Table of Contents

पैसिव फंड क्या हैं?

पैसिव फंड एक प्रकार के फंड होते हैं जो लगातार ट्रैक करते हैं aमंडी एक फंड को अधिकतम लाभ प्राप्त करने की अनुमति देने के लिए सूचकांक। यह एक ऐसे पोर्टफोलियो में निवेश करता है जो a . की नकल करता हैबाजार सूचकांक जैसे निफ्टी, सेंसेक्स, आदि। पोर्टफोलियो में उनके अनुपात के साथ सभी प्रतिभूतियां उसी इंडेक्स के समान होंगी जो फंड ट्रैक कर रहा है।

पैसिव फंड में, फंड मैनेजर सक्रिय रूप से यह नहीं चुनता कि कौन से स्टॉक फंड बनाएंगे। यह एक कारण है कि सक्रिय फंडों की तुलना में निष्क्रिय फंडों में निवेश करना आसान होता है। निवेशक पैसिव फंड तब खरीदते हैं जब वे चाहते हैं कि उनका रिटर्न बाजार के अनुरूप हो। ये फंड कम लागत वाले फंड हैं क्योंकि स्टॉक चुनने और शोध करने में कोई लागत शामिल नहीं है।

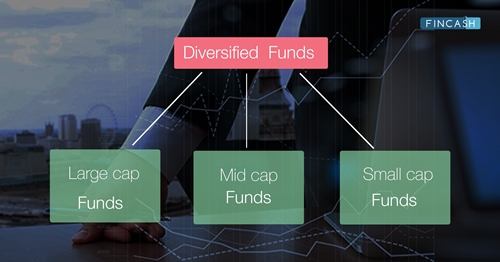

निष्क्रिय निधि के प्रकार

पैसिव फंड दो प्रकार के होते हैं, जैसे -

1. इंडेक्स फंड्स

इंडेक्स फंड्स एक ओपन-एंडेड योजना है जहां निवेशक की इकाइयों को खरीदते और भुनाते हैंम्यूचुअल फंड्स शुद्ध संपत्ति मूल्यों पर। दूसरे शब्दों में, इंडेक्स फंड का प्रदर्शन किसी विशेष इंडेक्स के प्रदर्शन पर निर्भर करता है। इंडेक्स फंड में उसी अनुपात में शेयर होते हैं जैसे वे किसी विशेष इंडेक्स में होते हैं।

2. एक्सचेंज ट्रेडेड फंड (ईटीएफ)

एक्सचेंज-ट्रेडेड फंड की इकाइयाँ स्टॉक एक्सचेंज में बेतरतीब ढंग से सूचीबद्ध होती हैं। निवेशक के माध्यम से रीयल-टाइम कीमतों पर इकाइयाँ खरीदते और बेचते हैंडीमैट खाता.

Talk to our investment specialist

पैसिव फंड और एक्टिव फंड के बीच अंतर

उनके कार्य करने और प्रभावित करने के तरीके में विशिष्ट अंतर हैंइन्वेस्टर.

सारणी निष्क्रिय फंड और सक्रिय फंड के बीच अंतर करती है:

| निष्क्रिय निधि | सक्रिय निधि |

|---|---|

| फंड मैनेजर फंड के चयन में सक्रिय रूप से भाग नहीं लेता है | फंड मैनेजर बहुत सारे शोध के लिए प्रतिबद्ध हैं और बाजार के प्रदर्शन के आधार पर विभिन्न प्रतिभूतियों में फंड का चयन करने के लिए तदनुसार कदम उठाते हैं |

| कम लागत | लागत अधिक |

| कम व्यय अनुपात के कारण लोकप्रियता | महंगा प्रबंधन इसे कम लोकप्रिय बनाता है |

कैसे पैसिव फंड ट्रस्ट हासिल कर रहा है?

