Table of Contents

Loans for Women- A Complete Guide

In order to help women grow and empower them, the Government of India has been introducing various financial schemes for women. One of the biggest boons towards empowering women financially is the introduction of women-centric loan schemes. Business loans, home loans and Marriage Loans are some of the key sectors the government initiated both in the public and the private sector banks to undertake.

Some of the major personal loan categories for women are:

- Business loan

- Marriage loan

- Home Loan

1. Business Loan

The Micro, Small and Medium Enterprises (MSME) ecosystem in India has seen exponential growth in the past years. But the number of male and female entrepreneurs is yet to tally. According to a recent survey, 13.76% of the entrepreneurs in India are women. The survey states said that about 8 million of the population were businesswomen, whereas the number of male entrepreneurs crossed 50 million.

However, the central and state governments have played their part in helping women access financial help to start their businesses. The main ones are listed below:

Women Scheme and Loan Amount

| Scheme | Loan Amount |

|---|---|

| Mudra Yojana Scheme | Rs. 50,000- Rs. 50 lakhs |

| Mahila Udyam Nidhi Scheme | Up to Rs. 10 lakhs |

| Stree Shakti Package | Rs. 50,000 to Rs. 25 lakhs |

| Dena Shakti Scheme | Up to Rs. 20 lakhs |

| Bharatiya Mahila Business Bank Loan | Up to Rs. 20 crore |

| Annapurna Scheme | Up to Rs. 50,000 |

| Cent Kalyani Scheme | Up to Rs. 1 crore |

| Udyogini Scheme | Up to Rs. 1 lakh |

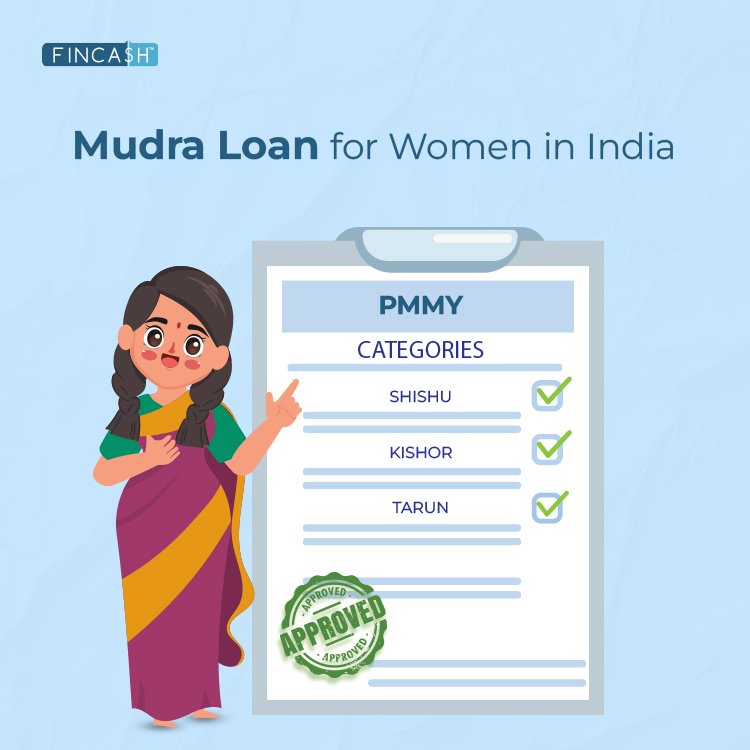

a. Mudra Yojana Scheme

Mudra Yojana Scheme is tailored to help women who want to begin a small enterprise like a tuition centre, tailoring centre, beauty parlour, etc. Women can access loans worth Rs. 50,000 to Rs. 50 lakhs. However, for loans above Rs. 10 lakhs, Collateral or guarantors are a must.

