Table of Contents

- Union Budget 2024

- Income Tax Slab 2024-25

- Income Tax Slab FY 2023-24

- Income Tax Slab & Rate for 2019-20 (AY 2020-21)

- How to Calculate Income Tax from Income Tax Slabs?

- Income Tax Slab & Rate for FY 2017-18 (AY 2018-19)

- Income Tax Slab & Rate for FY 2016-17 (AY 2017-18)

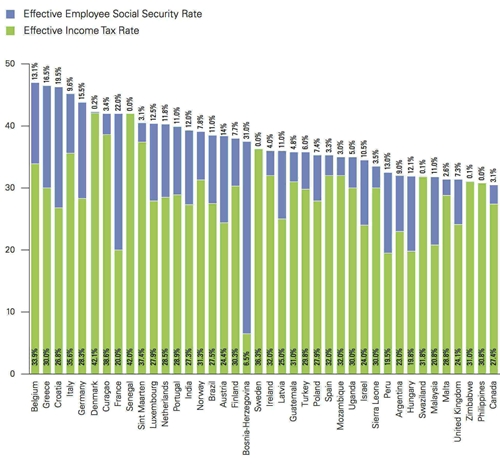

- Comparing Indian Tax Rates with Other Countries

Income Tax Slab & Rate for FY 2024-25

In India, income tax is charged based on an individual’s Income. These tax rates are based on the Range of income called income slabs. The more the income, more the tax. The tax slabs tend to undergo a change during every budget. In this article, we shall understand the tax based on slabs, categories of taxpayers, etc.

Union Budget 2024

Under the new tax regime, the Finance Minister - Ms. Nirmala Sitharaman has tweaked the income tax slab.

Let’s find out more about these modifications and changes.

Income Tax Slab 2024-25

Here is the new tax slab rate as per the Union Budget 2024:

| Income Range Per Annum | New Tax Range |

|---|---|

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,000 to Rs. 7,00,000 | 5% |

| Rs. 7,00,000 to Rs. 10,00,000 | 10% |

| Rs. 10,00,000 to Rs. 12,00,000 | 15% |

| Rs. 12,00,000 to Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

Income Tax Slab FY 2023-24

Finance Minister Nirmala Sitharaman has presented the Union Budget 2023-24 intending to increase income and boost purchasing power. As per the speech, the basic exemption limit has come down to Rs. 2.5 lakhs from Rs. 3 lakhs. Not just that, the rebate under Section 87A has been increased to Rs. 7 lakhs from Rs. 5 lakhs.

Here is the tax slab rate as per the Union Budget 2023-24:

| Income Range Per Annum | Tax Range (2023-24) |

|---|---|

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,000 to Rs. 6,00,000 | 5% |

| Rs. 6,00,000 to Rs. 9,00,000 | 10% |

| Rs. 9,00,000 to Rs. 12,00,000 | 15% |

| Rs. 12,00,000 to Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

Those individuals who have an income of Rs. 15.5 lakhs and above will be eligible for the standard Deduction of Rs. 52,000. Moreover, the new tax regime has become the Default one. Yet, people have the option to retain the old tax regime, which is as follows:

| Income Range Per Annum | Tax Range (2021-22) |

|---|---|

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001 to Rs. 5,00,000 | 5% |

| Rs. 5,00,001 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Talk to our investment specialist

Income Tax Slab & Rate for 2019-20 (AY 2020-21)

Here's the income tax slab rates FY 2019-2020 for-

- Individuals & HUF (Age <60 years)

- Senior Citizens (Age: 60-80 yrs)

- Senior Citizens (Age > 80 yrs)

- Domestic Companies

1. Individual Tax Payers & HUF (Less Than 60 Years Old)– I

| Income Range Per Annum | Tax Rate | Health and Education Cess |

|---|---|---|

| Up to INR 2,50,000 | No tax | Nil |

| Above INR 2,50,000 to 5,00,000 | 5% | 4% cess |

| Above INR 5,00,000 to 10,00,000 | 20% | 4% cess |

| Above INR 10,00,000 to 50,00,000 | 30% | 4% cess |

| Above INR 10,00,000 to 1 crore | 30% + 10% surcharge | 4% cess |

| Above INR 1 crore | 30% +15% surcharge | 4% cess |

As per the amendments to Section 87(A), if your annual Taxable Income is lower than INR 5,00,000, you can avail the Tax Rebate. The existing laws made way for a 2,500 income tax rebate. However, the updated law ensured that the limit was increased to a 12,500 income tax rebate.