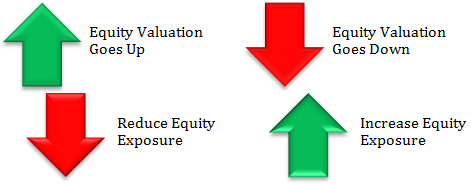

2019 में, भारतीय निवेशकों ने पाया कि पैसिव म्यूचुअल फंड भरोसेमंद थे। निष्क्रिय निधियों द्वारा प्रबंधित कुल संपत्ति, जिसमें सोना औरईटीएफ अन्य इंडेक्स फंडों के साथ बहुत बड़ा था। यह पाया गया कि यह पर खड़ा थारु. 177,181 करोड़ 30 नवंबर 2019 को।

एसोसिएशन ऑफ म्युचुअल फंड्स इन इंडिया (एम्फी) ने कहा कि इंडेक्स फंड्स ने का एयूएम इकट्ठा किया हैरु. 7717 करोड़ नवंबर 2019 को। निष्क्रिय लार्ज-कैप ईटीएफ सक्रिय रूप से प्रबंधित की तुलना में 11.53% का रिटर्न प्रदान करते हैंलार्ज कैप फंड जो 10.19% की पेशकश की।

गोल्ड ईटीएफ यहां पर खड़ारु. 5,540.40 करोड़ नवंबर 2019 तक। यह रुपये की तुलना में आता है। दिसंबर 2018 में 4,571 करोड़। अन्य ईटीएफ का एयूएम रु। 1,63,923.66 करोड़ रुपये की तुलना में। 2018 के अंत में 1,07,363 करोड़।

2019 के एक बड़े हिस्से में देखा गया कि लार्ज-कैप योजनाएं रिटर्न चार्ट में सबसे ऊपर थीं। 2020 में भी, शीर्ष 15 लार्ज-कैप योजनाओं में से नौ निष्क्रिय फंड हैं।

पैसिव फंड्स के बीच कोरोनावायरस महामारी

दुनिया भर में मौजूदा स्थिति के साथ, वित्तीय बाजार गहरी चिंता के मुद्दों का सामना कर रहे हैं। जबकि निवेशक अतीत में जोखिम लेने के लिए तैयार थे, आज की स्थितियों ने अधिकांश निवेशकों को एक की तलाश करने के लिए प्रेरित किया हैसुरक्षित ठिकाना. इसका मतलब है कि वे ऐसे निवेश की तलाश में हैं जो उच्च रिटर्न या कम से कम स्थिर रिटर्न दे।

कई निवेशक अब निष्क्रिय मोड जैसे एक्सचेंज ट्रेडेड फंड या इंडेक्स फंड के माध्यम से निवेश करना चाह रहे हैं। AMFI के अनुसार, इंडेक्स फंड्स में इनफ्लो को अब तक के उच्चतम स्तर का सामना करना पड़ारु. 2076.5 करोड़ मार्च 2020 में।

बेस्ट पैसिव फंड्स 2022 - 2023

निष्क्रिय म्युचुअल फंड की बढ़ती लोकप्रियता के साथ, उच्च रिटर्न प्राप्त करने की संभावना अधिक है। यहां सबसे अच्छे पैसिव म्यूचुअल फंड हैं जिन्हें आप निवेश करना चुन सकते हैं:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) LIC MF Index Fund Sensex Growth ₹146.417

↑ 2.81 ₹78 2.4 -3.2 7.7 10.6 20 8.2 Nippon India Index Fund - Sensex Plan Growth ₹39.7322

↑ 0.76 ₹761 2.5 -3 8.4 11.1 20.6 8.9 SBI Nifty Index Fund Growth ₹209.59

↑ 3.64 ₹8,409 2.8 -3.5 8.4 11.6 21.4 9.5 IDBI Nifty Index Fund Growth ₹36.2111

↓ -0.02 ₹208 9.1 11.9 16.2 20.3 11.7 Franklin India Index Fund Nifty Plan Growth ₹191.4

↑ 3.30 ₹646 2.8 -3.5 8.4 11.5 21.1 9.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

*कम से कम वाले इंडेक्स म्यूचुअल फंड की सूची नीचे दी गई है15 करोड़ या अधिक शुद्ध संपत्ति में।

