Table of Contents

- Savings calculator for buying a new house

- Savings calculator for buying a new car

- Calculator for planning your savings for higher education

- Planning investment for marriage expense

- Financial calculator for other goal

- Understanding financial goal calculator

- How does financial goal calculator work?

- Conclusion

Financial Goal Calculator: A Smart Tool for Various Investments Goals

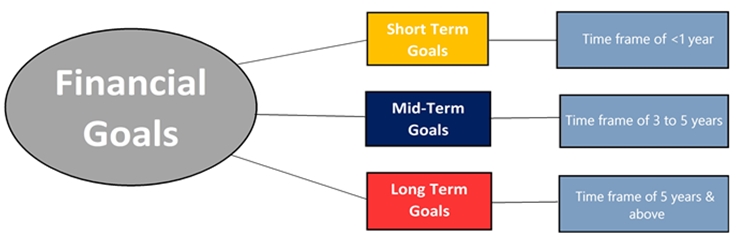

Financial Goal calculator is a smart tool that helps people to understand the amount to be saved for attaining their objectives. People do financial planning to achieve numerous objectives in their life such as purchasing a house, purchasing a vehicle, planning for higher education and so on. The financial calculator helps people to assess their present savings amount to attain their future objectives. So, let us look at the various financial goal calculators and their explanation accordingly.

Savings calculator for buying a new house

House is an important thing which people need to live. However, to purchase a house it is always important to have the right amount of savings. Though many people buy a house on EMIs however; the payout on purchasing the house on EMIs is much higher which is almost double the investment amount. So, let us see how you can plan to purchase a house with the help of the savings calculator.

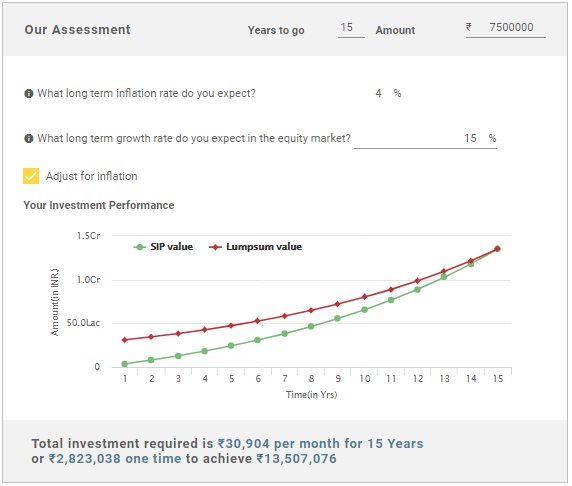

Illustration

Investment Tenure to Buy a House 15 Years

Money Required to buy a house: INR 75,00,000

Expected Long-term Growth Rate: 15%

Expected Long-term Inflation Rate: 4%

From the above image, it can be said that one needs to save INR 30,904 monthly to attain the objective of purchasing the house at the end of 20th year. If we see the image, the end value changes it's because of the inflation effect that reduces the value of money over a period of time. Therefore, people need to save more in order to match their objectives at the end of the tenure.

Know Your Monthly SIP Amount

Talk to our investment specialist

Savings calculator for buying a new car

People can also use a savings goal calculator to purchase a car. In many instances, people purchase cars on EMI. However, through proper savings people can ensure that they can purchase a car without EMI. The savings goal calculator to buy a car helps people to identify the amount required to save for purchasing a car. The input data for this calculator includes tenure of investment, the total amount to purchase the car, expected long-term growth rate and expected long-term inflation rate. So, let us understand with an illustration how the calculator looks.

Illustration

Investment Tenure to Buy a car 5 Years

Money Required to buy a house: INR 6,00,000

Expected Long-term Growth Rate: 15%

Expected Long-term Inflation Rate: 4%

From the above calculations you need to save INR 9,227 monthly to purchase a car after five years. In this situation also, we have considered the inflation-adjusted returns because the value of money decreases with the passage of time.

Calculator for planning your savings for higher education

People can even use the calculator as a tool to plan for higher education. In today’s world, higher education costs a lot of money. However, with proper planning, you can wisely accumulate money for higher education. So, let us see through an illustration how the calculator works.

Illustration

Investment Tenure to Buy a House 3 Years

Money Required to buy a house: INR 5,00,000

Expected Long-term Growth Rate: 15%

Expected Long-term Inflation Rate: 4%

The calculations show that you need to save INR 13,834 per month to attain your objective after 3 years. You can save the amount accordingly in the required financial avenue to attain your objectives within the mentioned period.

