e Filing of Income Tax – A Complete Guide to File Income Tax Return

There is no denying the fact that filing Income Tax Returns (ITR) can be quite a tedious task. On top of that, if you don’t acquire enough knowledge of this domain, you are left with no other choice than to seek help from a professional, right?

However, with the commencement of income tax e-filing, things may have become a bit easier for you. Apparently, it has become mandatory to file Income Tax Return online, except the senior citizens above 80 years of age. Having said that, it is necessary to understand the knows and hows of online filing for accurate results. In this article, you will know how to seamlessly File ITR online.

e-Filing of Income Tax Returns

Before you begin the procedure, here are a few things to keep in mind:

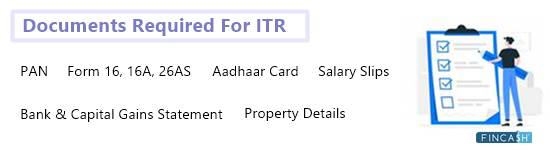

Ensuring proper documents

Before you sit for ITR e-filing, ensure that you have all the adequate documents in place. Basically, you would require salary slips, Form 16, Form 26AS, and interest certificates. If you don’t have your Form 26AS yet, you can easily download it from the government portal of TRACES. For this, login to your account, click on My Account and choose View Form 26AS. And from there, you can easily download the form.

Keeping these documents at an arm’s reach will surely help you calculate the gross taxable Income. Not just that, but this way, you will even have details of your tax deducted at source (TDS) from the income ready.

Calculation of total income

Once you are done with documents, the next step would be to calculate the total Earnings chargeable to tax for the financial year. This can be done by adding the earnings from five varied heads and claiming all of the deductions under the Income-tax Act. In case you have had losses, you can set them off too.

Not just that, but you would also have to arrange for the source-wise division of all the revenues that are taxable under the income from other sources head.

Talk to our investment specialist

Calculating tax liability

Next, you would also have to keep the Tax Liability in handy while applying for ITR online. You can calculate this as per the rates from your income tax slab.

Calculate payable tax

After that, you would have to compute the total amount that you have to pay as tax. For this, you would have to add interest payable under sections 234A, 234B, and 234C, if any.

How to eFile Tax Return- Steps to follow

Now that you have gone through the steps mentioned above, then would be the time to start the process for e-filing ITR. For that, follow the below-mentioned steps.

Step 1

To begin with, login to the Income Tax Department Portal. If you haven’t registered there yet, you can seamlessly do so with the help of your Permanent Account Number (PAN), which will be your user ID.

Step 2

Once you are logged into the portal, visit Download option and go to e-filing under the associative assessment year and choose the adequate Income Tax Return (ITR) form. If you are a salaried individual, you can download the ITR-1’s return preparation software.

Step 3

Next step would be to enter details in Form 16. For this, you can follow the simple instructions provided on the screen and enter the required information.

Step 4

Once you are done with the details, confirm the information that you have entered. Then, generate an XML file, and it will be saved on your system automatically.

Step 5

In case you are a non-salaried person, add tax payments that you have made already. Once done, visit Submit Return section and upload the XML file.

Step 6

When asked, sign the file digitally. However, you can even skip this step if you don’t have a digital signature.

Step 7

In case you see No Tax Due or Refund, click on proceed to e-filing. You will get your acknowledgement number through a message. An ITR-verification will be generated that you can download. It will even be emailed to the ID that you have registered.

Step 8

Once it is filed, you can e-verify your tax return through different methods, such as Bank ATM, netbanking, bank account number, Aadhaar OPT, registered mobile number & e-mail ID, and Demat account number.

E-verifying the returns remove the stress to courier the physical copy of the ITR-5 acknowledgement to the headquarters.

Conclusion

With ITR filing online, things have become quite easier for people. So, now that you are aware of How to File ITR, ensure you do that without Fail.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

IT'S VERY MUCH USEFUL TO ALL THOSE WHO ARE FILING THEIR ITR AS AN INDIVIDUAL WITHOUT ANY ASSISTANCE OF ANY AUDITOR OR CHARTERED ACCOUNTANTS, THIS MAY PLEASE BE UPDATED TIME-TO-TIME AS PER THE DEPARTMENT OF THE INCOME TAX AND THE C.B.D.A, THANKS

Detailed information liked the content and easy explanation. Thank you

It appears all the glitches have been sorted out. Can I now upload ITR 2 ?