The main investment objective of the fund is to generate returns commensurate with the performance of the index either Nifty / Sensex based on the plans by investing in the respective index stocks subject to tracking errors. LIC MF Index Fund Sensex is a Others - Index Fund fund was launched on 14 Nov 02. It is a fund with Moderately High risk and has given a Below is the key information for LIC MF Index Fund Sensex Returns up to 1 year are on The primary investment objective of the scheme is to replicate the composition of the Sensex, with a view to generate returns that are commensurate with the performance of the Sensex, subject to tracking errors. Nippon India Index Fund - Sensex Plan is a Others - Index Fund fund was launched on 28 Sep 10. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Index Fund - Sensex Plan Returns up to 1 year are on The scheme will adopt a passive investment strategy. The scheme will

invest in stocks comprising the Nifty 50 Index in the same proportion as in the

index with the objective of achieving returns equivalent to the Total Returns

Index of Nifty 50 Index by minimizing the performance difference between the

benchmark index and the scheme. The Total Returns Index is an index that

reflects the returns on the index from index gain/loss plus dividend payments

by the constituent stocks. SBI Nifty Index Fund is a Others - Index Fund fund was launched on 17 Jan 02. It is a fund with Moderately High risk and has given a Below is the key information for SBI Nifty Index Fund Returns up to 1 year are on The investment objective of the scheme is to invest in the stocks and equity related instruments comprising the S&P CNX Nifty Index in the same weights as these stocks represented in the Index with the intent to replicate the performance of the Total Returns Index of S&P CNX Nifty index. The scheme will adopt a passive investment strategy and will seek to achieve the investment objective by minimizing the tracking error between the S&P CNX Nifty index (Total Returns Index) and the scheme. IDBI Nifty Index Fund is a Others - Index Fund fund was launched on 25 Jun 10. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Nifty Index Fund Returns up to 1 year are on The Investment Objective of the Scheme is to invest in companies whose securities are included in the Nifty and subject to tracking errors, endeavouring to attain results commensurate with the Nifty 50 under NSENifty Plan Franklin India Index Fund Nifty Plan is a Others - Index Fund fund was launched on 4 Aug 00. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Index Fund Nifty Plan Returns up to 1 year are on 1. LIC MF Index Fund Sensex

CAGR/Annualized return of 13.2% since its launch. Ranked 79 in Index Fund category. Return for 2024 was 8.2% , 2023 was 19% and 2022 was 4.6% . LIC MF Index Fund Sensex

Growth Launch Date 14 Nov 02 NAV (17 Apr 25) ₹146.417 ↑ 2.81 (1.95 %) Net Assets (Cr) ₹78 on 28 Feb 25 Category Others - Index Fund AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating ☆ Risk Moderately High Expense Ratio 0.98 Sharpe Ratio -0.41 Information Ratio -8.57 Alpha Ratio -1.18 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Months (1%),1 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,719 31 Mar 22 ₹19,759 31 Mar 23 ₹19,957 31 Mar 24 ₹24,979 31 Mar 25 ₹26,262 Returns for LIC MF Index Fund Sensex

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 5.8% 3 Month 2.4% 6 Month -3.2% 1 Year 7.7% 3 Year 10.6% 5 Year 20% 10 Year 15 Year Since launch 13.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.2% 2022 19% 2021 4.6% 2020 21.9% 2019 15.9% 2018 14.6% 2017 5.6% 2016 27.4% 2015 1.6% 2014 -5.4% Fund Manager information for LIC MF Index Fund Sensex

Name Since Tenure Sumit Bhatnagar 3 Oct 23 1.49 Yr. Data below for LIC MF Index Fund Sensex as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 0.03% Equity 99.97% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 09 | HDFCBANK15% ₹12 Cr 69,625

↑ 402 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 09 | 53217410% ₹8 Cr 64,941

↑ 390 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 09 | RELIANCE10% ₹7 Cr 62,325

↑ 415 Infosys Ltd (Technology)

Equity, Since 31 Mar 09 | INFY7% ₹6 Cr 33,246

↑ 200 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 09 | BHARTIARTL5% ₹4 Cr 24,617

↑ 140 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 09 | LT4% ₹3 Cr 10,756

↑ 78 ITC Ltd (Consumer Defensive)

Equity, Since 30 Sep 11 | ITC4% ₹3 Cr 85,280

↑ 645 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Mar 09 | TCS4% ₹3 Cr 9,313

↑ 64 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | 5322153% ₹3 Cr 26,195

↑ 120 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Jun 17 | KOTAKBANK3% ₹3 Cr 13,499 2. Nippon India Index Fund - Sensex Plan

CAGR/Annualized return of 9.9% since its launch. Ranked 74 in Index Fund category. Return for 2024 was 8.9% , 2023 was 19.5% and 2022 was 5% . Nippon India Index Fund - Sensex Plan