2. Senior Citizens (60 Years Old Or More but Less than 80 Years Old)

| Income Range Per Annum | Tax Rate FY 24 - 25 | Health and Education Cess |

|---|---|---|

| Up to INR 3,00,000 | No tax | Nil |

| Above INR 3,00,000 to 5,00,000 | 5% | 4% cess |

| Above INR 5,00,000 to 10,00,000 | 20% | 4% cess |

| Above INR 10,00,000 to 50,00,000 | 30% | 4% of cess |

| Above INR 50,00,000 to 1 crore | 30% + 10% surcharge | 4% of cess |

| Above INR 1 crore | 30% +15% surcharge | 4% cess |

As per the amendments to Section 87(A), if your annual taxable income is lower than INR 5,00,000, you can avail the tax rebate. The existing laws made way for a 2,500 income tax rebate. However, the updated law ensured that the limit was increased to a 12,500 income tax rebate.

3. Senior Citizens (80 Years Old Or More )

| Income Range Per Annum | Tax Rate FY 24 - 25 | Health and Education Cess |

|---|---|---|

| Up to INR 2,50,000 | No tax | Nil |

| Up to INR 5,00,000 | No tax | Nil |

| Above INR 5,00,000 to 10,00,000 | 20% | 4% cess |

| Above INR 10,00,000 to 50,00,000 | 30% | 4% cess |

| Above INR 50,00,000 to 1 crore | 30% + 10% surcharge | 4% cess |

| Above INR 1 crore | 30% +15% surcharge | 4% cess |

4. Domestic Companies

| Turnover Particulars | Domestic Companies | Firms |

|---|---|---|

| Income Tax for turnover upto INR 400 crores | 25% | 30% |

| Income Tax for turnover above INR 400 crores | 30% | 30% |

| Cess | 3% + surcharge | 3% + surcharge |

| Surcharge | 7% if the income is more between INR 1 crore to 10 crore. And, income above INR 10 crore will be taxed 10% | 12% of tax if the total income exceeds INR 1 crore |

How to Calculate Income Tax from Income Tax Slabs?

For illustration purpose, let’s assume a total taxable income of INR 8,00,000, and this income has been calculated by including income from all sources such as salary, interest income, and rental income. Deductions under Section 80 have also been reduced.

Now, let us calculate income tax for FY 2017-18 (AY 2018-19)-

| Income Range Per Annum | Tax Rate | Tax Calculation |

|---|---|---|

| Income up to INR 2,50,000 | No tax | |

| Income from INR 2,50,000 – INR 5,00,000 | 5% (INR 5,00,000 – INR 2,50,000) | INR 12,500 |

| Income from INR 5,00,000 – 10,00,000 | 20% (INR 8,00,000 – INR 5,00,000) | INR 60,000 |

| Income more than INR 10,00,000 | 30% | nil |

| Tax | INR 72,500 | |

| Cess | 4% of INR 72,500 | INR 2,900 |

| Total tax in FY 2017-18 (AY 2018-19) | INR 75,400 |

Income Tax Slab & Rate for FY 2017-18 (AY 2018-19)

Here's the income tax slab rates FY 2018-19 for -

1. Individual Tax Payers & HUF (Less Than 60 Years Old)

| Income Tax Slabs | Tax Rate | Health and Education Cess |

|---|---|---|

| Income up to INR 2,50,000* | No tax | |

| Income from INR 2,50,000 – INR 5,00,000 | 5% | 3% of Income Tax |

| Income from INR 5,00,000 – INR 10,00,000 | 20% | 3% of Income Tax |

| Income more than INR 10,00,000 | 30% | 3% of Income Tax |

*Income tax exemption limit for FY 2017-18 is up to INR 2,50,000 for individual & HUF other than those covered in 2 or 3.

2. Senior Citizens (60 Years Old Or More but Less than 80 Years Old)

| Income Tax Slabs | Tax Rate | Health and Education Cess |

|---|---|---|

| Income up to INR 3,00,000* | No tax | |

| Income from INR 3,00,000 – INR 5,00,000 | 5% | 3% of Income Tax |

| Income from INR 5,00,000 – INR 10,00,000 | 20% | 3% of Income Tax |

| Income more than INR 10,00,000 | 30% | 3% of Income Tax |

*Income tax exemption limit for FY 2017-18 is up to INR 3,00,000 other than those covered in 1 or 3.

