Table of Contents

Liquid Assets: Overview & Benefits

Liquid assets are assets that can be easily converted into cash with minimum impact on the asset’s value. Liquid assets keep your money accessible anytime you want. An asset is only considered liquid when it is in an established Market and there are lots of interested buyers so that the asset does not get easily changed or manipulated. Also, the investors must have the ability to transfer the ownership of these assets easily.

Liquid Assets Benefits

Keep Cash Handy

The most significant benefit of Liquid Assets is that they keep your cash available whenever you need them. Emergencies come uninformed. The investors are often advised to maintain some assets in their Portfolio so that they can have an easy hand on their money at the time of unforeseen emergencies.

Investing Benefits

Holding Liquid Assets, like Money market funds, is highly beneficial for your investment portfolio. Not only these assets keep your money available for emergencies, but one can use them for further investments as well. At any time, you can utilise your asset to make new investments without selling any other investments.

Less Risky

Another advantage of these assets is that they are comparatively less risky than assets that are not liquid. During the times of market emergency, these assets can be sold swiftly and at a full value, unlike Non-Liquid Assets. Also, some of these assets, like the Savings Account, keep your money safe at the time of financial crisis as they are insured up to a certain amount by the federal government. Unlike Illiquid assets like Real Estate that may not be sold at the time of emergency or may be sold at a considerable discount to true value. So, with these assets, there is a very little chance of losing value.

Talk to our investment specialist

Improves Financial Profile

Finally, with Liquid Assets in a portfolio, the chances of loan approval increases. It shows your discipline to keep your money safe and ensures that you will make regular payments.

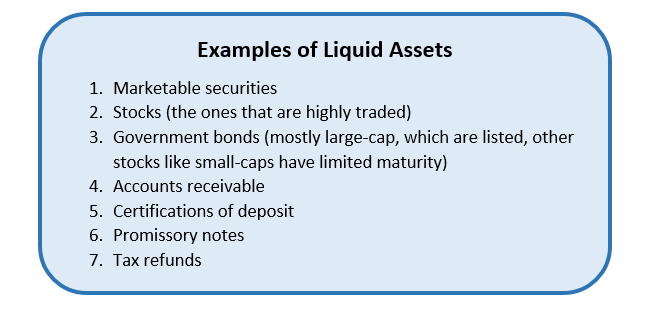

Examples of Liquid Assets

The most common types of Liquid Assets owned by investors include cash and savings account. But, there are some other assets that are considered to be liquid as they are established in the market and can be transferred between owners easily. These include-

Therefore, the investors are advised to maintain some Liquid Assets in their portfolio. Invest in the above-mentioned assets and have your cash available with least effort. Additionally, earn better returns on these assets as well. Invest now or regret later!

Best Money Market Funds for Liquid Assets

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Money Manager Fund Growth ₹365.687

↑ 0.07 ₹25,581 2.3 4.1 8 7.2 6.2 7.8 UTI Money Market Fund Growth ₹3,047.8

↑ 0.69 ₹16,265 2.4 4.2 8 7.2 6.1 7.7 ICICI Prudential Money Market Fund Growth ₹375.096

↑ 0.08 ₹24,184 2.4 4.2 8 7.2 6.1 7.7 Kotak Money Market Scheme Growth ₹4,439.08

↑ 0.93 ₹25,008 2.4 4.1 8 7.1 6 7.7 L&T Money Market Fund Growth ₹26.0922

↑ 0.01 ₹2,536 2.3 4.1 7.8 6.7 5.4 7.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.