Growth Launch Date 28 Sep 10 NAV (17 Apr 25) ₹39.7322 ↑ 0.76 (1.95 %) Net Assets (Cr) ₹761 on 28 Feb 25 Category Others - Index Fund AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.58 Sharpe Ratio -0.36 Information Ratio -9.57 Alpha Ratio -0.57 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,795 31 Mar 22 ₹19,942 31 Mar 23 ₹20,189 31 Mar 24 ₹25,378 31 Mar 25 ₹26,846 Returns for Nippon India Index Fund - Sensex Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 5.9% 3 Month 2.5% 6 Month -3% 1 Year 8.4% 3 Year 11.1% 5 Year 20.6% 10 Year 15 Year Since launch 9.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.9% 2022 19.5% 2021 5% 2020 22.4% 2019 16.6% 2018 14.2% 2017 6.2% 2016 27.9% 2015 2% 2014 -4.7% Fund Manager information for Nippon India Index Fund - Sensex Plan

Name Since Tenure Himanshu Mange 23 Dec 23 1.27 Yr. Data below for Nippon India Index Fund - Sensex Plan as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 0.03% Equity 99.97% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 10 | HDFCBANK15% ₹117 Cr 677,560

↑ 15,890 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 10 | 53217410% ₹76 Cr 631,771

↑ 14,816 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 10 | RELIANCE10% ₹73 Cr 605,893

↑ 14,208 Infosys Ltd (Technology)

Equity, Since 31 Oct 10 | INFY7% ₹55 Cr 323,478

↑ 7,585 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 10 | BHARTIARTL5% ₹38 Cr 239,659

↑ 5,620 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹33 Cr 104,658

↑ 2,454 ITC Ltd (Consumer Defensive)

Equity, Since 29 Feb 12 | ITC4% ₹33 Cr 828,954

↑ 19,439 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 10 | TCS4% ₹32 Cr 90,717

↑ 2,127 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | 5322153% ₹26 Cr 254,920

↑ 5,978 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Jun 17 | KOTAKBANK3% ₹25 Cr 131,743

↑ 3,090 3. SBI Nifty Index Fund

CAGR/Annualized return of 14.2% since its launch. Ranked 75 in Index Fund category. Return for 2024 was 9.5% , 2023 was 20.7% and 2022 was 5.1% . SBI Nifty Index Fund

Growth Launch Date 17 Jan 02 NAV (17 Apr 25) ₹209.59 ↑ 3.64 (1.77 %) Net Assets (Cr) ₹8,409 on 28 Feb 25 Category Others - Index Fund AMC SBI Funds Management Private Limited Rating ☆ Risk Moderately High Expense Ratio 0.5 Sharpe Ratio -0.37 Information Ratio -20.5 Alpha Ratio -0.54 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-15 Days (0.2%),15 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,114 31 Mar 22 ₹20,447 31 Mar 23 ₹20,451 31 Mar 24 ₹26,462 31 Mar 25 ₹28,071 Returns for SBI Nifty Index Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 5.9% 3 Month 2.8% 6 Month -3.5% 1 Year 8.4% 3 Year 11.6% 5 Year 21.4% 10 Year 15 Year Since launch 14.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 9.5% 2022 20.7% 2021 5.1% 2020 24.7% 2019 14.6% 2018 12.5% 2017 3.8% 2016 29.1% 2015 3.4% 2014 -4.2% Fund Manager information for SBI Nifty Index Fund

Name Since Tenure Raviprakash Sharma 1 Feb 11 14.17 Yr. Pradeep Kesavan 1 Dec 23 1.33 Yr. Data below for SBI Nifty Index Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Equity 100.2% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 03 | HDFCBANK13% ₹1,119 Cr 6,460,796

↑ 159,811 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 03 | ICICIBANK9% ₹722 Cr 5,994,945

↑ 148,291 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 03 | RELIANCE8% ₹692 Cr 5,767,672

↑ 142,665 Infosys Ltd (Technology)

Equity, Since 31 Jan 03 | INFY6% ₹517 Cr 3,060,453

↑ 75,703 Bharti Airtel Ltd (Communication Services)

Equity, Since 29 Feb 04 | BHARTIARTL4% ₹358 Cr 2,278,708

↑ 56,368 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 04 | LT4% ₹316 Cr 1,000,203

↑ 24,746 ITC Ltd (Consumer Defensive)