Mudra Yojana Scheme comes with three plans:

- Shishu Plan for start-ups (loans up to Rs. 50,000)

- Kishor Plan for well-established enterprises (loans between Rs. 50,000 and 5 lakhs)

- Tarun Plan for business expansion (between Rs. 5 lakhs and Rs. 10 lakhs)

Talk to our investment specialist

b. Mahila Udyam Nidhi Scheme

This scheme is offered by the Small Industries Development Bank of India (SIDBI). Women can access financial aid of up to Rs. 10 lakhs under this scheme for any new small-scale startup. It also provides financial assistance for the upgrade and modernisation of ongoing projects. The time-limit for loan repayment is 10 years and includes a five-year moratorium period. Interest rates are subject to Market rates.

c. Stree Shakti Package

This is offered for women with over 50% ownership in a small business. However, these women should have been enrolled in the Entrepreneurship Development Programmes (EDP) held by their state agency. Interest concession of 0.05% can be availed on loans exceeding Rs. 2 lakhs.

d. Dena Shakti Scheme

Under this scheme, women can avail loans up to Rs. 20 lakhs for business in agriculture, Manufacturing, micro-credit, retail stores and other small enterprises. Loans up to Rs. 50,000 are offered under microcredit category.

e. Bharatiya Mahila Business Bank Loan

Women can avail loans up to Rs. 20 crores under the manufacturing enterprises category. Under the Credit Guarantee Fund, Trust for Micro and Small Enterprises, no collateral is needed for loans up to Rs. 1 crore. This bank was merged with State Bank of India in 2017. The loans under this scheme are to be repaid within seven years.

f. Annapurna Scheme

The women having a business in a food catering unit can avail a loan of up to Rs. 50,000 under this scheme. The loan can be used to purchase kitchen equipment like utensils and water filters. However, a guarantor is required to secure the loan.

g. Cent Kalyani Scheme

The Central Bank of India offers this scheme for women business owners in the agricultural and retail industries. The scheme provides loans of up to Rs. 1 crore and no collateral or guarantors are required. Interest rates are subject to market rates.

f. Udyogini Scheme

This scheme can be availed by women in the age group between 18 years and 45 years. However, any woman applying for this scheme should have a proven annual Income below Rs. 45,000. Income limit does not apply to widows, destitute or disabled women. Women can avail loans of up to Rs. 1 lakh.

2. Marriage Loan

Various private sector banks are Offering low-interest marriage loans to women.

Here is a list of top banks with their loan amount and interest rates.

| Bank | Loan Amount (INR) | Interest Rate (%) |

|---|---|---|

| Axis Bank | Rs. 50,000 to Rs. 15 lakhs | 12% -24% |

| ICICI Bank | Up to Rs. 20 lakhs | 11.25% |

| Indiabulls Dhani | Rs. 1000 to Rs. 15 lakhs | 13.99% |

| Tata Capital | Rs. 75,000 to Rs. 25 lakhs | 10.99% |

a. Axis Bank Personal Loan

Axis Bank personal loan for weddings is a good choice. A woman can avail loans from Rs. 50,000 to Rs. 15 lakhs. Women applying for the loan should be a minimum of 21 years old. The repayment for personal loans can Range from between 12-60 months.

Axis personal loan for marriage comes with minimal documentation and attractive interest rates. Here are the interest rates for loans with tenures of up to 36 months.

| Fixed Rate Loan | 1 Yr MCLR | Spread over | 1 year MCLR | Effective ROI Reset |

|---|---|---|---|---|

| Personal Loan | 7.45% | 4.55%-16.55% | 12%-24% | No Reset |

b. ICICI Bank

ICICI Bank offers some good loans of up to Rs. 20 lakhs for wedding-related expenses. The wedding loan can be availed through iMobile App.

ICICI bank personal loan interest rates ranges between 11.25% to 21.00% per annum. One of the best features is that you have the flexibility to choose the loan tenure. You can apply for a loan from 12 to 60 months. Furthermore, you need not provide any collateral or security.

c. Indiabulls Dhani

Indiabulls Dhani offers wedding loans for women ranging from between Rs. 1000 to Rs. 15 lakhs. You can use the loan amount as per your choice, for instance on your exotic vacation, or to add the final touches on your wedding.

The loan comes with flexible repayment tenure that is between 3 months to 36 months. The marriage loan from Indiabulls can be instantly approved with the disbursal within minutes.

d. Tata Capital

Women can avail marriage loans ranging from between Rs. 75,000 and Rs. 25 lakhs. The repayment tenure ranges between 12 months to 72 months and Tata Capital charges no fees on prepayment of the loan. The interest rate is 10.99% p.a.

For personal loans, Tata Capital don’t ask for any collateral or security.