3. Senior Citizens (80 Years Old Or More)

| Income Tax Slabs | Tax Rate | Health and Education Cess |

|---|---|---|

| Income up to INR 5,00,000* | No tax | |

| Income from INR 5,00,000 – INR 10,00,000 | 20% | 3% of Income Tax |

| Income more than | INR 10,00,000 | 30% |

*Income tax exemption limit for FY 2017-18 is up to INR 5,00,000 other than those covered in 1 or 2.

4. Domestic Companies

| Turnover Particulars | Tax Rate |

|---|---|

| Gross turnover upto 50 Cr. in the previous year 2015-16 | 25% |

| Gross turnover exceeding 50 Cr. in the previous year 2015-16 | 30% |

*In addition, cess and surcharge are levied as follows: Cess: 3% of corporate tax Surcharge. Taxable income is more than 1 Cr but less than 10 Cr- 7%, Taxable income is more than 10 Cr- 12%

Income Tax Slab & Rate for FY 2016-17 (AY 2017-18)

Here's the income tax slab rates FY 2018-19 for

1. Individual Tax Payers & HUF (Less than 60 Years Old)

| Income Tax Slabs | Tax Rate |

|---|---|

| Income up to INR 2,50,000* | No tax |

| Income from INR 2,50,000 – INR 5,00,000 | 10% |

| Income from INR 5,00,000 – INR 10,00,000 | 20% |

| Income more than INR 10,00,000 | 30% |

*Income tax exemption limit for FY 2016-17 is up to INR 2,50,000 other than those covered in 1 or 2.

2. Senior Citizens (60 Years Old Or More but Less than 80 Years Old)

| Income Tax Slabs | Tax Rate |

|---|---|

| Income up to INR 3,00,000* | No tax |

| Income from INR 3,00,000 – INR 5,00,000 | 10% |

| Income from INR 5,00,000 – 10,00,000 | 20% |

| Income more than INR 10,00,000 | 30% |

*Income tax exemption limit for FY 2016-17 is up to INR 3,00,000 other than those covered in 1 or 3.

3. Senior Citizens (80 Years Old Or More)

| Income Tax Slabs | Tax Rate |

|---|---|

| Income up to Rs 5,00,000* No tax | |

| Income from Rs 5,00,000 – 10,00,000 20% | |

| Income more than Rs 10,00,000 30% |

Income tax exemption limit for FY 2016-17 is up to INR 5,00,000 other than those covered in 1 or 2.

4. Domestic Companies

| Turnover Particulars | Tax Rate |

|---|---|

| Gross turnover upto 5 Cr. in the previous year 2014-15 | 29% |

| Gross turnover exceeding 5 Cr. in the previous year 2014-15 | 30% |

In addition, cess and surcharge are levied as follows: Cess: 3% of corporate tax Surcharge. Taxable income is more than 1Cr but less than 10 Cr- 7%. Taxable income is more than 10Cr- 12%.

Comparing Indian Tax Rates with Other Countries

As per the report by KPMG-

'A country’s personal income tax rate is only one indicator of how much tax an individual actually ends up paying on their income.'

Effective Income Tax and Social Security Rates on USD100,000 of Gross Income

| Rank | Country | Effective income tax rate | Effective employee social security rate |

|---|---|---|---|

| 1 | Beligium | 33.9% | 13.1 |

| 2 | Greece | 30.0% | 16.5 |

| 3 | Croatia | 26.8% | 19.5% |

| 4 | Italy | 35.6% | 9.6% |

| 5 | Germany | 28.3% | 15.5% |

| 6 | Denmark | 42.1% | 0.2% |

| 7 | Curacao | 38.6% | 3.4% |

| 8 | France | 20.0% | 22.0% |

| 9 | Senegal | 42.0% | 0.0% |

| 10 | Sint Maarten | 37.4% | 3.1% |

| 11 | Luxembourg | 27.9% | 12.5% |

| 12 | Netherlands | 28.5% | 11.8% |

| 13 | Portugal | 28.9% | 11.0% |

| 14 | India | 27.3% | 12.0% |

Source- KPMG's Individual Income Tax and Social Security Rate Survey 2012, KPMG International

Source- KPMG's Individual Income Tax and Social Security Rate Survey 2012, KPMG International

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

GOOD KNOWLEDGE