+91-22-48913909

+91-22-48913909

Table of Contents

What are Liquid Funds?

Liquid funds are typically debt mutual fund that invest your money in liquid assets (very short-term Market instruments) for short periods of time (ranging from a couple of days to a few weeks). They have high liquidity, that means, one can quickly convert the assets invested in (to yield some returns) to cash. The residual maturity of liquid Mutual Funds is less than or equal to 91 days.

Further, the liquid fund returns are less volatile as they invest in short-term investment instruments like commercial papers, certificates of deposit, treasury bills etc. Liquid funds are one of the best mutual funds to invest your idle money to earn good returns in a shorter duration.

Top 10 Liquid Mutual Funds 2025 - 2026

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity BOI AXA Liquid Fund Growth ₹2,966.67

↑ 0.50 ₹1,741 0.7 1.9 3.7 7.4 7.4 6.98% 1M 20D 1M 20D Axis Liquid Fund Growth ₹2,868.74

↑ 0.48 ₹42,867 0.8 1.9 3.7 7.3 7.4 7.17% 1M 9D 1M 9D Canara Robeco Liquid Growth ₹3,101.41

↑ 0.52 ₹5,294 0.8 1.9 3.7 7.3 7.4 7.03% 29D 1M 1D DSP BlackRock Liquidity Fund Growth ₹3,678.25

↑ 0.62 ₹22,387 0.7 1.9 3.6 7.3 7.4 0.12% 1M 10D 1M 17D Invesco India Liquid Fund Growth ₹3,541.33

↑ 0.59 ₹14,276 0.8 1.9 3.6 7.3 7.4 7.12% 1M 14D 1M 14D Aditya Birla Sun Life Liquid Fund Growth ₹415.19

↑ 0.07 ₹57,091 0.8 1.9 3.6 7.3 7.3 7.33% 1M 13D 1M 13D UTI Liquid Cash Plan Growth ₹4,227

↑ 0.71 ₹24,805 0.8 1.9 3.6 7.3 7.3 7.23% 1M 8D 1M 8D Mirae Asset Cash Management Fund Growth ₹2,700.92

↑ 0.45 ₹12,731 0.7 1.9 3.6 7.3 7.3 7.11% 1M 13D Edelweiss Liquid Fund Growth ₹3,294.37

↑ 0.55 ₹7,270 0.7 1.9 3.6 7.3 7.3 7.17% 1M 18D 1M 18D Mahindra Liquid Fund Growth ₹1,676.48

↑ 0.28 ₹1,324 0.7 1.9 3.6 7.3 7.4 7.27% 1M 13D 1M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Apr 25 Liquid funds having AUM/Net Assets above 1000 Crore. Sorted on Last 1 Year Return.

Why Should you Invest in Liquid Funds?

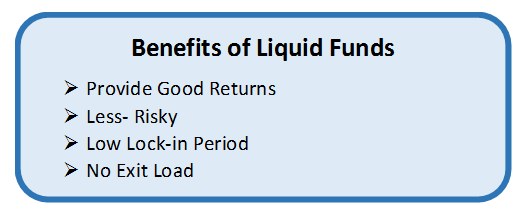

Generally, liquid funds offer various benefits. Some of the major ones are listed below.

Liquid Fund Returns are Good

Being invested for a short duration, these funds are one of the best investment instruments to avail high Inflation benefits. Typically, during high inflation period, RBI keeps the rate of inflation high and reduces liquidity. This helps the liquid funds to earn good returns.

Liquid Investments are Less Risky

The maturity of liquid investments is 91 days, so it is very less risky. Also, some of the portfolios of these investments have a very low maturity, sometimes as low as six or eight days. So, being a short-term investment, these funds are not traded in the market but are Held-to-Maturity by the fund.

Talk to our investment specialist

No Lock-in Period of Liquid Mutual Funds is Low

The liquid mutual funds have no lock-in period, which means that you can withdraw your money anytime you want. Once you request for withdrawal, the money can be received within 24 hours.

Liquid Funds Taxation

Though liquid funds returns might seem tax-free in the hands of investors, an additional Dividend Distribution Tax (DDT) is paid by the Fund House. So, the returns are not totally tax-free.

Convenience of Selecting Best Liquid Funds

There are various Investing options available to invest in liquid mutual funds. These include growth plans, monthly dividend plans, weekly dividend plans and daily dividend plans. Therefore, the investors have an option to choose a plan according to their convenience and liquidity needs.

No Exit Load Offered By Liquid Funds

Lastly, there are no entry and exit loads applicable on liquid funds.

Conclusion

When planning to invest idle money to earn better returns liquid funds are a good option. Generally, anyone having idle cash in their Savings Account must have thought of investing it somewhere to make more money out of it. But the desire of having our money available whenever we need it retains us from making such investments. If you are struggling with the same problem, we have a solution for you. Invest in liquid mutual funds and let your money grow to save better!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.