्यताओं | आंकड़े |

|---|---|

| विकास दर | 14% |

| मुद्रास्फीति | फैक्टर नहीं |

| निवेश राशि (दोपहर) | 3,81,600 |

| समय सीमा | 10 वर्ष |

| निवेश की गई राशि | 4,57,92,000 |

| कुल कोष | 10,00,14,072 |

| शुद्ध लाभ | 5,42,22,072 |

नीचे दिए गए बटन पर क्लिक करके हमारे एसआईपी कैलकुलेटर का उपयोग करके अधिक विवरण पर काम किया जा सकता है-

शीर्ष 10 प्रदर्शन करने वाले म्युचुअल फंड

*निधि के आधार पर सूची To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Franklin Build India Fund is a Equity - Sectoral fund was launched on 4 Sep 09. It is a fund with High risk and has given a Below is the key information for Franklin Build India Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. DSP BlackRock India T.I.G.E.R Fund is a Equity - Sectoral fund was launched on 11 Jun 04. It is a fund with High risk and has given a Below is the key information for DSP BlackRock India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile IDFC Sterling Equity Fund) To generate capital appreciation from a diversified portfolio of equity and equity related instruments.It will predominantly invest in small and midcap equity and equity related instruments. Small and Midcap equity & equity related instruments will be the stocks included in the Nifty Free Float Midcap 100 or equity and equity related instruments of such companies which have a market capitalization lower than the highest components of Nifty Free Float Midcap 100. It may also invest in stocks other than mid cap stocks (i.e. in stocks, which have a market capitalisation of above the market capitalisation range of the defined small - midcap stocks) & derivatives. On defensive consideration,It may also invest in debt and money market instruments. In case of discontinuation /suspension of Nifty Free Float Midcap 100, the AMC reserves the right tomodify the definition of Mid cap and Small cap companies. In case of such amodification, the interest of investors will be of paramount importance. IDFC Sterling Value Fund is a Equity - Value fund was launched on 7 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for IDFC Sterling Value Fund Returns up to 1 year are on (Erstwhile Edelweiss Mid and Small Cap Fund ) The investment objective is to seek to generate long-term capital appreciation from a portfolio that predominantly invests in equity and equity-related securities of Mid Cap companies.

However, there can be no assurance that the investment objective of the Scheme will be realised. Edelweiss Mid Cap Fund is a Equity - Mid Cap fund was launched on 26 Dec 07. It is a fund with High risk and has given a Below is the key information for Edelweiss Mid Cap Fund Returns up to 1 year are on T o g e n e r a t e income/capital appreciation by investing in equities and equity related instruments of companies in the infrastructure sector. However, there can be no assurance that the investment objective of the scheme will be realized. Canara Robeco Infrastructure is a Equity - Sectoral fund was launched on 2 Dec 05. It is a fund with High risk and has given a Below is the key information for Canara Robeco Infrastructure Returns up to 1 year are on The investment objective of ICICI Prudential Dividend Yield Equity Fund is to provide medium to long term capital gains and/or dividend distribution by investing in a well diversified portfolio of predominantly equity and equity related instruments, which offer attractive dividend yield ICICI Prudential Dividend Yield Equity Fund is a Equity - Dividend Yield fund was launched on 16 May 14. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Dividend Yield Equity Fund Returns up to 1 year are on संपत्ति>= 200 करोड़ पर छाँटा गया5 साल का सीएजीआर रिटर्न.1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (28 Mar 25) ₹178.42 ↓ -0.23 (-0.13 %) Net Assets (Cr) ₹6,886 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio -0.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹13,597 28 Feb 22 ₹17,702 28 Feb 23 ₹21,851 29 Feb 24 ₹35,616 28 Feb 25 ₹36,176 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 9.1% 3 Month -4.3% 6 Month -12% 1 Year 8.1% 3 Year 29.5% 5 Year 40.9% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.4% 2023 44.6% 2022 28.8% 2021 50.1% 2020 3.6% 2019 2.6% 2018 -14% 2017 40.8% 2016 2% 2015 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 37.53% Basic Materials 21.32% Financial Services 16.4% Utility 8.67% Energy 6.7% Communication Services 1.27% Consumer Cyclical 1.01% Real Estate 0.39% Asset Allocation