3. Home Loan

Women today are living independently. Both the government and the private sector have jointly taken efforts to provide loans to women with good interest rates. A man buying houses can enjoy various benefits with a woman co-owner too.

Some of the recent developments in the home loan sector have been especially beneficial for women. The Pradhan Mantri Awas Yojana (PMAY) has allowed home buyers to avail credit subsidy under the PMAY scheme if the woman is a co-owner of the property. This was launched especially to help women in the economically weaker sections (EWS) of the society and lower-income groups (LIG).

The Stamp Duty Charges on a property is lower for a woman home buyer. She can save between 1-2% on stamp duty. Men can benefit from this with a woman co-owner.

Women home buyers are entitled to tax benefits under Section 80C income tax Act. An individual woman owner will be allowed deductions up to Rs. 150,000. Along with a woman co-owner, individuals can benefit up to Rs. 300,000.

List of Banks with Home Loan Amount and Interest Rate

Women can avail marriage loans ranging from between Rs. 75,000 and Rs. 25 lakhs. The repayment tenure ranges between 12 months to 72 months and Tata Capital charges no fees on prepayment of the loan.

Here is the list of the top 5 banks offering loans at a low interest rate.

| Bank | Loan Amount (INR) | Interest Rate (%) |

|---|---|---|

| HDFC Ltd. Home Loan | Above Rs. 75 lakhs | 8.00% to 8.50% |

| ICICI Bank Home Loan | Rs. 5 lakhs to Rs. 3 crores | 8.65% p.a. onwards |

| State Bank of India Home Loan | Above Rs. 75 lakhs | 7.75% p.a onwards |

| LIC HFL Home Loan | From Rs. 15 lakhs | 7.40% p.a. onwards |

| Union Bank of India Home Loan | Rs. 75 lakhs | 8.05% p.a. onwards |

1. HDFC Ltd. Home Loan

The loan is tailor made for salaried individuals that comes with attractive rate of interest and a longer tenure. Women can avail loan for above Rs. 75 lakhs. The rate of interest ranges from between 8.00% to 8.50%. The repayment tenure ranges from between 1 to 30 years.

2. ICICI Bank Home Loan

You can take home loan from ICICI bank either to purchase or construct a new home, or renovate an existing one. Women can get loans ranging from Rs. 5 lakhs to Rs. 3 crores. The rate of interest starts from 8.65% p.a. with a loan repayment tenure of 3 to 30 years.

3. State Bank of India Home Loan

Women can get a home loan for even above Rs. 75 lakhs 7.75% p.a. interest rate. The loan repayment tenure is between 1-30 years.

Some of the benefits of the loan are -

- Low processing fee

- No hidden charges

- No pre-payment penalty

- Interest charges on daily reducing balance

- Home loan available as overdraft

4. LIC HFL Home Loan

Women can avail loan ranging from between Rs. 15 lakhs and above. The rate of interest lies between 7.40% p.a. onwards. The loan repayment tenure is between 5-30 years.

The terms of this loan is easy to understand and process simplified with utmost transparency.

5. Union Bank of India Home Loan

Women can avail a home loan of above Rs. 75 lakhs along with 8.05% p.a. rate of interest. The repayment tenure lies between 1-20 years.

Indian citizens and NRIs can apply for this loan and the minimum entry age is 18 years uptill 75 years.

An Alternative of Loan - Invest in SIP!

Well, most loan comes with higher interest rates and long tenure. The best way to accomplish your financial goal is by Investing in SIP (Systematic Investment plan). With the help of a sip calculator, you can get a precise figure for your dream business, home, wedding, etc., from which you can invest a fixed amount in SIP.

SIP is only the easiest and hassle-free way to achieve your Financial goals. Try now!

Speed-up your Savings to Fulfill your Financial Goals

If you are planning to fulfil a certain goal, then a SIP calculator will help you to calculate the amount you need to invest.

SIP calculator is a tool for investors to determine the expected return of the SIP investment. With the help of a SIP calculator, one can calculate the amount of investment and time period of investing requires to reach one's financial goal.

Know Your SIP Returns

Conclusion

Women are receiving various benefits from the government with regards to loans. Read all schemes related documents with utter caution before applying for loans. Take complete benefits from the various schemes available and empower yourself to fight any financial battle in life.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.