Table of Contents

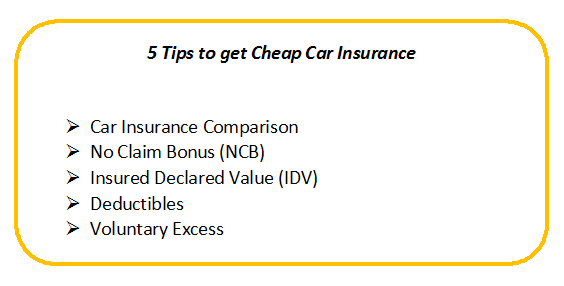

5 Ways to Get Cheap Car Insurance

Whether you are buying car insurance or a separate third-party insurance policy, the thought of cheap car insurance is enticing. Buying a cost-effective policy is not a difficult task, when you know the right features to reduce the premium. Hence, one needs to understand the basic features – No Claim Bonus, Insured Declared Value, Deductibles, Voluntary Excess – and by doing so, the scope of saving money on a Motor Insurance policy.

Top 5 Tips to Buy Cheap Auto Insurance

1. Car Insurance Comparison

Comparing Car Insurance Online is an effective way to get a cheap car insurance policy. While doing an Auto Insurance comparison, you need to consider the amount you are willing to pay as premium, with respect to the adequate coverage being offered. Depending on your car model, date of Manufacturing and engine type, i.e. Petrol, diesel or CNG, you need to understand what covers are required for your car. Today, you can obtain quotes online from multiple Insurance companies to compare premiums and features to take a concerted decision on which policy to opt for.

Doing an effective car insurance comparison will not only help you in getting a cheap car insurance policy but will also help you to find a quality plan from the top insurers.

2. No Claim Bonus (NCB)

No claim bonus is a feature which is not to be missed for getting a cheap car insurance policy. No claim bonus is a discount, given by an insurer to the insured for making no claim during the policy term. You can generally gain 20 to 50 percent of no claim bonus every year for not making a claim. NCB is offered to customers even if they change their vehicle, as no claim bonus can be transferred to the new vehicle when purchased.

3. Insured Declared Value (IDV)

Insured Declared Value or IDV is the Market value of your vehicle. If your vehicle is stolen or suffers a total loss ( a loss beyond repair), it is deemed as a ‘complete loss’ of the vehicle. In such a case, the insurer will pay you the sum insured, that is the Insured Declared Value of the vehicle, as calculated by the Depreciation formula of IDV.

For a cheap car insurance policy, it is advisable to get Insured Declared Value which is near to the cost of the market value of the car. Insurers provide with a Range of 5-10 percent to decrease IDV which could be chosen by the insured. Less IDV attracts less premium. However, in most cases, there are set formulas for this.

4. Deductibles

A Deductible is a value which you are willing to pay in case of an accident or collision. There are two types of deductibles- voluntary and mandatory. A voluntary deductible is an amount one is willing to pay to reduce the insurance premium. A mandatory deductible is a mandatory contribution when a claim arrives. Therefore, you can reduce the insurance premium by increasing the voluntary deductibles.

Talk to our investment specialist

5. Voluntary Excess

Voluntary Excess is a deductible amount which the insured agrees to pay at the time of claiming for the loss or damage. The rest of the amount is paid by the insurer. Opting for higher Voluntary Excess may give you a higher discount on car insurance premium, which is an ideal way to get a cheap car insurance policy.

Factors Deciding the Cost of Car Insurance

There is no standard list of insurers Offering cheap car insurance because the premium differs as per your car and its model.

1. Make & Model

Your vehicle's manufacturer, cubic capacity of the engine, model, speed, variant, etc., are important factors that determine the premium of car insurance. These factors also decide how a car performs and how likely it is to break down, which again is an essential parameter in calculating the premiums.

2. Age

The age of your car is one of the important deciding factors on how much premium you have to pay. The more the age of the vehicle, the more will be the premium price and vice versa. A new car will have a higher IDV (Insured Declared Value) and therefore a higher premium. This means it will cost less to insure an old car and more to insure a new vehicle.

3. Location

Another Factor that decides the car insurance premium is the geographic location of the RTO at which the car is registered. Insuring a vehicle in a metro city is going to cost more than in a tier 3 city for a reason that the car is more prone to damage in urban areas.

4. Add-ons

Including Add-ons such as gear lock, Handle lock, zero depreciation, passenger cover, GPS tracking device, etc. will increase the premium amount. Thus, it is advised to go for only those Add-ons that you feel are absolutely necessary.

5. No Claim Bonus

No claim bonus (NCB) is a discount that the company provides you with if you have made no claims in that particular year. Over time, this can accumulate and reduce your annual premium by up to 50%. So, next time when you renew the policy bring it to the attention of your insurer.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.