Asset Class Value Cash 6.12% Equity 93.3% Debt 0.59% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹687 Cr 1,925,850

↑ 221,167 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹302 Cr 108,747

↑ 13,090 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹296 Cr 2,695,324

↑ 955,233 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC4% ₹265 Cr 10,506,117

↑ 2,958,417 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹249 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹235 Cr 7,260,775

↓ -450,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹213 Cr 4,823,662

↑ 1,000,935 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹208 Cr 1,225,000

↑ 200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO3% ₹206 Cr 477,106

↑ 20,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹204 Cr 1,609,486 2. IDFC Infrastructure Fund

CAGR/Annualized return of 11.5% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (28 Mar 25) ₹45.942 ↓ -0.12 (-0.26 %) Net Assets (Cr) ₹1,400 on 28 Feb 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio -0.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹14,023 28 Feb 22 ₹17,580 28 Feb 23 ₹18,995 29 Feb 24 ₹32,794 28 Feb 25 ₹31,727 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 12.7% 3 Month -11.2% 6 Month -18% 1 Year 6.3% 3 Year 27.2% 5 Year 38% 10 Year 15 Year Since launch 11.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 56.44% Utility 12.75% Basic Materials 8.95% Communication Services 4.63% Energy 3.49% Financial Services 3.1% Consumer Cyclical 2.89% Technology 2.42% Health Care 1.83% Asset Allocation

Asset Class Value Cash 3.5% Equity 96.5% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹82 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹61 Cr 171,447 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE3% ₹57 Cr 452,706 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325383% ₹54 Cr 46,976 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹53 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹48 Cr 434,979 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹47 Cr 12,400,122 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL3% ₹47 Cr 289,163 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹43 Cr 512,915

↑ 37,553 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹42 Cr 1,431,700 3. Nippon India Power and Infra Fund

CAGR/Annualized return of 18% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (28 Mar 25) ₹318.077 ↓ -0.65 (-0.20 %) Net Assets (Cr) ₹6,125 on 28 Feb 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio -0.55 Information Ratio 1.03 Alpha Ratio 1.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹13,579 28 Feb 22 ₹16,253 28 Feb 23 ₹19,189 29 Feb 24 ₹34,107 28 Feb 25 ₹31,913 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 12% 3 Month -8.5% 6 Month -17% 1 Year 2.8% 3 Year 29.4% 5 Year 37.8% 10 Year 15 Year Since launch 18% Historical performance (Yearly) on absolute basis

Year Returns 2024 26.9% 2023 58% 2022 10.9% 2021 48.9% 2020 10.8% 2019 -2.9% 2018 -21.1% 2017 61.7% 2016 0.1% 2015 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.77 Yr. Rahul Modi 19 Aug 24 0.53 Yr. Data below for Nippon India Power and Infra Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 42.76% Utility 17.64% Basic Materials 9.73% Energy 7.95% Communication Services 7.7% Real Estate 3.94% Consumer Cyclical 3.24% Technology 2.27% Health Care 2.04% Financial Services 1.81% Asset Allocation

Asset Class Value Cash 0.91% Equity 99.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹532 Cr 1,492,001

↓ -205,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325557% ₹499 Cr 15,400,000

↑ 1,400,001 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE7% ₹474 Cr 3,750,000

↑ 200,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL6% ₹423 Cr 2,600,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹276 Cr 240,038

↓ -29,962 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004003% ₹236 Cr 6,475,789

↑ 1,511,030 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV3% ₹214 Cr 1,800,000 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹213 Cr 350,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES3% ₹203 Cr 423,938

↓ -68,266 Container Corporation of India Ltd (Industrials)