Know Your Monthly SIP Amount

Planning investment for marriage expense

Marriage is an important event in every individual’s life. However, as we know that nothing is available for free, people spend a considerable portion of money for their marriage. With the help of a proper planning and investment, you can accumulate money for the marriage purpose. So, let us see how the marriage expense calculator works with the help of an illustration where an individual is planning to save money for his/her child’s marriage.

Illustration

Years left for Marriage 20 Years

Money Required for marriage: INR 20,00,000

Expected Long-term Growth Rate: 15%

Expected Long-term Inflation Rate: 4%

One needs to save INR 5,373 per month to save money for the marriage. Here again, the adjust for inflation option is selected to get the inflation-adjusted amount.

Know Your Monthly SIP Amount

Financial calculator for other goal

Other than the above-mentioned goal, people do plan for various other goals. For this purpose, they can use the Other Goals calculator that helps them to check the amount to be invested the for attaining such goals. Let us see how the other goal calculator works with the help of an illustration assuming you want to buy a motorcycle worth INR 1,50,000 after two years.

Illustration

Tenure to Attain the Goal 2 Years

Money Required to Attain the Goal: INR 1,50,000

Expected Long-term Growth Rate: 15%

Expected Long-term Inflation Rate: 4%

Know Your Monthly SIP Amount

Therefore, you need to save INR 6,053 per month to attain the goal of purchasing a motorcycle after two years. In this situation too, the adjust for inflation option is selected.

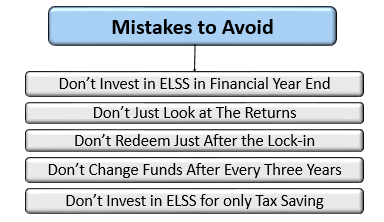

Understanding financial goal calculator

People who are new to investments do get confused about how to use the calculators. To overcome this problem, we have elaborated the steps on how to use the calculator which are listed below.

For most of the calculators, the input data required is the same. Before using the calculator, you need the following input variables:

- The desired investment tenure

- The estimated amount to purchase the house

- Expected long-term growth rate on the investments

- Expected long-term inflation rate

Once you enter all the input data, you get the estimated amount to be saved either monthly or through lumpsum. If you select the box Adjust for Inflation then you will get the inflation-adjusted amount or else, you will get the actual amount.

How does financial goal calculator work?

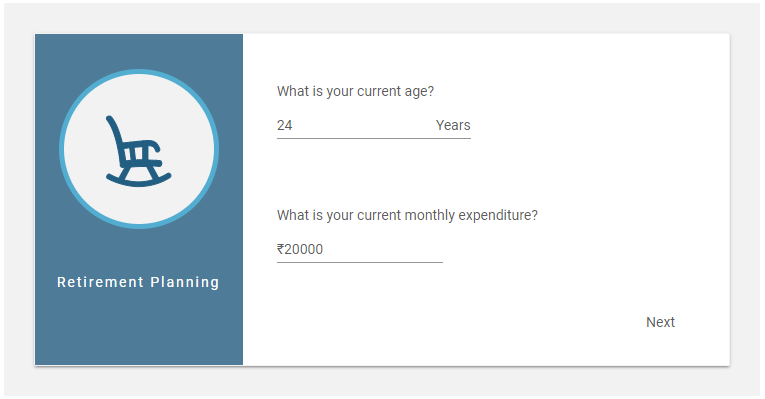

The steps that need to be followed for the calculator are similar in most of them. So, let us understand the questions that need to be answered while using the calculator.

1. Tenure and amount of investment

The first question in this calculator is related to the tenure and amount of investment. Here, you need to mention the investment tenure post which you are planning to buy a house. After entering the tenure, then enter the total amount required to purchase the house. After entering both the details, you need to click the Next button.

2. Expected long-term growth rate

The second question is related to the expected long-term growth rate in the equity Market. Against this question, you need to enter the expected long-term growth rate in the equity market. Once you enter the growth rate, you need to click on the

Next Button again.

3. Enter inflation rate & check your assessment

This is the last step in the process where once you click on the next button in the previous stage, the assessment screen opens. In this screen, you need to enter the inflation rate and select the Adjust for Inflation option to get the

4. Inflation-adjusted returns

Once you select this option, you can find the inflation-adjusted amount. If you do not select the inflation option, then you will get the normal amount.

Conclusion

You can use the calculators to plan your Financial goals and Investment plan as per your requirements. However, one should understand that these calculators may or may not give the exact results. Therefore, investors before Investing in any scheme should go through its modalities completely. Also, they can consult a financial advisor if required to ensure that their money is safe and earns required returns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.