Table of Contents

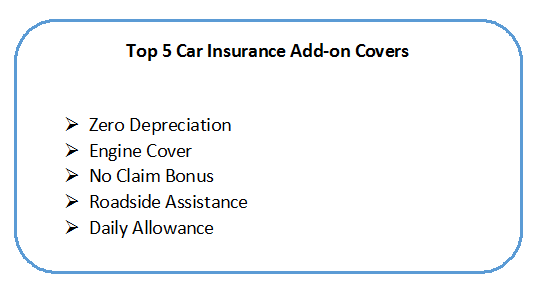

Top 5 Car Insurance Addon Covers

What are car insurance addon covers? An add-on, as the name refers, is an additional benefit added to the existing Motor Insurance policy. A right add-on covers not only strengthen your policy but gives overall protection to your vehicle. There are various types of car insurance addon covers such as Zero Depreciation, Engine Cover, No Claim Bonus, Roadside Assistance, etc., you can select according to your needs and requirements.

List of Smart Car Insurance Addon Covers

1. Zero Depreciation

Zero depreciation is one of the most popular and widely preferred car insurance addon covers by consumers. Under a zero depreciation add-on, it is made sure that the insured receives a full claim amount on the damage parts of a vehicle that are replaced after an accident. As per standard car insurance policies, only the depreciated value of vehicle's part is reimbursable and not the replacement value. However, at the time of buying a motor insurance plan, if you include a zero depreciation cover in your plan, you would get a full claim amount.

2. Engine Cover

As the name suggests, this is one of the types of car insurance addon covers that safeguards vehicle's engine and electronic circuits, especially during monsoons and at the time of flooding. Hydrostatic lock or constantly trying to run a moist engine can cause failure of the engine. Since, such damage is not a part of a car insurance policy, opting for an extra engine cover add-on is a wise way to ignore a huge cost of repairs.

3. No Claim Bonus (NCB)

No claim bonus(NCB) is a discount, given by an insurer to the insured for making no claim during the policy term. You can generally gain 20 to 50 percent of no claim bonus every year for not making a claim. NCB is offered to customers even if they change their vehicle, as no claim bonus can be transferred to the new vehicle when purchased.

The benefit under this cover may not be available if the insured makes more than one damage claim or total loss claim. Many companies don’t offer No Claim Bonus add-on cover for vehicles that are older than three years.

4. Roadside Assistance

Roadside assistance is one of the types of car insurance addon covers that enables basic services in case of an emergency while driving through a remote location. Roadside emergencies like the breakdown of a car, Flat tyres, battery issues, fuel requirements, minor repairs, etc., are covered under this add-on policy. This cover helps you get roadside assistance irrespective of location.

Talk to our investment specialist

5. Daily Allowance

Daily allowance coverage compensates you for the cost of hiring an alternative vehicle if your car is in the garage or is stolen. The number of days for which the allowance is handed out can Range from 10-15 days. The amount can mainly depend on the car model, but it may typically range from INR 100-500 per day.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.