Equity, Since 31 Aug 22 | CONCOR3% ₹195 Cr 2,500,000 4. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (28 Mar 25) ₹43.275 ↓ -0.11 (-0.24 %) Net Assets (Cr) ₹2,105 on 28 Feb 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹12,339 28 Feb 22 ₹14,687 28 Feb 23 ₹17,137 29 Feb 24 ₹31,152 28 Feb 25 ₹29,967 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 9.3% 3 Month -7.4% 6 Month -13.9% 1 Year 4.9% 3 Year 29.9% 5 Year 36.8% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 23% 2023 55.4% 2022 19.3% 2021 43.2% 2020 -7.5% 2019 -3.4% 2018 -29% 2017 43.3% 2016 -1.9% 2015 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.13 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 41.71% Financial Services 19.97% Basic Materials 11.11% Energy 7.53% Utility 6.76% Communication Services 3.67% Health Care 1.75% Technology 1% Real Estate 0.89% Consumer Cyclical 0.54% Asset Allocation

Asset Class Value Cash 3.98% Equity 94.91% Debt 1.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹163 Cr 1,300,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT5% ₹125 Cr 350,000

↑ 20,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹119 Cr 700,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL5% ₹110 Cr 1,500,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL3% ₹80 Cr 758,285 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹71 Cr 2,200,000

↑ 115,875 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹67 Cr 1,700,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹65 Cr 400,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹65 Cr 150,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹63 Cr 500,000 5. Franklin Build India Fund

CAGR/Annualized return of 17.9% since its launch. Ranked 4 in Sectoral category. Return for 2024 was 27.8% , 2023 was 51.1% and 2022 was 11.2% . Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (28 Mar 25) ₹129.008 ↓ -0.27 (-0.21 %) Net Assets (Cr) ₹2,406 on 28 Feb 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.13 Sharpe Ratio -0.41 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹13,297 28 Feb 22 ₹16,088 28 Feb 23 ₹18,350 29 Feb 24 ₹31,512 28 Feb 25 ₹30,972 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 9.4% 3 Month -7.1% 6 Month -13.1% 1 Year 6.8% 3 Year 28% 5 Year 36.5% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.8% 2023 51.1% 2022 11.2% 2021 45.9% 2020 5.4% 2019 6% 2018 -10.7% 2017 43.3% 2016 8.4% 2015 2.1% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 3.37 Yr. Kiran Sebastian 7 Feb 22 3.06 Yr. Sandeep Manam 18 Oct 21 3.37 Yr. Data below for Franklin Build India Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 37.8% Financial Services 12.39% Utility 11.4% Energy 10.96% Communication Services 7.6% Basic Materials 7.09% Consumer Cyclical 3.4% Real Estate 2.85% Technology 2% Asset Allocation

Asset Class Value Cash 4.19% Equity 95.81% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT10% ₹257 Cr 720,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | ICICIBANK6% ₹150 Cr 1,200,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE5% ₹133 Cr 1,050,000

↑ 170,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹130 Cr 300,000

↑ 65,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325555% ₹127 Cr 3,930,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003124% ₹118 Cr 4,500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL4% ₹115 Cr 710,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 21 | 5328984% ₹102 Cr 3,365,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322153% ₹89 Cr 900,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 23 | NCC3% ₹78 Cr 3,100,000 6. DSP BlackRock India T.I.G.E.R Fund

CAGR/Annualized return of 17.5% since its launch. Ranked 12 in Sectoral category. Return for 2024 was 32.4% , 2023 was 49% and 2022 was 13.9% . DSP BlackRock India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (28 Mar 25) ₹285.339 ↑ 0.59 (0.21 %) Net Assets (Cr) ₹4,465 on 28 Feb 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio -0.22 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹12,694 28 Feb 22 ₹15,993 28 Feb 23 ₹18,596 29 Feb 24 ₹30,453 28 Feb 25 ₹30,265 Returns for DSP BlackRock India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 10.2% 3 Month -11.8% 6 Month -18.2% 1 Year 7.5% 3 Year 26.9% 5 Year 36.5% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 32.4% 2023 49% 2022 13.9% 2021 51.6% 2020 2.7% 2019 6.7% 2018 -17.2% 2017 47% 2016 4.1% 2015 0.7% Fund Manager information for DSP BlackRock India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 14.7 Yr. Data below for DSP BlackRock India T.I.G.E.R Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 35.97% Basic Materials 15.45% Consumer Cyclical 7.89% Utility 6.84% Energy 5.5% Financial Services 5.47% Communication Services 3.6% Health Care 2.72% Technology 2.44% Real Estate 1.45% Consumer Defensive 1.42% Asset Allocation

