Fincash » Mutual Funds India » Mahila Samman Saving Certificate Scheme

Table of Contents

- Mahila Samman Saving Certificate Eligibility

- Mahila Samman Saving Certificate in Post Office 2023

- Mahila Samman Saving Certificate Benefits

- Mahila Samman Saving Certificate Interest Rate

- Mahila Samman Savings Certificate Calculator

- Documents Required for Mahila Samman Saving Certificate Scheme

- How to Apply for a Mahila Samman Savings Certificate?

- Mahila Samman Savings Certificate vs PPF vs NSC vs SCSS vs SSY

- Conclusion

Mahila Samman Saving Certificate Scheme

The government has hailed Budget 2023-24 as an inclusive and powerful package and stated that it is a vision for Amrit Kaal. According to the finance minister, Ms Nirmala Sitharaman, the budget includes such programs and initiatives that will reach more people in society and increase women's Financial Literacy.

Keeping this progress in mind, one of the programs that were spoken about in the budget was the Mahila Samman Savings Certificate, which is a one-time small savings program that will be accessible for two years till March 2025. Let’s figure out more about the overview, benefits and eligibility of this program in this post.

Mahila Samman Saving Certificate Eligibility

The program would provide women and girls of all ages with a deposit Facility of up to Rs 2 lakh for a two-year term.

Mahila Samman Saving Certificate in Post Office 2023

If a woman changes domicile, she can withdraw the money without incurring any fees and effortlessly move her Savings Account from one location to another. In addition to providing financial advantages, the program encourages women to take charge of their finances and make informed decisions, which promotes financial literacy and gives them more authority. The program aids in encouraging women to work in finance and increases their representation in financial institutions. This way, Mahila Samman Bachat Patra Yojana 2023 is a positive move to empower women and advance financial literacy.

Mahila Samman Saving Certificate Benefits

Here are the benefits of the Mahila Samman Saving Certificate:

- The interest rate offered by the program is designed to encourage saving. Those seeking a shorter investment time find it appealing

- The program will inspire women from all social classes to develop financial literacy because it intends to assist low-Income families in accumulating financial reserves

- Most housewives save tiny sums each year and deposit them in fixed deposits, which can hold up to Rs 2 lakh. Women will be able to earn more interest while learning about financial advantages

- The discussion surrounding this ought to be able to engage women in domestic finance discussions

Talk to our investment specialist

Mahila Samman Saving Certificate Interest Rate

The scheme offers a 7.5% fixed rate annually, which is typically higher than most Fixed Deposit and other popular Small Saving Schemes. However, the responses to the interest rate provided by the Mahila Samman Savings Certificate program have been conflicting. Some have stated that the interest rate is sufficient to encourage women to save money, but others have suggested that it could have been higher. The interest rate provided for the period is higher than the rates supplied by virtually every Bank, and it provides savings while outpacing Inflation.

Mahila Samman Savings Certificate Calculator

Consider Investing Rs. 2,000,000 in the program for two years; you would receive a Fixed Interest Rate of 7.5% per year. As a result, you will receive Rs. 15,000 on the principal amount in the first year and Rs. 16,125 in the second. After two years, you will have received Rs. 2,31,125 (Rs. 2,00,000 for the initial investment plus Rs. 31,125 for interest).

The plan will accept investments starting on April 1, 2023. Only cash or cheques can be used to make the deposit.

Documents Required for Mahila Samman Saving Certificate Scheme

Here is the list of documents required for the Mahila Samman Saving Certificate Scheme:

- Aadhar Card

- PAN Card

How to Apply for a Mahila Samman Savings Certificate?

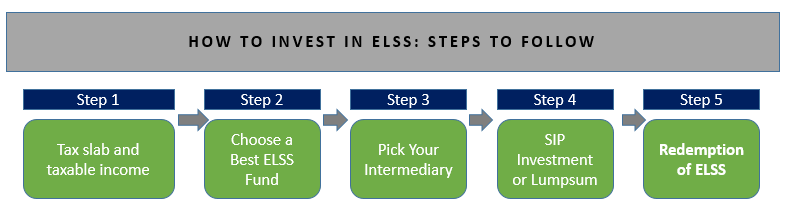

The process for purchasing a Mahila Samman Savings Certificate is as follows:

- Get the Mahila Samman Bachat Patra Yojana form by going to the closest bank or Post Office that offers this program

- Fill out the application form with your financial, personal, and nomination information

- Submit the form and the necessary documentation, such as identity and address verification

- Decide on the deposit amount, and then make the deposit using cash or a cheque

- Receive the certificate as proof of your investment in the Mahila Samman Savings Certificate program

Mahila Samman Savings Certificate vs PPF vs NSC vs SCSS vs SSY

The Mahila Samman Savings Certificate program offers interest rates higher than those offered by National Savings Certificate (NSC) and Provision Pension Fund (PPF), which are now 7.1% and 7%, respectively. The existing schemes have a substantially longer tenure than the new system. While NSC is a five-year plan with no withdrawals other than in extraordinary circumstances, like the investor's death or a court order for it, PPF is a 15-year savings option that offers partial withdrawals after seven years.

Here's how the Mahila Samman Savings Certificate differs from PPF, NSC, SCSS, and SSY:

| Criteria | Mahila Samman Savings Certificate | PPF | NSC | SCSS | SSY |

|---|---|---|---|---|---|

| Eligibility | Women and girls | Any Indian citizen | Any individual including, Non-Resident Indians (NRI) | Senior citizens aged 60+ | Girl child less than ten years of age |

| Interest Rate | 7.5% | 7.1% | 7% | 8% | 7.6% |

| Tenure in years | 2 | 15 | 5 | 5 | 21 years from account opening or when the child attains 18 years of age |

| Limit Deposit | Max. Rs.2 lakh | Rs 500 to Rs 1.5 lakh | Rs. 100 + | Rs. 1000 to Rs. 30 lakh | Rs. 250 to Rs. 1.5 lakh |

| Premature Withdrawal | Allowed | Partial withdrawal post 7 years | Sometimes allowed | Closable anytime | Sometimes allowed |

| Tax Benefit | Not disclosed | Exempt-Exempt-Exempt (EEE) under Section 80C | Up to Rs.1.5 lakh Deduction under Section 80C | Up to Rs.1.5 lakh deduction under Section 80C | Exempt-Exempt-Exempt (EEE) under Section 80C |

Conclusion

The Mahila Samman Savings Certificate, which was put forth in the budget, encourages saving and provides a higher interest rate than the Industry standard over a shorter period. However, a larger interest rate would have benefited the two-year savings plan. Yet, it is a good initiative to allow women across the country to save more and learn the benefits of investments.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.