Table of Contents

PM Svanidhi Yojana - Aid for Street Vendors

The Coronavirus pandemic has affected the lives of many individuals, especially the ones involved in physical labour. One of the most affected is street vendors. With the lockdown, street vendors’ businesses have shut down or run on minimum Income.

In order to provide credits for the working Capital to the street vendors of the country, the Ministry of Housing and Urban Affairs has launched the PM Street Vendor's AtmaNirbhar Nidhi (PM SVANidhi). Street vendor can take loan for one year, Collateral-free and at low-interest rates to resume their businesses.

Since the beginning of the lending process under PM Svanidhi scheme on July 02, 2020, over 1,54,000 street vendors have applied for a working capital loan from across India. Over 48,000 have already been sanctioned. This scheme targets to benefit over 50 lakh Street Vendors.

Latest Update

In the Union Budget 2022 session of Indian Parliament, President Ram Nath Kovind mentioned that so far, 2.8 million street vendors have received monetary support worth over Rs. 29 billion from the PM Svanidhi Scheme. The Centre is now connecting these vendors via online companies. Thousands of people have received direct cash transfers during the pandemic.

PM Svanidhi App

The Ministry of Housing and Urban Affairs has launched the PM SVANidhi app. The app has all the features that are similar to PM Svanidhi portal. There is vendor search in survey data, e-KYC applicants, application processing and real-time monitoring.

You can download this app from Google Play store.

Features of PM Svanidhi Scheme

1. Loan Amount

Under this scheme, vendors can get Rs. 10,000 as a loan to fund their working capital needs.

2. Loan Repayment Tenure

The applicants will have to pay the loan amount in monthly instalments within a period of 1 year.

Talk to our investment specialist

3. Prepayment Benefit

If the applicant repays the loan early, an interest subsidy at 7% per annum will be credited to the Bank account through Direct Benefit Transfer (DBT) on a quarterly Basis. There will be no penalty on early repayment of the loan.

4. Digital Transactions

The scheme promotes digital transactions through incentives like cashback up to Rs. 1200 per annum.

5. Security

The loan is collateral-free and no banks can charge it under any circumstances.

6. Other Benefits

If the vendor completes timely repayment of the loan, he will be eligible for the next cycle of the working capital loan. This will have an enhanced limit.

7. Interest Subsidy

The vendors who avail the loan are eligible to get an interest subsidy at 7%. This amount will be credited to the vendors on a quarterly basis. The lenders will submit quarterly claims for interest subsidy on quarters ending as on June 30, September 30, December 31 and March 31 during each financial year. The interest subsidy is available until March 31, 2022.

The subsidy will be available for the first and subsequent enhanced loans up to that date. If the payment is made early, the admissible subsidy amount will be credited immediately.

PM Svanidhi Yojana Online Registration

Below is the complete process for applying PM SVANidhi scheme:

- Visit the official website at pmsvanidhi(dot)mohua(dot)gov(dot)in

- At the homepage, click at the 'Apply for Loan' tab or 'Login as applicant'

- In the new login window, street vendors can apply online for PM Svanidhi loan by logging in using mobile number. Enter the mobile number and click at the 'Request OTP' button to get one time password on that mobile phone. Afterwards, enter received OTP and click at 'Verify OTP' button

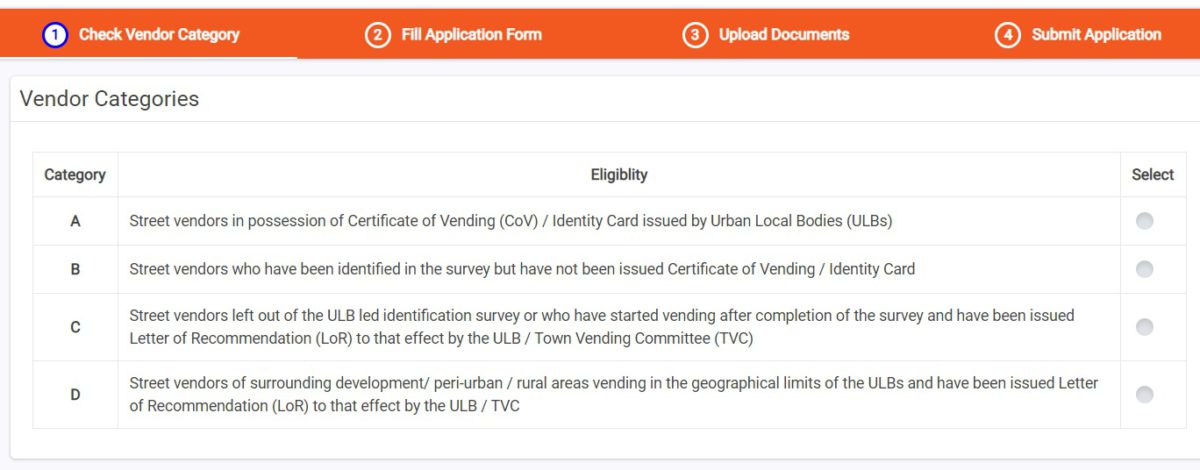

- Check Vendor Category. There are 4 options of vendor category, such as -

- Street vendors in possession of Certificate of Vending (CoV) / Identity Card issued by Urban Local Bodies (ULBs)

- Street vendors who have been identified in the survey but have not been issued Certificate of Vending / Identity Card

- Street vendors left out of the** ULB led identification survey** or who have started vending after completion of the survey and have been issued Letter of Recommendation (LoR) to that effect by the ULB / Town Vending Committee (TVC)

- Street vendors of surrounding development/ peri-urban / rural areas vending in the geographical limits of the ULBs and have been issued Letter of Recommendation (LoR) to that effect by the ULB / TVC

- Select and proceed further to fill PM Svanidhi Scheme online application form

- Make registration using Aadhar verification by entering aadhaar number and clicking at 'Verify' button, you will get an OTP on mobile number which is registered in Aadhar card

- After verification of Aadhar OTP, the PM Svanidhi online application form will appear

- Fill the application form and complete the online process

Eligibility Criteria for PM SVANidhi

1. Legal Requirements

Street vendors who wish to avail this scheme should have a certificate of vending or identity card issued by the Urban Local Bodies (ULBs).

2. Geographical Location

The vendors of surrounding development/peri-urban/rural areas vending in the geographical limits of the ULBs and have been issued Letter of Recommendation (LoR) to that effect by the ULB/TVC.

PM Svanidhi Interest Rates

For Commercial banks, Regional Rural Banks (RBBSs), Small Finance Banks (SFB), Cooperative Banks and SHG Banks, the rate of interest will be the same as the prevailing rates.

When it comes to NBFC, NBFC-MFIs, etc, the interest rates will be as per the guidelines from the Reserve Bank of India (RBI). In case of MFIs (non-NBFC) & other lender categories not covered under the RBI guidelines, interest rates under the scheme would be applicable as per the extant RBI guidelines for NBFC-MFIs.

Conclusion

PM SVANidhi is one of the most beneficial schemes for the working class amid the pandemic. Street vendors can be highly benefited from this scheme and get cashback benefits.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.