Table of Contents

Hammering

Defining Hammering

Hammering is a process of concentrated and rapid selling of a stock that is regarded to be overvalued by the speculators.

Hammering the Market could be either because of large sale orders or several small sell orders. In certain situations, investors could collaborate on orders to decrease the share price. Usually, market hammering occurs when there is sudden bad news, also called as the asteroid event, like a terrorist attack, and more.

Hammering could be a result of an asteroid event. These events are the event risk types that find unprepared companies. For instance, if a public company is dependent upon a specific board member or an executive, or the sales of a few products, sudden market disruption or departure can decrease sales as well as the stock price.

Generally, asteroid events may take place in small biotechnology or pharmaceutical companies that are relying upon clinical trial success, product sales of a drug, or FDA approval. Other possible asteroid events could be takeovers, spin-offs, Bankruptcy, acquisitions and mergers, and restructurings. Institutional investors could benefit from such events in case they anticipate them as temporary stock mispricing. Such a technique may leverage the tendency of the stock price to reduce because of a sudden, dramatic change.

Stock analysts may review aspects like potential synergies, regulatory environment or benefits of the changes, and then, may come up with a new price target for that stock. An investment decision could be made on the Basis of the current stock price and the objective price.

An adequate Call can lead to advantageous trading; while an inadequate call may create losses. For instance, if a hostile takeover occurs all of a sudden, the stock prices of an organization may fall. Research analysts would have an objective to project if the takeover will occur and what will be the duration, its effects as well as the implications for the stock price and the Earnings.

Talk to our investment specialist

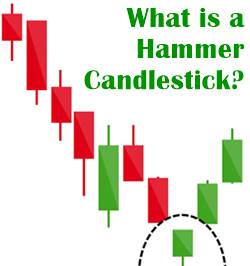

Hammer Candlestick Chart Pattern

In the Technical Analysis, a hammer Candlestick pattern is one such indicator that comes after a long downtrend in the prices of the stock. During this Hammer Candlestick period, the index or stock undergoes substantial selling.

Later, it recovers and gets closed near the higher or unchanged mark. In this situation, the market could be regarded as the hammering out a bottom. When collaborated with moving indicators and averages, these patterns could warn of essential trend reversals.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.