Asset Class Value Cash 11.26% Equity 88.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325555% ₹232 Cr 7,145,883

↓ -932,685 Siemens Ltd (Industrials)

Equity, Since 30 Nov 18 | 5005504% ₹224 Cr 369,482 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT4% ₹211 Cr 591,385 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL4% ₹176 Cr 1,080,606 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,502,475 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA3% ₹131 Cr 3,321,453 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 22 | KPIL2% ₹123 Cr 1,159,431

↓ -94,280 Polycab India Ltd (Industrials)

Equity, Since 31 Jan 21 | POLYCAB2% ₹110 Cr 182,282

↓ -21,868 Welspun Corp Ltd (Basic Materials)

Equity, Since 30 Nov 23 | 5321442% ₹98 Cr 1,323,293 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP2% ₹89 Cr 131,003

↑ 74,613 7. IDFC Sterling Value Fund

CAGR/Annualized return of 16.6% since its launch. Ranked 21 in Value category. Return for 2024 was 18% , 2023 was 32.6% and 2022 was 3.2% . IDFC Sterling Value Fund

Growth Launch Date 7 Mar 08 NAV (28 Mar 25) ₹138.067 ↓ -0.48 (-0.34 %) Net Assets (Cr) ₹8,996 on 28 Feb 25 Category Equity - Value AMC IDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.81 Sharpe Ratio -0.44 Information Ratio 0.75 Alpha Ratio -0.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹13,762 28 Feb 22 ₹18,421 28 Feb 23 ₹19,742 29 Feb 24 ₹28,532 28 Feb 25 ₹28,464 Returns for IDFC Sterling Value Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 5.4% 3 Month -5.1% 6 Month -13.4% 1 Year 4.6% 3 Year 16.8% 5 Year 35.9% 10 Year 15 Year Since launch 16.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 18% 2023 32.6% 2022 3.2% 2021 64.5% 2020 15.2% 2019 -6.2% 2018 -13% 2017 61.3% 2016 1.1% 2015 -0.3% Fund Manager information for IDFC Sterling Value Fund

Name Since Tenure Daylynn Pinto 20 Oct 16 8.37 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Sterling Value Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 28.95% Consumer Cyclical 10.93% Basic Materials 8.56% Technology 8.39% Industrials 8.15% Energy 8.1% Consumer Defensive 7.36% Health Care 5.86% Utility 2.62% Real Estate 1.78% Asset Allocation

Asset Class Value Cash 7.33% Equity 92.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 22 | HDFCBANK7% ₹696 Cr 4,100,000

↑ 700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 22 | RELIANCE7% ₹633 Cr 5,000,000

↑ 100,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322154% ₹424 Cr 4,300,000

↑ 400,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK4% ₹376 Cr 3,000,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 21 | TCS3% ₹327 Cr 795,000

↑ 95,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 23 | INFY3% ₹282 Cr 1,500,000

↑ 100,000 Hero MotoCorp Ltd (Consumer Cyclical)

Equity, Since 31 Aug 22 | HEROMOTOCO2% ₹204 Cr 470,000

↑ 45,000 ITC Ltd (Consumer Defensive)

Equity, Since 28 Feb 22 | ITC2% ₹201 Cr 4,500,000 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | INDUSINDBK2% ₹198 Cr 2,000,000 Jindal Steel & Power Ltd (Basic Materials)

Equity, Since 30 Apr 17 | 5322862% ₹198 Cr 2,500,000 8. Edelweiss Mid Cap Fund

CAGR/Annualized return of 13.6% since its launch. Ranked 22 in Mid Cap category. Return for 2024 was 38.9% , 2023 was 38.4% and 2022 was 2.4% . Edelweiss Mid Cap Fund

