Table of Contents

What is a Common Size Income Statement?

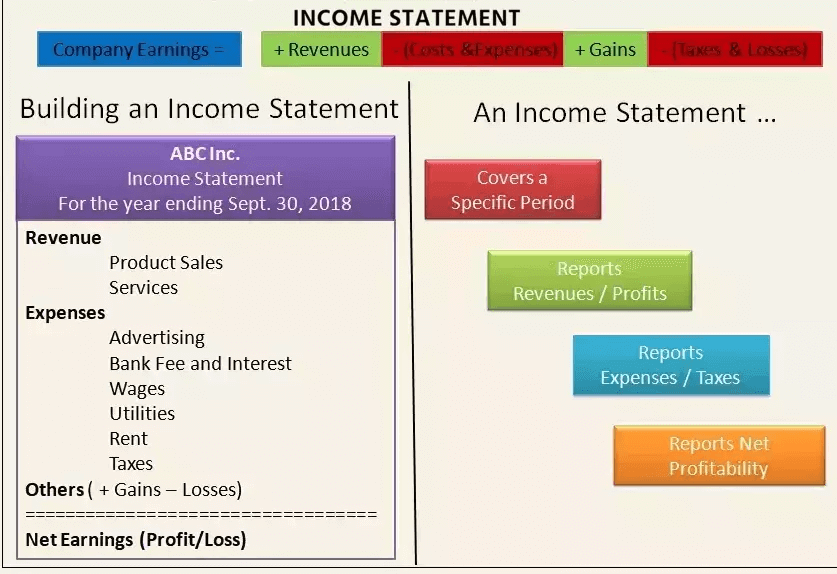

The common size Income statement meaning is defined as the financial statement, where every item is mentioned as the percentage value of the profits and sales. The approach is commonly used for carrying out the vertical analysis. The most common application here is identifying and comparing the overall performance of the organization for the past few years on the Basis of the sales figures.

The common size income statement can also be used to compare the Financial Performance of the company with their competitors just to get a better idea of how the company is performing as compared to the rivals.

GAAP (Generally Accepted Accounting Principles) is designed to enhance the consistency of the financial statements. The major purpose of the common size income statement is to get an idea of what’s improving the profit of the organization. It also gives you insights into the financial position of the organization. This makes it easier for the company to analyze as well as compare its financial performance with that of its peers. By giving you a better picture of how the financial outcome of the company has evolved over time, the common size financial income makes it easier for the investors to identify areas and the latest trends that the standard financial statement might not disclose.

Understanding the Common Size Income Statement

The main reason why people use the common size income statement is to figure out the possible consistency in the figures over a course of a few years. If you spot major changes in the revenue and expenses section, that’s probably a sign that your business is growing rapidly. The standard measures used for the calculation of the common size statements are expenses and revenues. As mentioned earlier, the statement is mainly used to show the percentage of the revenues and sales figures.

Talk to our investment specialist

Another important thing you must note here is that the calculation of the common size income is quite similar to calculating the margin of the organization. In order to calculate the net profit margin, the user is supposed to divide the net income earned by the organization by sales revenues. Similarly, the gross margin could be calculated. Note that the common size income statement isn’t just another common type of income statement, but it’s rather a tool that helps evaluate the income statement.

If you have been operating for the past few years, it is easier to analyze and compare different financial statements in order to calculate your financial progress for different years. This will also help you spot several trends in the Industry. That’s because when you present the items in the income statement in their percentage form, it becomes a whole lot easier for you to compare them in order to understand your company’s financial position.

The common size financial income approach is most commonly used as a tool to analyze the financial performance of different organizations. However, it does not offer data that could be used for making important investment decisions.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.