How To Invest In ELSS (Equity Linked Savings Scheme) ?

How to invest in ELSS? ELSS or Equity Linked Savings Scheme is one of the popular Tax Saving Investment options in India. As the financial year comes to an end, investors invest in tax saving options like ELSS. But before Investing in ELSS funds, investors must know how to invest in ELSS funds the best way. Typically, your ELSS investment should be a mix of the funds that offer good returns and the funds that help in tax saving. Investors can invest in ELSS and avail tax deductions upto INR 1,50,000 under Section 80C of the income tax Act.

Talk to our investment specialist

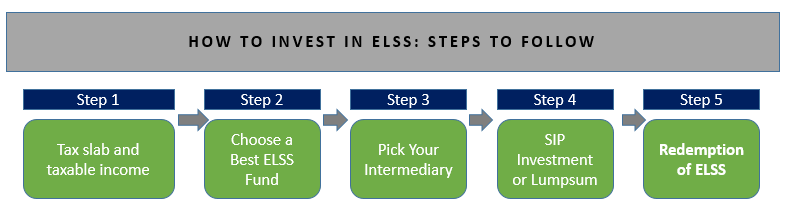

Steps To Follow While Investing in ELSS Funds

Let’s analyse the steps to invest in ELSS

1. Determine Your Tax Slab & Your Taxable Income

The foremost step of investing in ELSS is analysing your tax slab and the taxable Income so that you can utilise your ELSS investment to the fullest by saving the maximum Taxable Income. Even investors under the maximum tax bracket i.e. of 30% can save upto INR 45,000 on their taxable income by investing in ELSS. Therefore, one must know their exact taxable income and then decide how much to invest accordingly. The tax slab and the related tax percentage liable for the taxpayers is mentioned below. Analyse and invest wisely.

Tax Saving by Investing in ELSS (FY 2017-18)

| Income Tax Slab (INR) | Tax Rate | Max Tax Savings (INR) |

|---|---|---|

| 0 to 2,50,000 | No Tax | 0 |

| 2,50,001 to 5,00,000 | 5% | 0 - 7,500 |

| 5,00,001 to 10,00,000 | 20% | 7,500 - 30,000 |

| Above 10,00,000 | 30% | 30,000 - 45, 000 |

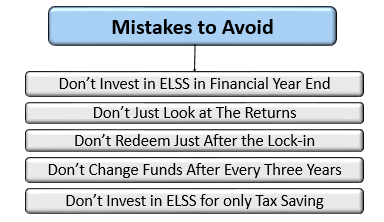

2. Pick A Best ELSS Fund

The most important part of investing in ELSS is choosing the best ELSS fund as per your needs. Though ELSS scheme is a tax saving investment, one should not look for only the tax saving Factor of these funds. This can be a loss for investors as the ELSS schemes that are tax efficient might not offer good returns. So, it is suggested to choose a fund that fulfils both the parameters, offers good returns and saves tax both.

Top 5 best performing ELSS Mutual Funds 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Tax Saver Fund Growth ₹1,459.84

↑ 7.83 ₹17,194 2.1 4.7 7.2 20.4 22.5 21.3 SBI Magnum Tax Gain Fund Growth ₹449.182

↑ 3.07 ₹31,783 2.6 3.1 2 22.5 22.3 27.7 Motilal Oswal Long Term Equity Fund Growth ₹50.0255

↑ 0.48 ₹4,515 -4.2 -2.8 -11.5 21.1 20.7 47.7 DSP Tax Saver Fund Growth ₹144.22

↑ 0.87 ₹17,241 3.9 3.7 3.1 18.9 20.1 23.9 Bandhan Tax Advantage (ELSS) Fund Growth ₹158.089

↑ 1.02 ₹7,215 3.5 4.8 3.7 15.1 19.9 13.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 12 Dec 25 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Tax Saver Fund SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund DSP Tax Saver Fund Bandhan Tax Advantage (ELSS) Fund Point 1 Lower mid AUM (₹17,194 Cr). Highest AUM (₹31,783 Cr). Bottom quartile AUM (₹4,515 Cr). Upper mid AUM (₹17,241 Cr). Bottom quartile AUM (₹7,215 Cr). Point 2 Oldest track record among peers (29 yrs). Established history (18+ yrs). Established history (10+ yrs). Established history (18+ yrs). Established history (16+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Not Rated. Rating: 4★ (upper mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 22.52% (top quartile). 5Y return: 22.30% (upper mid). 5Y return: 20.65% (lower mid). 5Y return: 20.10% (bottom quartile). 5Y return: 19.90% (bottom quartile). Point 6 3Y return: 20.37% (lower mid). 3Y return: 22.46% (top quartile). 3Y return: 21.12% (upper mid). 3Y return: 18.95% (bottom quartile). 3Y return: 15.05% (bottom quartile). Point 7 1Y return: 7.25% (top quartile). 1Y return: 2.03% (bottom quartile). 1Y return: -11.52% (bottom quartile). 1Y return: 3.14% (lower mid). 1Y return: 3.69% (upper mid). Point 8 Alpha: 2.58 (top quartile). Alpha: -2.21 (lower mid). Alpha: -2.71 (bottom quartile). Alpha: -2.28 (bottom quartile). Alpha: -1.66 (upper mid). Point 9 Sharpe: 0.25 (top quartile). Sharpe: -0.18 (bottom quartile). Sharpe: -0.08 (upper mid). Sharpe: -0.15 (bottom quartile). Sharpe: -0.14 (lower mid). Point 10 Information ratio: 1.38 (upper mid). Information ratio: 1.86 (top quartile). Information ratio: 0.75 (bottom quartile). Information ratio: 0.80 (lower mid). Information ratio: -0.27 (bottom quartile). HDFC Tax Saver Fund

SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

DSP Tax Saver Fund

Bandhan Tax Advantage (ELSS) Fund

ELSS funds based on Asserts >= 200 Crore & Sorted on 5 Year CAGR Return.

3. Choose Your Intermediary

Once you select a best tax saver fund (ELSS), you should choose an intermediary through which you want to make a Mutual Fund investment. Though investors can directly invest through Mutual Fund companies, opting for an intermediary is considered a better option. The different options of investing in ELSS funds include-

ELSS Investment through Mutual Fund distributor Mutual Fund distributors are easily available to help you do the paperwork for investing in ELSS funds. They make the investing procedure easy and do not charge any fees as well. They earn commission from Mutual Fund companies for this. It is advised to choose an ELSS fund to invest and then go to a mutual fund distributor rather going to them directly.

ELSS Investment through Online Distributor There are various online share trading distributors that help you invest in ELSS funds and manage your investments as well. There are various independent online Mutual Fund distributors that enable the ease of online investment without any extra charges. Through online distributors, tracking the performance of your ELSS funds is much easy.

4. SIP Investment Or Lumpsum Investment

This is an essential step in planning your ELSS investment. The investors often remain confused in between these two investing options. But, it is suggested to choose an option that suits you the best. Some might find it suitable to invest in ELSS via SIP and some might find lump sum investment a better option. However, SIP is considered to be a more preferred option for investors, as it is systematic and disciplined.

5. Redemption Of ELSS Mutual Funds

The ELSS Mutual Funds have a lock-in period of three years. So, any investment made in ELSS Funds will be locked for three years and the investors can redeem their units only after the lock-in is over. The investment procedure is easy. The investor simply needs to fill a small ELSS Redemption form and the money will be redeemed to your account within next three days.

So, what are you waiting for? Invest in ELSS funds via SIP today! Save tax and grow money hand-in-hand.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.