Growth Launch Date 26 Dec 07 NAV (28 Mar 25) ₹89.859 ↓ -0.20 (-0.22 %) Net Assets (Cr) ₹7,729 on 28 Feb 25 Category Equity - Mid Cap AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.86 Sharpe Ratio 0.14 Information Ratio 0.18 Alpha Ratio 8.1 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹14,133 28 Feb 22 ₹17,305 28 Feb 23 ₹18,450 29 Feb 24 ₹27,871 28 Feb 25 ₹30,097 Returns for Edelweiss Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 8.4% 3 Month -10.5% 6 Month -12.4% 1 Year 17.6% 3 Year 22.9% 5 Year 35.1% 10 Year 15 Year Since launch 13.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 38.9% 2023 38.4% 2022 2.4% 2021 50.3% 2020 26.4% 2019 5.2% 2018 -15.7% 2017 52.3% 2016 2.5% 2015 9.4% Fund Manager information for Edelweiss Mid Cap Fund

Name Since Tenure Dhruv Bhatia 14 Oct 24 0.38 Yr. Trideep Bhattacharya 1 Oct 21 3.41 Yr. Raj Koradia 1 Aug 24 0.58 Yr. Data below for Edelweiss Mid Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 20.96% Consumer Cyclical 16.5% Industrials 14.68% Health Care 12.6% Technology 11.89% Basic Materials 7.86% Consumer Defensive 4.99% Real Estate 3.84% Communication Services 1.79% Energy 1.35% Asset Allocation

Asset Class Value Cash 3.54% Equity 96.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Jan 20 | DIXON4% ₹322 Cr 214,550

↑ 3,802 Persistent Systems Ltd (Technology)

Equity, Since 31 Mar 21 | PERSISTENT3% ₹283 Cr 468,879

↓ -102,975 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 21 | MAXHEALTH3% ₹261 Cr 2,461,020

↑ 1,351,437 Indian Hotels Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | 5008503% ₹244 Cr 3,185,298

↑ 680,114 Lupin Ltd (Healthcare)

Equity, Since 31 Jul 24 | 5002573% ₹237 Cr 1,140,343

↑ 27,563 Marico Ltd (Consumer Defensive)

Equity, Since 31 Oct 24 | 5316423% ₹223 Cr 3,318,848

↑ 1,715,413 Coforge Ltd (Technology)

Equity, Since 30 Jun 23 | COFORGE3% ₹221 Cr 267,153

↑ 6,457 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433903% ₹213 Cr 1,231,780

↑ 29,774 Solar Industries India Ltd (Basic Materials)

Equity, Since 30 Sep 12 | SOLARINDS2% ₹196 Cr 192,679

↑ 4,656 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Aug 17 | UNOMINDA2% ₹176 Cr 1,859,803

↑ 249,595 9. Canara Robeco Infrastructure

CAGR/Annualized return of 14.8% since its launch. Return for 2024 was 35.3% , 2023 was 41.2% and 2022 was 9% . Canara Robeco Infrastructure

Growth Launch Date 2 Dec 05 NAV (28 Mar 25) ₹144.52 ↓ -0.71 (-0.49 %) Net Assets (Cr) ₹726 on 28 Feb 25 Category Equity - Sectoral AMC Canara Robeco Asset Management Co. Ltd. Rating Risk High Expense Ratio 2.47 Sharpe Ratio 0.02 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹13,025 28 Feb 22 ₹16,856 28 Feb 23 ₹18,567 29 Feb 24 ₹28,292 28 Feb 25 ₹29,689 Returns for Canara Robeco Infrastructure

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 11.5% 3 Month -8.4% 6 Month -14.9% 1 Year 13.6% 3 Year 26% 5 Year 34.9% 10 Year 15 Year Since launch 14.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 35.3% 2023 41.2% 2022 9% 2021 56.1% 2020 9% 2019 2.3% 2018 -19.1% 2017 40.2% 2016 2.1% 2015 6.7% Fund Manager information for Canara Robeco Infrastructure

Name Since Tenure Vishal Mishra 26 Jun 21 3.68 Yr. Shridatta Bhandwaldar 29 Sep 18 6.42 Yr. Data below for Canara Robeco Infrastructure as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 48.03% Utility 13.81% Energy 8.25% Technology 6.67% Basic Materials 6.38% Financial Services 6.23% Communication Services 2.74% Real Estate 1.81% Consumer Cyclical 1.76% Asset Allocation

Asset Class Value Cash 4.32% Equity 95.68% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 11 | LT6% ₹51 Cr 143,401 NTPC Ltd (Utilities)

