Table of Contents

What is Marginal Propensity to Consume (MPC)?

Induced consumption refers to the state where the consumer’s spending increases with the increase in their disposable Income. Now, the proportion of this revenue when an individual spends on the consumption requirements is called the propensity to consume. The marginal propensity to consume can be defined as the additional revenue that the individual spends on consumption.

For instance, if a person earns the extra INR 50 of the disposable income and the MPC is INR 30, then the person will spend extra 30 bucks on consumption and save the rest 20 bucks. Of course, the person cannot spend more than INR 50 on the consumption unless they take a loan.

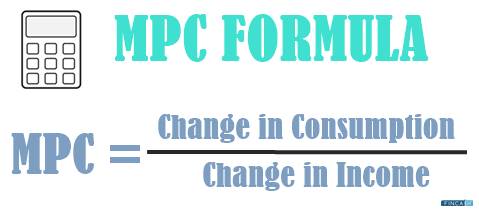

MPC Formula

Mathematically,

Marginal Propensity to Consume = Change in Consumption / Change in Income

MPC is also described as the extra raise in your income that you spend on the consumption requirements rather than saving this money. It is considered one of the most crucial concepts of Macroeconomics. The two main factors used to determine the MPC are - change in your income and change in your consumption habits.

Let’s understand the concept with a simple example.

Examples of Marginal Propensity to Consume and Save

Let’s say you get a bonus of INR 3000 apart from your regular monthly income. Now, you have an additional 3000 bucks in your income. Suppose you decide to spend INR 2000 on the latest dress and save the remaining INR 1000. The marginal propensity to consume will be calculated by dividing the amount you spend on consumption, i.e. INR 2000 by the extra income you earned, i.e. INR 3000.

There is also the Marginal Propensity to Save, which is another important concept of macroeconomics. As the name suggests, this helps you determine the additional amount from the pay raise you decided to save rather than spending on consumption. It is mainly used to find the changes in your savings when the income level increases.

If we consider the above example, then the marginal propensity to save will be calculated by dividing the additional amount you save from the pay raise, i.e. INR 1000 by the amount you received as the bonus, i.e. INR 3000. Note that your marginal propensity to save can be brought to zero if you save the entire amount, i.e. INR 3000.

Talk to our investment specialist

How Economists Calculate Marginal Propensity to Consume?

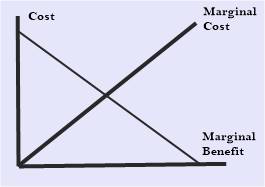

With the income and consumption expenditure of a family given, economists can find out the marginal propensity to consume using the income level. It is important to note that MPC is rarely stable. It fluctuates depending on the income you earn every month and your consumption habits.

Even people who have a stable income, i.e. a fixed salary for a month can have a fluctuating marginal propensity to consume rate. That’s because your consumption spending may vary. Basically, the higher the revenues you generate every month, the lesser the MPC gets. With the increase in your income, your wants will automatically be satisfied. That will encourage you to save rather than spending more.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.