Amitabh Bachchan Financial Comeback and Net Worth 2025

Amitabh Bachchan, fondly known as Big B, is a living legend whose life and career have inspired millions across the globe. But beyond the glitz and glamour of his Bollywood success lies a compelling story of financial resilience that holds valuable lessons for anyone facing a financial crisis. Let’s delve into how Amitabh Bachchan rebuilt his financial empire and what we can learn about managing debt, refinancing, and rebuilding financial health.

The Financial Downfall

The 1990s were a turbulent time for Amitabh Bachchan. After achieving unparalleled success as an actor, he ventured into entrepreneurship by launching Amitabh Bachchan Corporation Limited (ABCL) in 1995. ABCL was ambitious, aiming to produce films, manage events, and Market celebrities. However, the venture faced significant losses, leading to mounting debts. By 1999, Bachchan’s financial situation had reached a critical point. He owed crores of rupees and faced legal notices from creditors.

For many, such a crisis would spell the end of their career, but Amitabh Bachchan saw it as a turning point. His resilience and strategic decisions not only pulled him out of debt but also cemented his status as one of Bollywood’s most bankable stars.

Talk to our investment specialist

Lessons from Big B’s Financial Comeback

1. Acknowledge the Problem

The first step in managing debt is acknowledging it. Amitabh Bachchan openly admitted his financial struggles. Instead of ignoring the issue, he faced it head-on, which is a crucial step in regaining control over finances.

Lesson: Ignoring debt won’t make it disappear. Assess your financial situation honestly and take proactive steps to address the issue.

2. Leverage Your Strengths

To pay off his debts, Amitabh Bachchan returned to what he knew best: acting. He made a strong comeback with films like Mohabbatein (2000) and ventured into television with Kaun Banega Crorepati (KBC), a game show that became a massive hit. These projects revitalised his career and provided the financial stability he needed.

Lesson: Identify your core strengths and use them to generate Income. Whether it’s taking on additional work, freelancing, or starting a side hustle, your skills can be your biggest asset during a financial crunch.

3. Prioritise Debt Repayment

Amitabh Bachchan focused on clearing his debts systematically. Reports suggest he negotiated with creditors and prioritised repayments to rebuild trust.

Lesson: Create a debt repayment plan. List all your debts, prioritise them based on interest rates, and consider the snowball or avalanche method to pay them off efficiently.

4. Negotiate and Refinance

Just as Bachchan reportedly negotiated repayment terms with creditors, you can explore options like refinancing loans or consolidating debt to secure better terms and lower interest rates.

Lesson: Don’t hesitate to negotiate with lenders. Many financial institutions offer refinancing or restructuring options that can make repayments more manageable.

5. Diversify Your Income

Bachchan’s ventures into television, brand endorsements, and film appearances diversified his income streams, ensuring he wasn’t reliant on a single source of revenue.

Lesson: Diversify your income to reduce financial vulnerability. Explore investments, side gigs, or passive income opportunities to build financial resilience.

6. Maintain Financial Discipline

Recovering from debt requires strict financial discipline. Bachchan’s focus on rebuilding his career and carefully selecting projects reflects this.

Lesson: Cut unnecessary expenses, stick to a budget, and avoid accumulating new debt while you work on paying off existing obligations.

Insights on ABCL

ABCL’s losses stemmed from overambitious projects and insufficient risk management, making it a case study for budding entrepreneurs on the importance of financial planning. The company’s downfall underscored the risks of diversifying too rapidly without a robust financial strategy.

Highlighting Kaun Banega Crorepati’s Role

Kaun Banega Crorepati (KBC) not only marked a turning point in Bachchan’s career but also revolutionised Indian television. Its success underscores the potential of diversification in financial recovery. For Amitabh Bachchan, KBC became a platform to connect with audiences across India, boosting his popularity and stabilising his finances.

Rebuilding Trust and Reputation

Amitabh Bachchan’s financial comeback wasn’t just about clearing debts; it was also about rebuilding his reputation. His professionalism, humility, and dedication endeared him to fans and Industry peers alike, helping him regain trust and secure new opportunities.

Lesson: Reputation matters in both personal and professional finance. Honouring commitments and maintaining transparency can go a long way in rebuilding trust.