Equity, Since 30 Nov 18 | 5325555% ₹37 Cr 1,131,666 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE4% ₹31 Cr 244,750 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Jan 23 | INDIGO4% ₹29 Cr 67,250

↑ 7,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Oct 09 | 5328984% ₹29 Cr 957,546

↓ -20,000 Hitachi Energy India Ltd Ordinary Shares (Technology)

Equity, Since 31 Aug 23 | POWERINDIA4% ₹29 Cr 22,250

↑ 750 Tata Power Co Ltd (Utilities)

Equity, Since 30 Sep 24 | 5004004% ₹29 Cr 785,000

↑ 75,000 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Jul 19 | BEL3% ₹27 Cr 919,000

↑ 30,000 Power Finance Corp Ltd (Financial Services)

Equity, Since 30 Nov 23 | 5328103% ₹26 Cr 610,000

↑ 45,000 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Oct 23 | DIXON3% ₹25 Cr 16,950

↓ -500 10. ICICI Prudential Dividend Yield Equity Fund

CAGR/Annualized return of 15.8% since its launch. Ranked 38 in Dividend Yield category. Return for 2024 was 21% , 2023 was 38.8% and 2022 was 9.2% . ICICI Prudential Dividend Yield Equity Fund

Growth Launch Date 16 May 14 NAV (28 Mar 25) ₹49.13 ↓ -0.02 (-0.04 %) Net Assets (Cr) ₹4,575 on 28 Feb 25 Category Equity - Dividend Yield AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.41 Sharpe Ratio -0.15 Information Ratio 1.52 Alpha Ratio 2.98 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹13,753 28 Feb 22 ₹18,322 28 Feb 23 ₹20,202 29 Feb 24 ₹30,689 28 Feb 25 ₹31,866 Returns for ICICI Prudential Dividend Yield Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 7.4% 3 Month -0.1% 6 Month -10.2% 1 Year 9.3% 3 Year 21.7% 5 Year 34.7% 10 Year 15 Year Since launch 15.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 21% 2023 38.8% 2022 9.2% 2021 47.1% 2020 14.1% 2019 -2.9% 2018 -11.9% 2017 40.7% 2016 9.7% 2015 -5.2% Fund Manager information for ICICI Prudential Dividend Yield Equity Fund

Name Since Tenure Mittul Kalawadia 29 Jan 18 7.09 Yr. Sharmila D’mello 31 Jul 22 2.59 Yr. Data below for ICICI Prudential Dividend Yield Equity Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 28.85% Consumer Cyclical 11.19% Energy 9.08% Consumer Defensive 8.08% Utility 7.75% Health Care 6.9% Industrials 6.57% Basic Materials 6.09% Technology 5.28% Communication Services 4.74% Real Estate 1.52% Asset Allocation

Asset Class Value Cash 1.89% Equity 96.03% Debt 1.79% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK8% ₹378 Cr 2,222,624 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | ICICIBANK8% ₹364 Cr 2,905,184 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jan 22 | MARUTI7% ₹353 Cr 286,610 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 30 Apr 21 | SUNPHARMA7% ₹325 Cr 1,864,051

↑ 90,000 NTPC Ltd (Utilities)

Equity, Since 31 Oct 16 | 5325556% ₹305 Cr 9,420,524

↑ 1,219,502 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 20 | BHARTIARTL4% ₹213 Cr 1,312,548 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Dec 21 | 5003124% ₹213 Cr 8,094,802 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Aug 21 | LT4% ₹173 Cr 485,774

↑ 57,761 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322153% ₹163 Cr 1,656,380

↑ 35,281 Britannia Industries Ltd (Consumer Defensive)

Equity, Since 31 Jul 23 | 5008252% ₹113 Cr 219,613

म्यूचुअल फंड एसआईपी ऑनलाइन में निवेश कैसे करें?

Fincash.com पर आजीवन मुफ्त निवेश खाता खोलें।

अपना पंजीकरण और केवाईसी प्रक्रिया पूरी करें

Upload Documents (PAN, Aadhaar, etc.). और, आप निवेश करने के लिए तैयार हैं!

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।