Equity, Since 29 Feb 12 | ITC4% ₹312 Cr 7,899,287

↑ 195,388 Tata Consultancy Services Ltd (Technology)

Equity, Since 28 Feb 05 | TCS4% ₹302 Cr 868,281

↑ 21,472 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 10 | 5322153% ₹246 Cr 2,422,996

↑ 59,934 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | KOTAKBANK3% ₹237 Cr 1,247,589

↑ 30,863 4. IDBI Nifty Index Fund

CAGR/Annualized return of 10.3% since its launch. Ranked 83 in Index Fund category. . IDBI Nifty Index Fund

Growth Launch Date 25 Jun 10 NAV (28 Jul 23) ₹36.2111 ↓ -0.02 (-0.06 %) Net Assets (Cr) ₹208 on 30 Jun 23 Category Others - Index Fund AMC IDBI Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 0.9 Sharpe Ratio 1.04 Information Ratio -3.93 Alpha Ratio -1.03 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,049 31 Mar 22 ₹20,178 31 Mar 23 ₹20,108 Returns for IDBI Nifty Index Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 3.7% 3 Month 9.1% 6 Month 11.9% 1 Year 16.2% 3 Year 20.3% 5 Year 11.7% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI Nifty Index Fund

Name Since Tenure Data below for IDBI Nifty Index Fund as on 30 Jun 23

Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. Franklin India Index Fund Nifty Plan

CAGR/Annualized return of 12.7% since its launch. Ranked 76 in Index Fund category. Return for 2024 was 9.5% , 2023 was 20.2% and 2022 was 4.9% . Franklin India Index Fund Nifty Plan

Growth Launch Date 4 Aug 00 NAV (17 Apr 25) ₹191.4 ↑ 3.30 (1.76 %) Net Assets (Cr) ₹646 on 28 Feb 25 Category Others - Index Fund AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆ Risk Moderately High Expense Ratio 0.62 Sharpe Ratio -0.37 Information Ratio -3.6 Alpha Ratio -0.59 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-30 Days (1%),30 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,967 31 Mar 22 ₹20,211 31 Mar 23 ₹20,200 31 Mar 24 ₹26,057 31 Mar 25 ₹27,627 Returns for Franklin India Index Fund Nifty Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 5.9% 3 Month 2.8% 6 Month -3.5% 1 Year 8.4% 3 Year 11.5% 5 Year 21.1% 10 Year 15 Year Since launch 12.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 9.5% 2022 20.2% 2021 4.9% 2020 24.3% 2019 14.7% 2018 12% 2017 3.2% 2016 28.3% 2015 3.3% 2014 -3.6% Fund Manager information for Franklin India Index Fund Nifty Plan

Name Since Tenure Sandeep Manam 18 Oct 21 3.45 Yr. Shyam Sriram 26 Sep 24 0.51 Yr. Data below for Franklin India Index Fund Nifty Plan as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 0.31% Equity 99.69% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 03 | HDFCBANK13% ₹86 Cr 494,900

↑ 6,300 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 10 | ICICIBANK9% ₹55 Cr 458,823

↑ 5,453 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 03 | RELIANCE8% ₹53 Cr 441,171

↑ 4,989 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY6% ₹39 Cr 233,693

↑ 2,245 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 04 | BHARTIARTL4% ₹27 Cr 174,000

↑ 1,672 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT4% ₹24 Cr 76,374

↑ 734 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 11 | ITC4% ₹24 Cr 603,183

↑ 5,796 Tata Consultancy Services Ltd (Technology)

Equity, Since 28 Feb 05 | TCS4% ₹23 Cr 66,301

↑ 637 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 09 | 5322153% ₹19 Cr 185,017

↑ 1,777 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | KOTAKBANK3% ₹18 Cr 95,264

↑ 915

निष्कर्ष

खासकर मौजूदा वित्तीय संकट में पैसिव फंड निवेशकों के लिए उम्मीद की किरण साबित हो रहे हैं। पहलेनिवेश किसी भी पैसिव म्यूचुअल फंड में, योजनाओं से संबंधित सभी दस्तावेजों को ध्यान से पढ़ना सुनिश्चित करें। इससे आपको सुरक्षा की भावना के साथ-साथ क्या उम्मीद करनी है और क्या देना है, इसकी समझ हासिल करने में मदद मिलेगी।

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।