Table of Contents

Fiscal Multiplier

According to the Fiscal Multiplier definition, it is responsible for measuring the overall effect of increased fiscal spending on the GDP or economic output of the country.

As per the economists, Fiscal Multiplier is defined as the ratio of some change in the overall output to the respective change in government spending or tax revenue.

Fiscal Multiplier examples turn out to be useful as they can help in guiding the policies of the government in case of economic crisis. Moreover, it also helps in setting the stage for ensuring Economic Recovery.

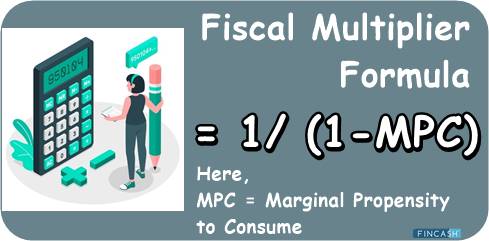

Fiscal Multiplier Formula

Fiscal Multiplier can also be calculated as:

Fiscal Multiplier = 1/ (1-MPC)

Here,

MPC = Marginal Propensity to Consume

You come across two important variants of fiscal multipliers:

- Revenue multiplier,

- Expenditure multiplier

Revenue Multiplier

It is used for measuring the respective change in the output for every amount of increase in the revenues obtained by the government. It is measured as:

Revenue Multiplier = ΔY/ΔT

Here,

- Delta Y = Change in the output

- Delta T = Changes in the government revenue or Taxes

Talk to our investment specialist

Expenditure Multiplier

It is used for measuring the respective change in output for the amount spent by the government. It is measured as:

Expenditure Multiplier = ΔY/ ΔG

Here,

- Delta Y =Change in the output

- Delta G =Change in government spending

Fiscal Multiplier Example

Let us assume that the central government features a fiscal stimulus of around INR 1 crore. Assume the MPC of consumers to be 0.75. Consumers receiving the initial INR 1 Crore will be saving around INR 250 Lakh while spending INR 750 Lakh. This, in turn, initiates another, yet small stimulus. The recipients of INR 750 Lakh will be receiving INR 562.5 Lakh, and so more.

The overall change in the total national Income refers to the initial increase in autonomous or government spending multiplied by the fiscal multiplier. As the MPC value is 0.75 in the given case, the fiscal multiplier turns out to be 4. As per the Fiscal Multiplier Keynesian Theory, it predicts the total increase in the national income to be around INR 4 Crore due to the initial INR 1 Crore fiscal stimulus.

Factors Affecting Fiscal Multiplier

The higher control the government has on the given Economy, the higher is the value for the fiscal multiplier. Here are some factors:

Debt Level

Higher levels of debts can reduce the fiscal multiplier’s impact. This is because any fiscal stimulus can service debt before using the same for productive activities. Therefore, the output will increase by some smaller amount. This implies reduced fiscal multiplier.

Exchange Rate Regime

A highly flexible regime for interest rate can lead to a smaller value for the multiplier.

There are also several more factors like openness of the trade, structural grounds, and business cycle for you to consider.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.