The Net Worth of Amitabh Bachchan 2025

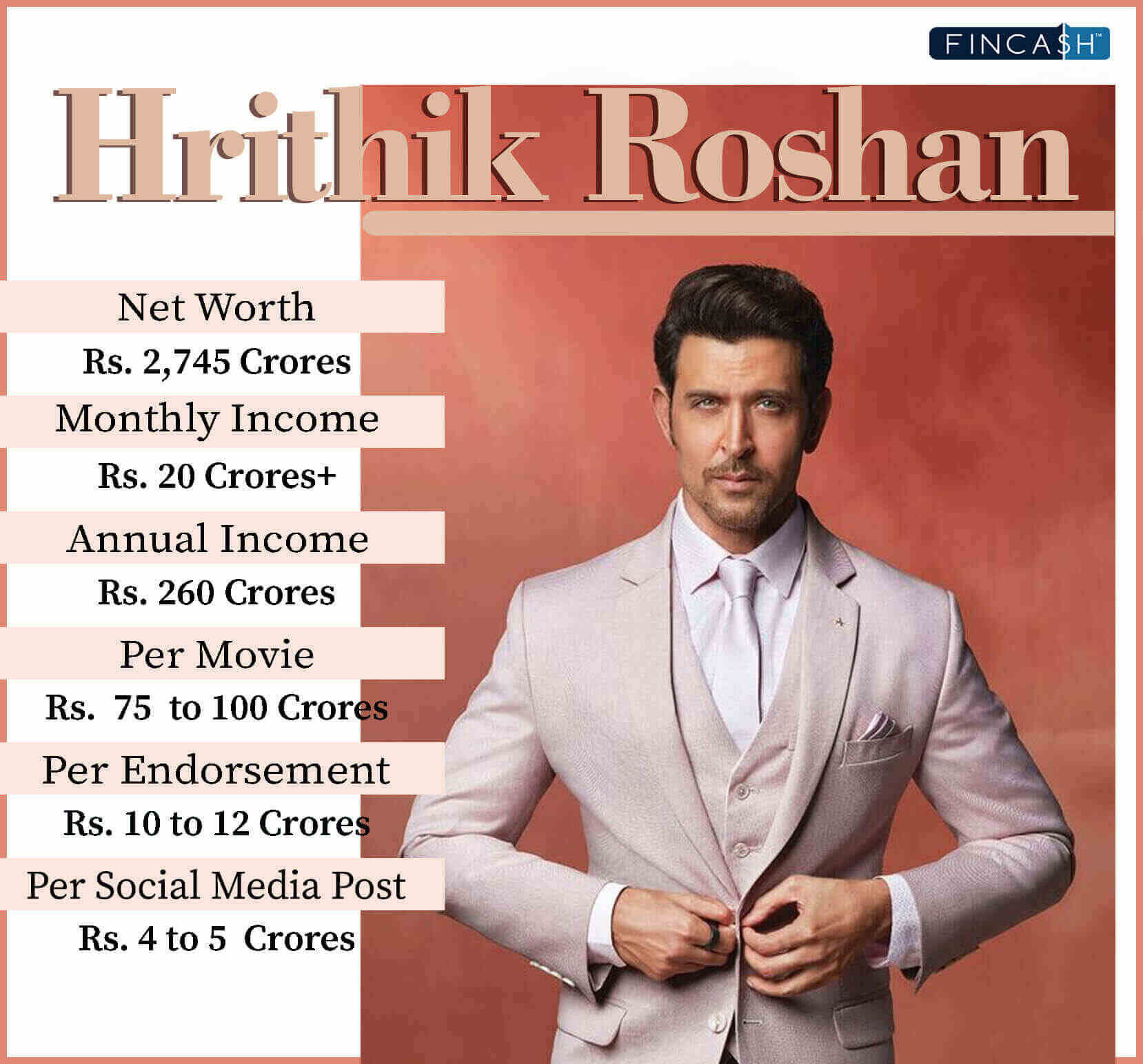

Today, Amitabh Bachchan stands as one of the wealthiest celebrities in India, with an estimated Net worth of INR 3,500 crore (approximately USD 420 million). With this net worth, Amitabh Bachchan ranks alongside other Bollywood titans like Shah Rukh Khan and Salman Khan. His wealth comes from multiple sources, including acting, brand endorsements, television appearances, and smart investments in Real Estate and startups.

A Blueprint for Overcoming Financial Adversity

Amitabh Bachchan’s financial journey is a masterclass in resilience and strategic decision-making. His comeback story serves as a blueprint for overcoming financial adversity. With the right mindset and strategies, you too can navigate challenges and emerge stronger, just like the Shahenshah of Bollywood.

The Takeaway

Amitabh Bachchan’s journey from Financial Distress to renewed success is a testament to resilience, strategic planning, and determination. Whether you’re dealing with personal debt or a business setback, his story offers timeless lessons:

- Acknowledge and address financial challenges promptly.

- Leverage your skills and strengths to generate income.

- Prioritise debt repayment and explore refinancing options.

- Diversify income streams to safeguard against future crises.

- Maintain financial discipline and rebuild trust.

Big B’s comeback isn’t just an inspirational story—it’s a blueprint for overcoming financial adversity. With the right mindset and strategies, you too can navigate challenges and emerge stronger, just like the Shahenshah of Bollywood.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.